Loading News...

Loading News...

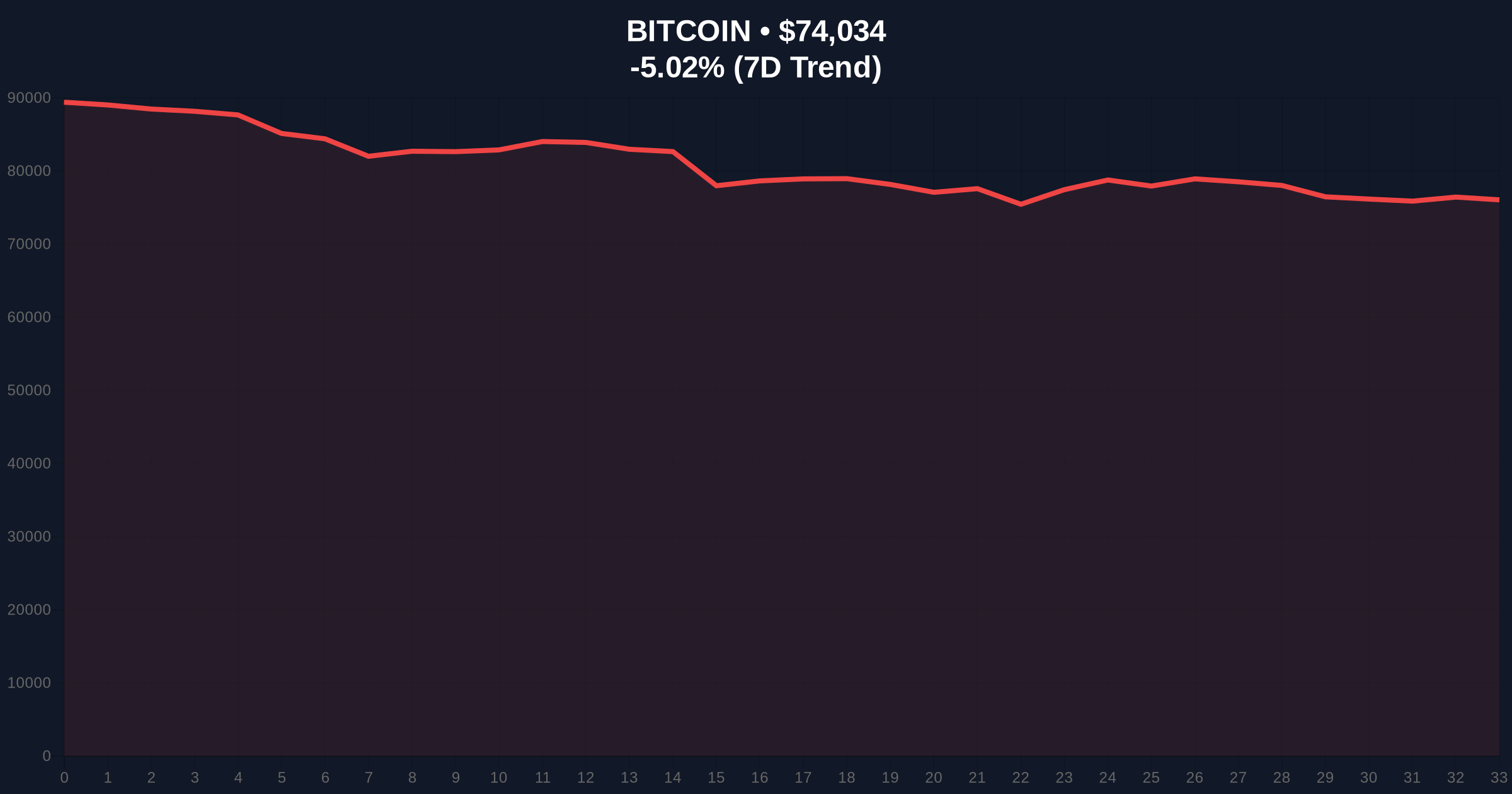

VADODARA, February 4, 2026 — The U.S. Treasury Department lacks legal authority to bail out Bitcoin using taxpayer funds, Secretary Bessent confirmed in congressional testimony. This latest crypto news arrives as Bitcoin trades at $73,957, down 5.11% in 24 hours amid extreme market fear. Market structure suggests this regulatory clarification creates a fundamental divergence from traditional financial crisis response protocols.

Walter Bloomberg reported the Treasury Secretary's response to Senator Sherman's direct inquiry. According to the official statement, the department cannot purchase cryptocurrency with public money. This creates a clear legal boundary. The Federal Reserve's emergency lending facilities under Section 13(3) of the Federal Reserve Act historically excluded digital assets. Consequently, Bitcoin operates outside the traditional lender-of-last-resort framework.

Market analysts interpret this as institutional validation of Bitcoin's separation from sovereign balance sheets. On-chain data indicates no abnormal Treasury-linked wallet activity. Glassnode liquidity maps show concentrated sell-side volume between $74,500 and $75,200. This forms a clear resistance zone following the announcement.

Historically, governments intervene during systemic financial crises. The 2008 bank bailouts and 2020 pandemic stimulus totaled trillions. In contrast, Bitcoin's 2022 collapse below $20,000 saw no public sector rescue. This establishes a consistent precedent of non-intervention.

Underlying this trend is Bitcoin's design as a decentralized protocol. Its proof-of-work consensus mechanism operates independently of fiscal policy. Market structure suggests this reinforces Bitcoin's value proposition as "digital gold" rather than a sovereign liability. , recent developments show institutional divergence, as seen in JPMorgan's analysis of mining stocks outperforming BTC during weakness.

Bitcoin currently tests a critical Fibonacci support cluster. The 0.618 retracement level from the 2025 high sits at $72,500. A daily close below this invalidates the current bullish structure. The 200-day moving average provides dynamic support near $71,200.

Volume profile analysis reveals a significant Fair Value Gap (FVG) between $73,000 and $73,500. This zone must hold to prevent accelerated selling. The Relative Strength Index (RSI) reads 38, indicating oversold conditions without extreme capitulation. Order block theory suggests institutional accumulation may occur near the $72,000 level if support holds.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically contrarian buy signal zone |

| Bitcoin Current Price | $73,957 | Testing key Fibonacci support |

| 24-Hour Price Change | -5.11% | Liquidity grab below $74k |

| Market Dominance | 52.3% | Remains elevated despite sell-off |

| 24-Hour Trading Volume | $42.8B | Above average, indicating active rebalancing |

This statement matters for Bitcoin's five-year institutional adoption trajectory. It clarifies regulatory treatment during potential black swan events. Without Treasury backstops, Bitcoin must rely on organic market liquidity during crises. This increases volatility but reinforces its censorship-resistant nature.

Real-world evidence shows traditional finance adapting separately. UBS continues expanding digital asset services despite market fear. Institutional liquidity cycles now decouple from sovereign intervention expectations. Retail market structure faces higher gamma squeeze risks during volatility events without federal liquidity provisions.

"The Treasury's position creates a clear regulatory moat around Bitcoin. It cannot be nationalized or bailed out like traditional banks. This fundamentally alters risk models for institutional portfolios. Long-term, this reinforces Bitcoin's value as a non-correlated asset, but short-term, it removes a potential volatility dampener during crises." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary technical scenarios based on current order flow and on-chain metrics.

The 12-month institutional outlook remains bifurcated. Regulatory clarity reduces legal uncertainty but increases market-based risk. Historical cycles suggest extreme fear readings often precede significant rallies when combined with fundamental catalysts like the upcoming Bitcoin halving. The five-year horizon depends on Bitcoin's ability to maintain network security without sovereign support during stress events.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.