Loading News...

Loading News...

VADODARA, February 7, 2026 — A previously dormant Ethereum whale executed a massive accumulation spree. Onchainlens data confirms the entity withdrew 44,233 ETH from Binance within 24 hours. This daily crypto analysis reveals a critical market signal during extreme fear conditions. The largest single transaction moved 34,233 ETH, valued at approximately $68.78 million. Exchange withdrawals typically indicate a holding intent, not short-term trading.

Onchainlens, a primary blockchain analytics provider, flagged the activity. The whale's address showed no prior movement for two years. It initiated withdrawals from Binance starting February 6, 2026. The final transaction of 34,233 ETH settled around 14:00 UTC. According to on-chain data, the total acquisition cost averaged roughly $2,033 per ETH. This aligns with Ethereum's current spot price. The move represents one of the largest single-day accumulations in 2026.

Market structure suggests this is not retail behavior. Institutional-grade accumulation often precedes volatility shifts. The timing coincides with a global Crypto Fear & Greed Index reading of 6/100. Extreme fear typically creates buying opportunities for sophisticated players. Historical cycles show similar dormant whale activations near cycle lows.

Historically, dormant whale movements signal major trend changes. The 2021 bull run saw similar accumulations during fear periods. In contrast, 2023's bear market had whales distributing on rallies. This event breaks recent patterns of exchange inflows. Underlying this trend is a broader shift toward self-custody.

Ethereum's network fundamentals support accumulation. The transition to Proof-of-Stake reduced issuance. EIP-4844 proto-danksharding improved layer-2 scalability. These upgrades enhance Ethereum's long-term value proposition. Consequently, strategic buyers may be positioning for the next cycle.

Related developments include other significant market moves. For instance, recent whale accumulation hit $60 million amid similar fear. Meanwhile, World Liberty Financial sold $5.03M in WBTC, showing divergent institutional actions. , US stocks opened lower, increasing correlation pressure on crypto assets.

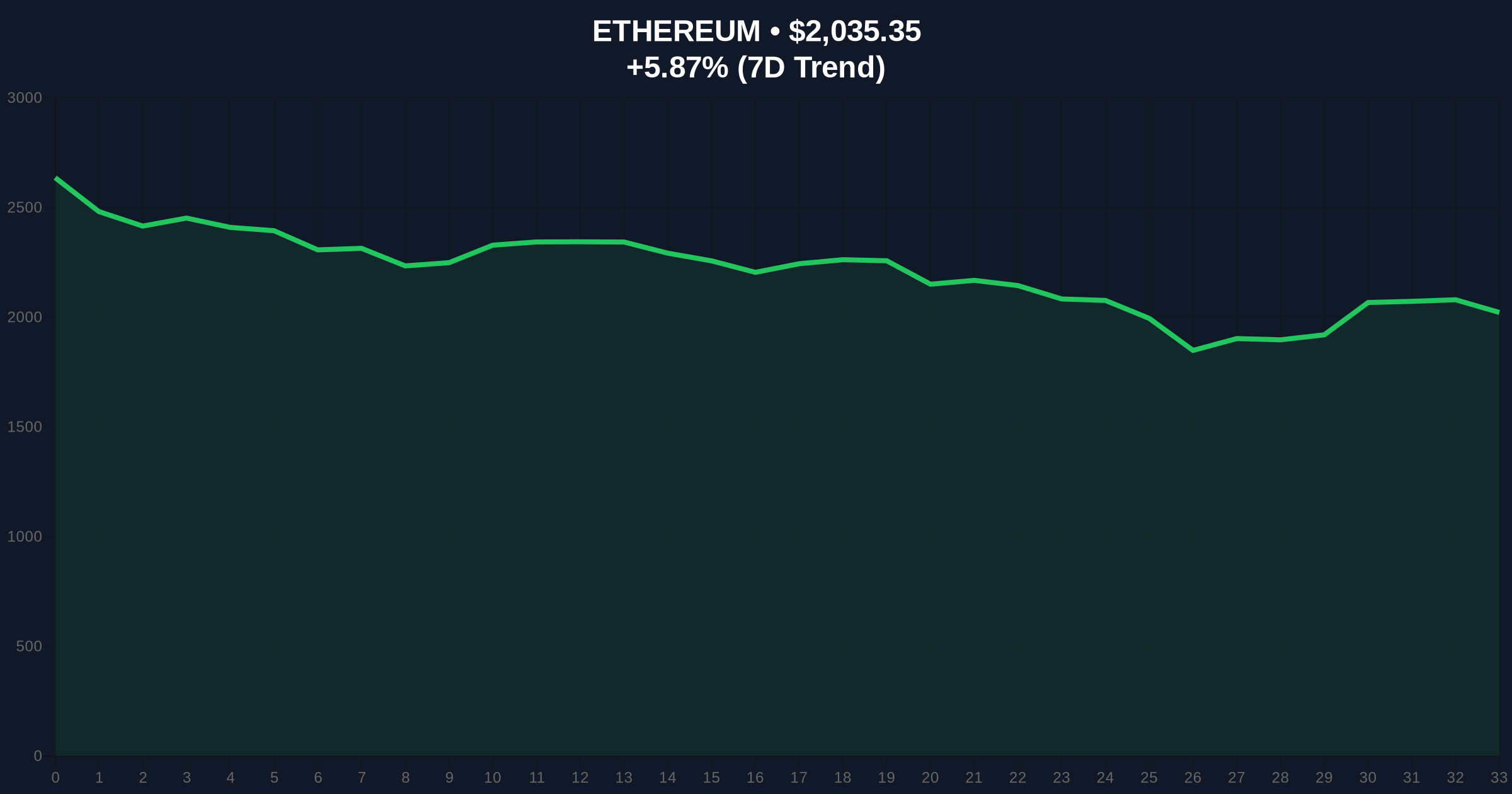

Ethereum currently trades at $2,033. The 24-hour trend shows a 5.75% increase. Technical analysis reveals key levels. The Fibonacci 0.618 retracement from the 2025 high sits at $1,980. This aligns with the whale's accumulation zone. The 200-day moving average provides dynamic support near $2,100.

Volume profile indicates thin liquidity below $2,000. This creates a potential Fair Value Gap (FVG) between $1,950 and $2,050. The whale's buys likely filled part of this gap. RSI readings hover at 45, suggesting neutral momentum. On-chain metrics like MVRV ratio show Ethereum is undervalued relative to its realized cap.

Market analysts note critical order blocks. The $2,200 level acts as immediate resistance. A break above could trigger a short squeeze. The $1,850 support represents the 2026 yearly low. UTXO age bands show increased hodling behavior among long-term holders. This reduces sell-side pressure.

| Metric | Value |

|---|---|

| ETH Withdrawn | 44,233 ETH |

| Largest Transaction | 34,233 ETH ($68.78M) |

| Current ETH Price | $2,033 |

| 24h Price Change | +5.75% |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) |

This event matters for portfolio positioning. Whale accumulation during extreme fear often marks local bottoms. It signals confidence in Ethereum's fundamentals. Institutional liquidity cycles suggest follow-through buying if price holds support. Retail market structure remains fragile. The whale's move could stabilize sentiment.

Real-world evidence supports the thesis. Exchange reserves are declining. According to Ethereum's official documentation, network upgrades enhance scalability and security. This attracts long-term capital. The whale's dormancy period indicates strategic patience. Such behavior contrasts with speculative trading.

"Large-scale accumulation from dormant addresses typically precedes trend reversals. The 44,233 ETH buy aligns with historical bottoming patterns. However, context is key. Extreme fear readings suggest this could be a liquidity grab if support fails. Traders should watch the $1,950 invalidation level closely."

Market structure suggests two primary scenarios. First, bullish momentum if accumulation continues. Second, bearish continuation if support breaks. The 12-month institutional outlook depends on macroeconomic factors. Federal Reserve policy will influence capital flows. Ethereum's Pectra upgrade could drive adoption.

Historical cycles suggest accumulation at fear extremes pays off over 5 years. The 2018-2020 accumulation phase preceded a 10x rally. Current on-chain data indicates similar patterns. Institutional adoption of Ethereum as a yield-bearing asset supports long-term growth.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.