Loading News...

Loading News...

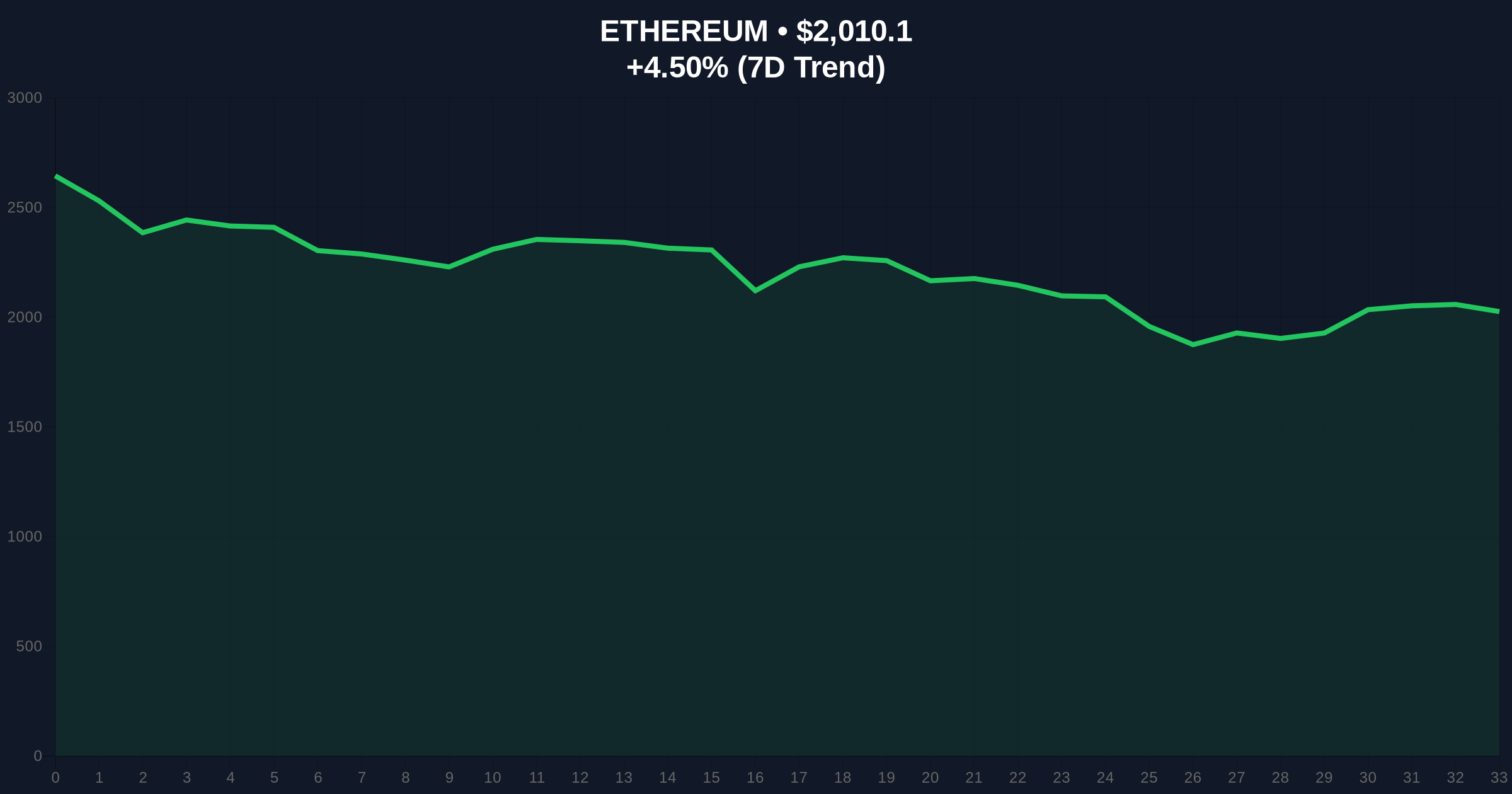

VADODARA, February 7, 2026 — Two unidentified whale addresses executed significant Ethereum withdrawals totaling $59.78 million from major exchanges this week, according to on-chain data from Lookonchain. This daily crypto analysis scrutinizes whether the move represents genuine accumulation or a tactical liquidity grab during a period of extreme market fear.

Lookonchain, a blockchain analytics platform, reported the withdrawals on February 7. Address 0x46DB removed 19,503 ETH, valued at approximately $40 million, from OKX. Simultaneously, address 0x28eF withdrew 9,576 ETH, worth $19.78 million, from Binance. Market analysts typically interpret exchange withdrawals as a bullish signal, suggesting intent to hold rather than sell. However, the timing raises questions. These transactions occurred as the broader crypto market grappled with extreme fear, with the Crypto Fear & Greed Index hitting 6/100. This contradiction between whale behavior and retail sentiment demands deeper investigation.

Historically, large exchange outflows have preceded price rallies. For instance, similar whale accumulation patterns emerged before Ethereum's 2021 bull run. In contrast, the current market environment diverges sharply. The extreme fear sentiment, as tracked by alternative metrics, suggests retail capitulation. This creates a potential Fair Value Gap (FVG) where institutional accumulation meets retail sell-offs. , the withdrawals align with a broader trend of infrastructure development, such as the recent Aster Chain testnet launch, which aims to bolster DeFi ecosystems. Market structure suggests whales may be positioning for a mid-term infrastructure buildout, rather than a short-term pump.

Ethereum's price action reveals critical levels. At press time, ETH trades at $2,009.79, up 4.49% in 24 hours. The key support rests at the $1,950 level, coinciding with the 0.618 Fibonacci retracement from the 2024 highs. Resistance looms at $2,150, a previous order block that capped gains in January 2026. On-chain data indicates the whale withdrawals reduced exchange supply, potentially tightening liquidity. This could amplify volatility. The RSI sits at 45, showing neutral momentum. Market structure suggests a consolidation phase between $1,950 and $2,150. A break above $2,150 would confirm bullish accumulation, while a drop below $1,950 signals distribution.

| Metric | Value |

|---|---|

| Total ETH Withdrawn | 29,079 ETH |

| Total USD Value | $59.78M |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) |

| Current ETH Price | $2,009.79 |

| 24-Hour Price Change | +4.49% |

This event matters for portfolio allocation over a 5-year horizon. Whale accumulation during extreme fear often marks cycle bottoms. However, skepticism is warranted. The withdrawals could be a liquidity grab, where whales remove coins to create artificial scarcity before a sell-off. Institutional liquidity cycles, as seen in Bitcoin ETF flows, show that large players often front-run retail sentiment. The Ethereum Foundation's roadmap, including upcoming upgrades like EIP-4844, provides fundamental support. Yet, retail market structure remains fragile. If whales are accumulating, they likely anticipate a post-fear rally driven by institutional adoption and technological advancements.

Market structure suggests these withdrawals are strategic. The extreme fear index at 6/100 indicates retail panic, creating a buying opportunity for sophisticated players. However, we must monitor whether these addresses transfer to cold storage or move to other exchanges. The 12-month outlook hinges on Ethereum's ability to hold the $1,950 support.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. If accumulation is genuine, ETH could see a 30-50% appreciation as fear subsides and institutional products like spot Ethereum ETFs gain traction. Conversely, a liquidity grab would lead to a sharp decline, aligning with predictions of an altcoin wipeout as the bear cycle nears its end.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.