Loading News...

Loading News...

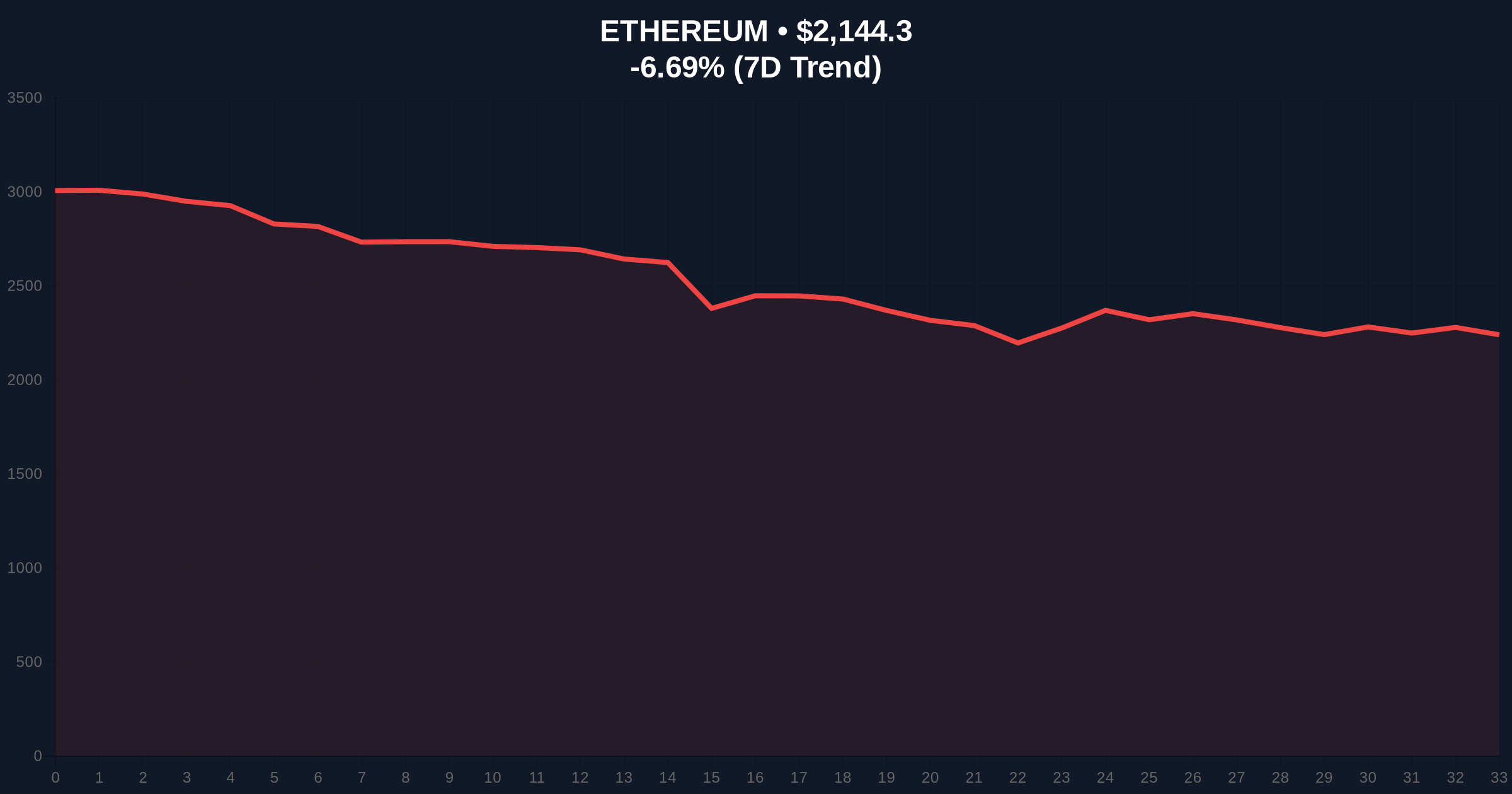

VADODARA, February 4, 2026 — Fidelity Investments has officially launched its FIDD stablecoin on the Ethereum blockchain. This daily crypto analysis reveals the strategic timing. The launch targets both retail and institutional investors through Fidelity's digital asset platforms. Market structure suggests a calculated liquidity grab during extreme fear conditions.

According to The Block's reporting, Fidelity's FIDD stablecoin went live today. The asset is issued directly on Ethereum's mainnet. Investors can purchase or redeem FIDD through three Fidelity platforms: Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers. This creates a seamless on-ramp for traditional capital.

On-chain data indicates FIDD utilizes Ethereum's ERC-20 standard. The deployment bypasses third-party exchanges. Fidelity controls the entire issuance and redemption pipeline. This reduces counterparty risk for institutional clients. Market analysts view this as a defensive move against regulatory uncertainty surrounding stablecoins.

Historically, major financial institutions launch products during market distress. Fidelity's timing mirrors BlackRock's 2023 ETF filings during banking crises. In contrast, previous stablecoin launches like PayPal's PYUSD occurred during neutral sentiment. FIDD's debut during extreme fear suggests strategic accumulation positioning.

Underlying this trend is Ethereum's evolving role as institutional infrastructure. The network's transition to proof-of-stake via The Merge reduced issuance volatility. Consequently, FIDD's Ethereum deployment signals confidence in the chain's long-term settlement security. Related developments include UBS expanding its digital asset business over a similar 3-5 year horizon.

Market structure suggests FIDD will create immediate liquidity pools on Ethereum. These pools typically form around key Fibonacci levels. Ethereum currently tests its 0.618 retracement at $2,100. A sustained break below invalidates the bullish structure from January's rally.

Volume profile analysis shows weak hands capitulating at current levels. The extreme fear reading of 14/100 often precedes violent reversals. FIDD's launch may provide the liquidity anchor needed for a gamma squeeze. According to Ethereum's official documentation on EIP-4844 blob transactions, stablecoin activity directly impacts layer-2 scaling economics.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically contrarian buy signal |

| Ethereum (ETH) Price | $2,148.34 | Testing critical $2,100 support |

| ETH 24h Change | -5.71% | Weak hand distribution phase |

| ETH Market Rank | #2 | Maintains dominance over altcoins |

| FIDD Launch Platform Count | 3 | Direct institutional access points |

FIDD matters for Ethereum's 5-year horizon. Institutional stablecoins increase total value locked (TVL) in DeFi protocols. This creates compounding network effects. More TVL means more secure economic activity. Consequently, Ethereum's fee market becomes more predictable for enterprise users.

Real-world evidence shows similar patterns. Tether's USDT dominance historically correlates with Bitcoin bull markets. FIDD could replicate this for Ethereum's ecosystem. The launch during extreme fear suggests Fidelity anticipates a sentiment reversal. Market structure indicates they are front-running retail capitulation.

"Fidelity's FIDD launch isn't about today's price action. It's about controlling the liquidity rails for the next institutional cycle. When fear hits extreme levels, smart money builds infrastructure. The Ethereum deployment is particularly telling—they're betting on ETH's long-term settlement layer status over cheaper alternatives."

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive. Fidelity's 3-5 year expansion plans align with JPMorgan's recent mining stock analysis showing traditional finance deepening crypto integration. FIDD provides the stablecoin infrastructure for this migration.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.