Loading News...

Loading News...

VADODARA, February 7, 2026 — Trend Research deposited 414,864 ETH worth approximately $816.9 million to Binance in the past 24 hours. This daily crypto analysis reveals a massive institutional liquidity shift. According to data from Arkham Intelligence, the entity moved a total of 636,864 ETH (valued around $1.31 billion) to the exchange over the past week.

Arkham Intelligence on-chain data confirms the movement. Trend Research executed the deposits between February 6-7, 2026. The 414,864 ETH transfer represents one of the largest single-entity exchange inflows this quarter. Market structure suggests this is a liquidity grab targeting immediate execution.

Exchange inflows of this magnitude typically precede sell-side pressure. The timing coincides with a global Crypto Fear & Greed Index reading of 6/100 (Extreme Fear). This creates a potential contrarian signal. Historical cycles indicate such fear levels often precede volatile reversals.

This event mirrors 2021's Q4 institutional exits. In contrast, current macro conditions differ significantly. The Federal Reserve's latest policy stance, detailed on FederalReserve.gov, shows tightening liquidity. This pressures risk assets like Ethereum.

Underlying this trend is a broader institutional recalibration. The move follows other high-profile shifts, including a $207 million USDT whale transfer that sparked market structure concerns. , Multicoin Capital's co-founder exiting the industry highlights extreme sentiment. Consequently, the market faces a confluence of bearish signals.

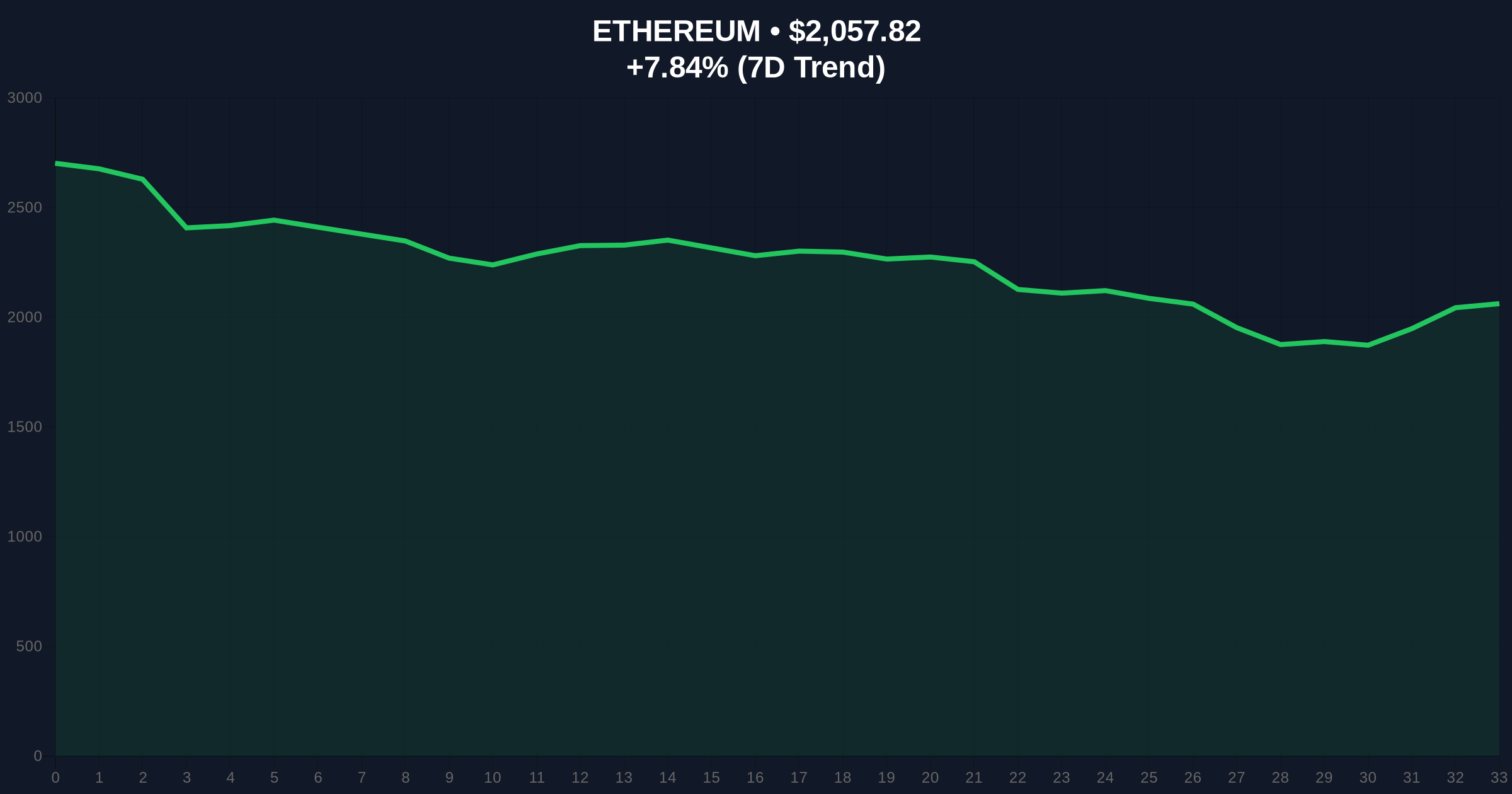

Ethereum's price currently sits at $2,056.46. This is down 8.04% in 24 hours. The deposit activity creates a clear Fair Value Gap (FVG) on lower timeframes. Key support rests at the $1,950 level, aligning with the 0.618 Fibonacci retracement from the 2025 high.

Volume Profile analysis shows weak buying interest near current prices. The Relative Strength Index (RSI) on daily charts reads 32, indicating oversold conditions. However, large exchange inflows often delay a bounce. Market analysts watch the 50-day moving average at $2,150 as dynamic resistance.

| Metric | Value |

|---|---|

| 24h ETH Deposit (Trend Research) | 414,864 ETH ($816.9M) |

| 7-Day Total Deposit | 636,864 ETH ($1.31B) |

| Current ETH Price | $2,056.46 |

| 24h Price Change | -8.04% |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) |

This matters for portfolio risk management. Institutional moves of this scale impact liquidity pools. They can trigger cascading liquidations in derivatives markets. On-chain data indicates weakening holder conviction among large entities.

Retail market structure often follows these signals with a lag. The deposit suggests Trend Research seeks immediate fiat or stablecoin conversion. This aligns with a broader risk-off environment. Historical UTXO age bands show similar patterns before major corrections.

"Large exchange inflows during Extreme Fear readings create asymmetric opportunities. The key is identifying the invalidation level. Current market structure suggests watching the $1,950 support closely. A break below would confirm bearish momentum." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from this event.

The 12-month institutional outlook remains cautious. Ethereum's upcoming Pectra upgrade (EIP-7251) could improve staking dynamics. However, near-term liquidity outflows dominate. This aligns with a 5-year horizon where infrastructure maturity may offset cyclical volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.