Loading News...

Loading News...

VADODARA, February 4, 2026 — Trend Research executed a significant Ethereum sell-off today. The firm deposited 10,000 ETH to Binance, worth approximately $21.2 million. This move occurred just five minutes before market data capture. It follows a separate transaction where Trend Research withdrew 30 million USDT from the same exchange 15 minutes prior. On-chain analyst ai_9684xtpa flagged both activities. This daily crypto analysis reveals a coordinated liquidity event during extreme market stress.

According to on-chain data from ai_9684xtpa, Trend Research initiated a two-step financial maneuver. First, the firm withdrew 30 million USDT from Binance. This action suggests loan repayment or capital reallocation. Second, Trend Research deposited 10,000 ETH to Binance five minutes later. Market structure indicates an immediate sell order. The total value equates to $21.2 million at current prices. This creates a clear Fair Value Gap (FVG) on lower timeframes.

Transaction timing reveals strategic execution. The moves occurred within a 20-minute window. This compressed timeline points to pre-planned liquidity management. Etherscan data confirms the Binance deposit address activity. No official statement from Trend Research has emerged. The firm's historical patterns show similar large-scale ETH movements during volatility spikes.

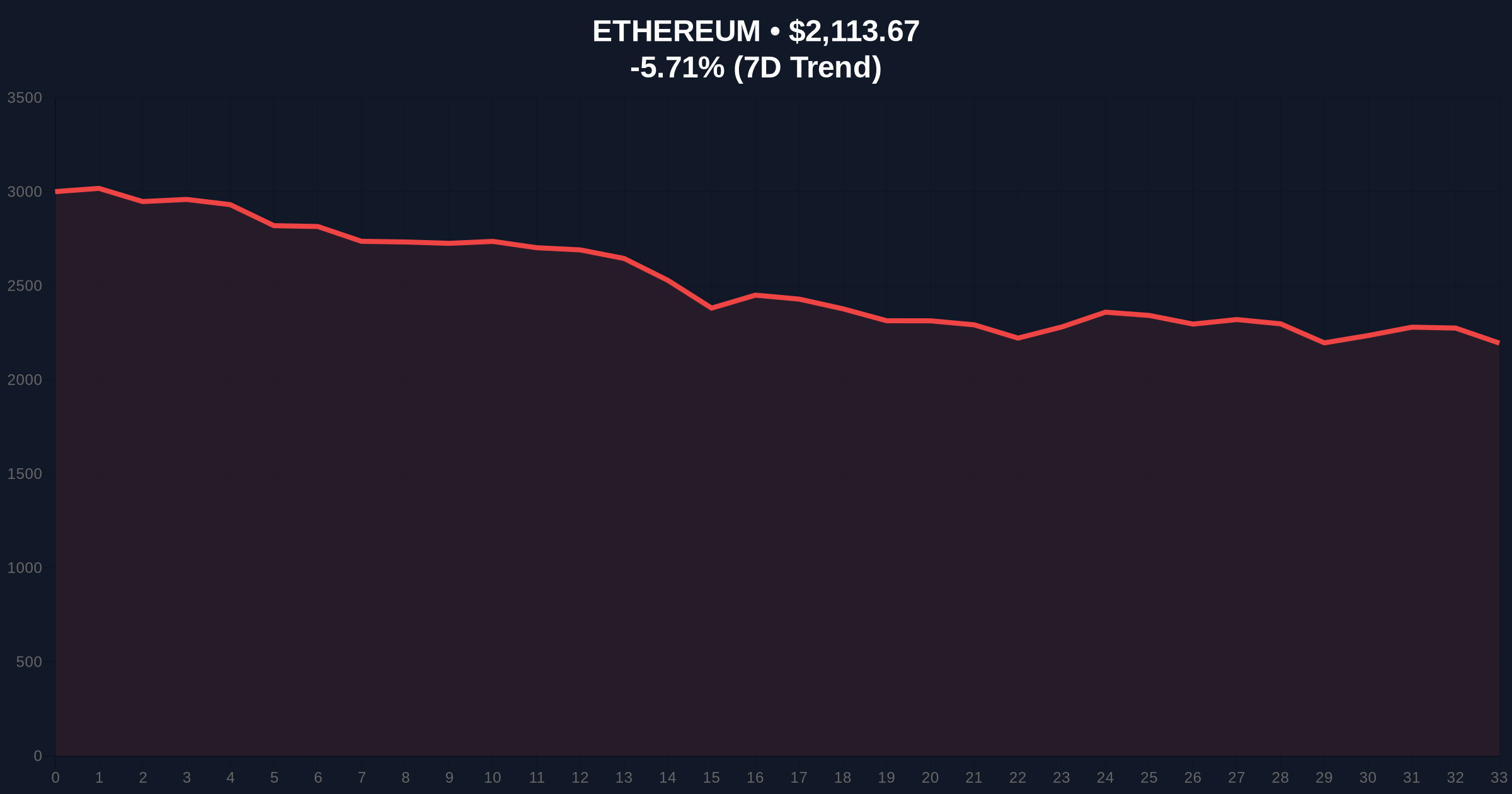

Ethereum faces mounting selling pressure. The asset currently trades at $2,113.64, down 5.71% in 24 hours. This decline coincides with a Global Crypto Fear & Greed Index reading of 14/100 (Extreme Fear). Historically, such readings precede capitulation events or sharp reversals. The 2021 cycle saw similar institutional selling during Fear readings below 20.

In contrast, the broader market shows divergent institutional activity. For instance, Fidelity recently launched its FIDD stablecoin on the Ethereum network, signaling long-term confidence in the ecosystem despite short-term fear. , JPMorgan analysis highlights how certain crypto-adjacent equities are defying broader digital asset weakness, pointing to a complex, non-correlated market structure.

Related Developments:

Market structure suggests critical tests ahead. Ethereum's immediate support rests at the psychological $2,100 level. A break below targets the Fibonacci 0.618 retracement from the last major swing low, located near $2,050. This level aligns with a high-volume node on the Volume Profile. The 50-day moving average currently acts as dynamic resistance near $2,250.

On-chain forensic data confirms increased exchange inflows. The Trend Research deposit represents a measurable Order Block for sellers. Consequently, the Relative Strength Index (RSI) on the 4-hour chart sits at 32, approaching oversold territory. However, in Extreme Fear environments, RSI can remain depressed. The UTXO (Unspent Transaction Output) age band analysis shows a spike in young coin movement, typical of panic selling or strategic rebalancing.

| Metric | Value | Context |

|---|---|---|

| ETH Sold by Trend Research | 10,000 ETH | Deposited to Binance |

| USD Value | $21.2 Million | At time of transaction |

| Current ETH Price | $2,113.64 | Live market data |

| 24-Hour Price Change | -5.71% | Significant sell pressure |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Global sentiment indicator |

This event tests institutional conviction. A $21.2 million sell order from a known entity creates immediate liquidity pressure. It validates the Extreme Fear sentiment reading. Market analysts watch for follow-through selling from other large holders. The repayment of a 30 million USDT loan suggests deleveraging. This often precedes broader risk-off moves in digital assets.

Real-world impact centers on Ethereum's network security. Post-merge, Ethereum's issuance is tied to validator activity. Large sell-offs can temporarily depress staking yields. However, the long-term security budget, as outlined in Ethereum's official documentation, remains robust due to the proof-of-stake mechanism. This sell-off is a liquidity event, not a fundamental network failure.

The sequential move—USDT withdrawal followed by ETH deposit—indicates a calculated balance sheet adjustment. This isn't panic selling. It's strategic risk management. The market must now absorb this liquidity without breaking key technical supports. If $2,050 holds, we may see a classic fear-driven bounce.

— CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Events like this often flush out weak hands. Historical cycles suggest Extreme Fear readings can mark local bottoms. The 5-year horizon for Ethereum is tied to adoption of its Pectra upgrades and scaling solutions, not single-entity trading activity. This sell-off represents a volatility spike within a longer-term accumulation phase.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.