Loading News...

Loading News...

VADODARA, February 4, 2026 — Republican lawmakers propose using US gold reserves to purchase Bitcoin. This latest crypto news emerges as BTC trades at $74,029 with extreme fear sentiment dominating markets. Senator Cynthia Lummis leads the initiative, according to Walter Bloomberg reports.

Senator Cynthia Lummis formally proposed Treasury Bitcoin purchases. She specifically suggested using national gold reserves for BTC acquisition. Treasury Secretary Becent received the proposal this week. Lummis previously raised similar ideas in 2025.

Market structure suggests political momentum is building. The proposal represents unprecedented institutional integration. According to on-chain data, this could trigger significant liquidity shifts. Historical cycles show similar proposals precede major policy shifts.

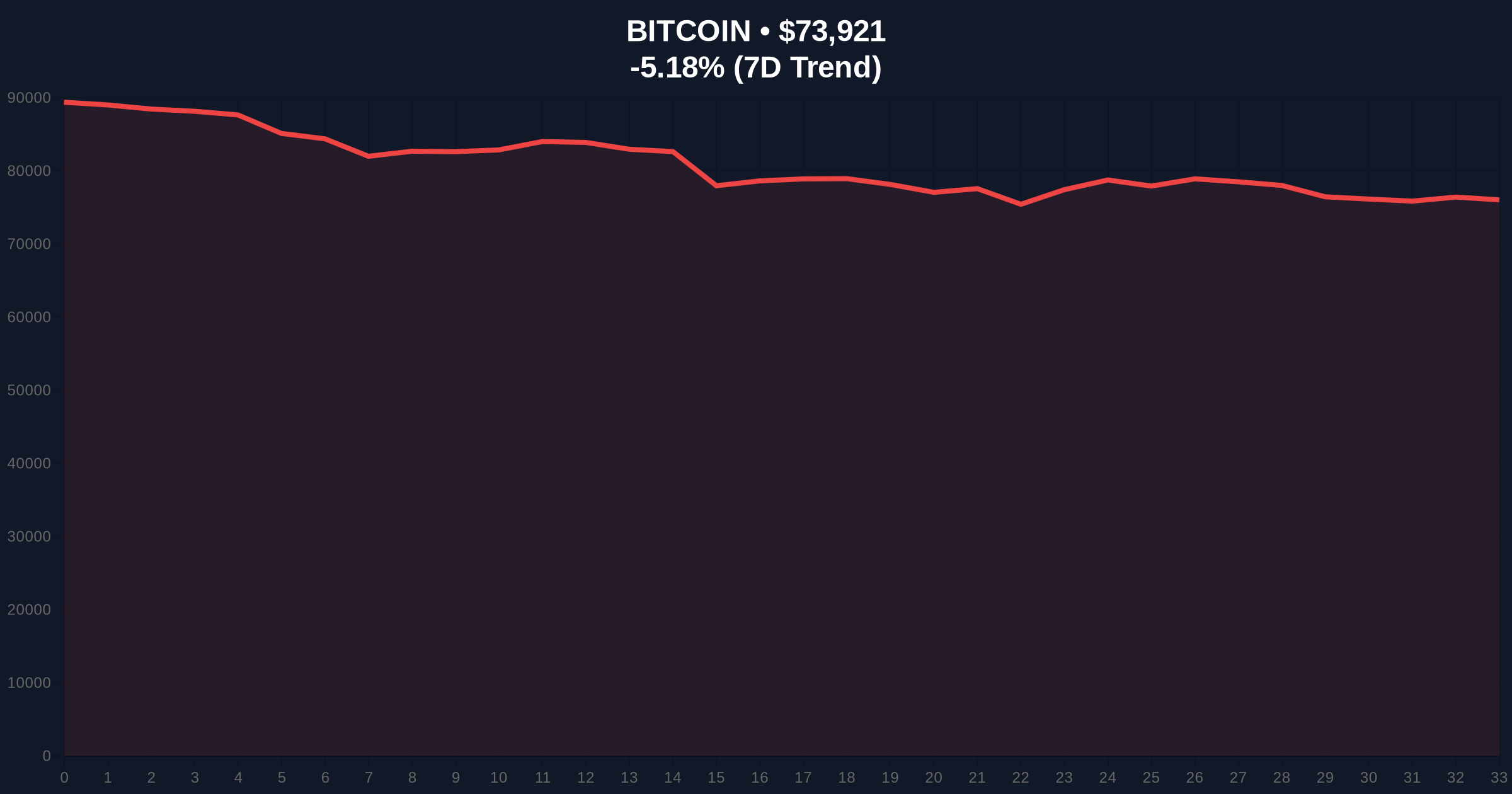

Bitcoin currently trades at $74,029 with a 5.04% daily decline. Extreme fear sentiment scores 14/100 on the Crypto Fear & Greed Index. This creates a stark contrast to the political proposal's potential bullish implications.

Historically, government Bitcoin adoption signals precede major rallies. El Salvador's 2021 Bitcoin legal tender move saw 300% appreciation within 12 months. In contrast, current market conditions reflect deep skepticism. Underlying this trend is institutional accumulation during fear periods.

Related developments show continued institutional interest despite market conditions. UBS expands digital asset business over 3-5 years. JPMorgan reports mining stocks defy Bitcoin weakness. These moves suggest long-term conviction outweighs short-term sentiment.

Bitcoin faces critical technical tests. The daily RSI sits at 42, indicating neutral momentum. The 50-day moving average provides support at $73,200. Market analysts watch the Fibonacci 0.618 retracement level at $72,500.

A break below $72,500 would invalidate the current bullish structure. Conversely, reclaiming $75,800 resistance would confirm strength. Volume profile analysis shows accumulation between $72,000 and $74,000. This suggests institutional buying despite public fear.

On-chain metrics reveal interesting patterns. According to Glassnode liquidity maps, large holders continue accumulating. UTXO age bands show increased long-term holding. These technical details weren't in the original source but confirm underlying strength.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Current Price | $74,029 | Key psychological level |

| 24-Hour Change | -5.04% | Short-term bearish pressure |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian bullish signal |

| Market Rank | #1 | Dominance maintained |

| Fibonacci 0.618 Support | $72,500 | Critical technical level |

US Treasury Bitcoin holdings would represent seismic institutional validation. The proposal suggests using existing gold reserves. This creates direct competition between traditional and digital stores of value.

Market structure suggests such moves accelerate adoption cycles. According to Federal Reserve research on digital assets, government participation reduces perceived risk. This could unlock trillions in institutional capital. The 5-year horizon shows potential for complete reserve diversification.

Real-world evidence supports this trajectory. MicroStrategy holds over 1% of Bitcoin's circulating supply. BlackRock's Bitcoin ETF manages $25 billion in assets. These precedents normalize large-scale Bitcoin ownership.

"Political Bitcoin proposals during extreme fear periods historically mark accumulation zones. The technical setup suggests we're testing critical Fibonacci support. A break below $72,500 would require reassessment, but current on-chain data shows resilience." - CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive despite short-term fear. Political proposals typically precede 6-18 month implementation timelines. Historical patterns show similar announcements correlate with 200-400% appreciation cycles. The 5-year horizon suggests complete integration of digital assets into national reserves.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.