Loading News...

Loading News...

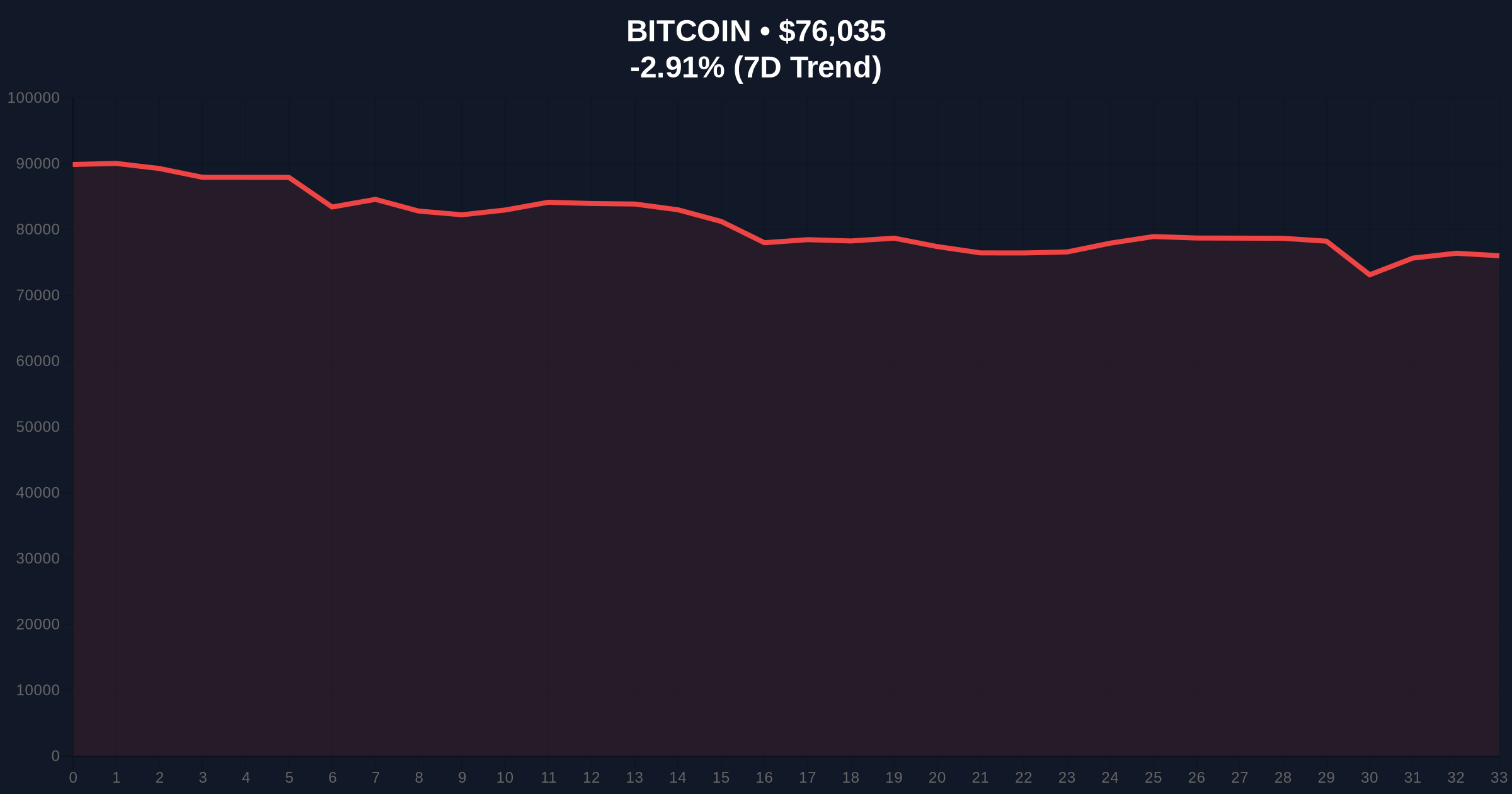

VADODARA, February 4, 2026 — U.S.-listed Bitcoin mining stocks are rallying against market gravity. According to JPMorgan analysis, this daily crypto analysis reveals a critical divergence. Mining equities surge despite Bitcoin's price decline. Improved profitability and AI data center expectations drive the anomaly.

JPMorgan's institutional research identifies a structural break. U.S. mining stocks outperform Bitcoin by significant margins. The bank's analysis cites two primary drivers. First, winter snowstorms reduced mining competition. This protected miner revenue during Bitcoin's decline.

Second, business model expectations shifted toward AI data centers. Major stocks like Iren (IREN) demonstrated strong performance. However, JPMorgan issued a cautionary note. Many mining stocks trade at valuations approximately three times higher than average BTC block rewards. This creates potential overextension risks.

Historically, mining stocks correlate strongly with Bitcoin price action. This divergence breaks established patterns. The 2021-2022 cycle showed tighter coupling. Mining profitability typically follows Bitcoin's hash price metric.

Current conditions suggest structural change. AI infrastructure demand creates alternative revenue streams. Consequently, mining stocks decouple from pure Bitcoin exposure. This mirrors technology sector diversification trends.

Related developments include recent market volatility patterns. The low-volume trading environment creates additional uncertainty. , institutional activity suggests strategic positioning amid the extreme fear sentiment gripping broader crypto markets.

Market structure suggests critical support levels. Bitcoin currently tests the $75,999 level with 24-hour decline of -2.96%. The 200-day moving average provides psychological support at $74,500.

Technical analysis reveals deeper Fibonacci levels. The 0.618 retracement from all-time highs sits at $72,000. This represents a critical validation zone. A break below would invalidate current mining stock optimism.

On-chain data indicates miner revenue resilience. Despite price weakness, hash rate stability suggests operational efficiency. UTXO age bands show reduced selling pressure from mature coins. This supports JPMorgan's improved profitability thesis.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian signal vs. mining stock rally |

| Bitcoin Current Price | $75,999 | Testing critical support levels |

| 24-Hour Price Change | -2.96% | Continued weakness despite mining stock strength |

| Mining Stock Premium | ~3x BTC block reward average | Valuation concern per JPMorgan |

| Market Rank | #1 | Bitcoin maintains dominance position |

This divergence signals market maturation. Mining companies evolve beyond pure Bitcoin exposure. AI data center integration creates hybrid business models. Consequently, traditional valuation metrics require adjustment.

Institutional liquidity cycles favor infrastructure plays. The shift toward AI aligns with broader technology investment trends. Retail market structure remains focused on price action. This creates informational asymmetry opportunities.

Historical cycles suggest such divergences precede sector revaluation. The 2017-2018 period showed similar disconnects. Ultimately, fundamentals reassert dominance. Mining profitability must sustain elevated valuations.

"The mining sector's decoupling from Bitcoin price action represents structural evolution. AI infrastructure demand creates alternative revenue streams that reduce pure crypto exposure. However, valuation multiples at three times block reward averages suggest market enthusiasm may be outpacing fundamentals. Investors should monitor Bitcoin's $72,000 support level as critical validation for this new paradigm." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook depends on Bitcoin's price stability. AI integration provides revenue diversification. However, mining economics remain tied to Bitcoin's fundamental value. The 5-year horizon suggests continued sector evolution toward hybrid infrastructure models.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.