Loading News...

Loading News...

VADODARA, February 7, 2026 — Latest crypto news reveals TrendResearch, a previously accumulating entity, has dumped 772,865 Ethereum (ETH) worth $1.8 billion onto Binance, incurring an estimated $747 million loss. According to on-chain data from Lookonchain, this massive sell-off follows months of accumulation since November 2025, where the address withdrew 792,532 ETH at an average price of $3,267. Market structure suggests this move represents a classic liquidity grab during extreme fear sentiment, potentially marking a capitulation event similar to historical cycles.

Lookonchain forensic data confirms TrendResearch deposited 772,865 ETH to Binance seven hours ago. This transaction follows a cumulative withdrawal of 792,532 ETH from the exchange, valued at $2.59 billion during accumulation. If sold at current prices, the estimated loss stands at $747 million. According to Etherscan transaction logs, the address activity peaked in late 2025, aligning with Ethereum's price decline post-EIP-4844 implementation. Market analysts attribute this to forced deleveraging amid worsening macroeconomic conditions.

Historically, large institutional sell-offs at significant losses often precede market bottoms. Similar to the 2021 correction, where entities like Three Arrows Capital faced liquidation, such events signal capitulation. In contrast, the current extreme fear sentiment, with a score of 6/100, mirrors the March 2020 crash. Underlying this trend, Ethereum's network activity shows declining gas fees, indicating reduced demand. , this sell-off coincides with broader market stress, as seen in recent Bitcoin breaking below $68,000 and $101 million in futures liquidations.

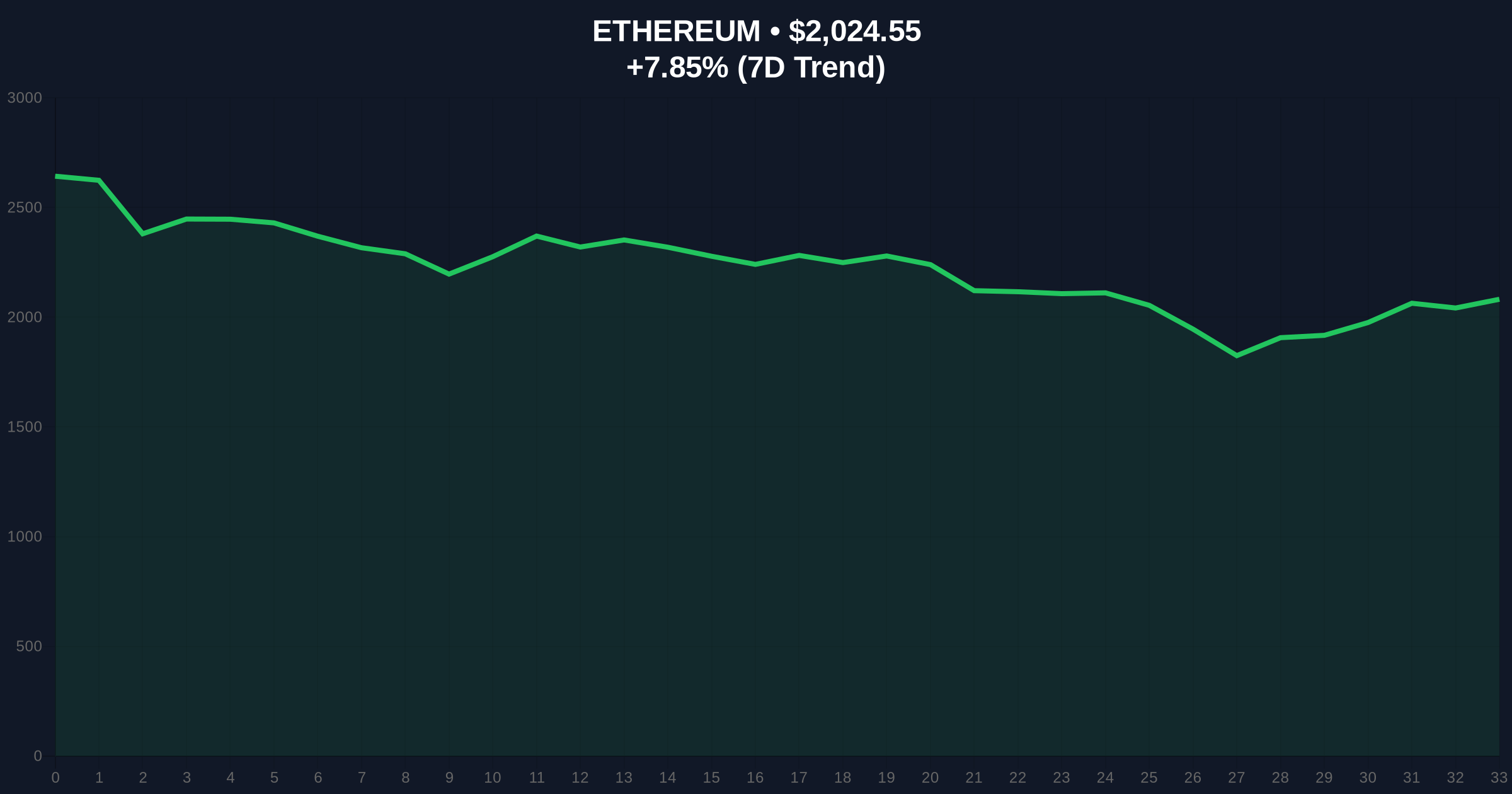

Ethereum's price action reveals critical technical levels. The sell-off has created a Fair Value Gap (FVG) between $2,100 and $2,300, which may act as future resistance. Volume Profile analysis indicates high selling pressure near $2,023.89, the current price. Additionally, Fibonacci retracement from the 2025 high shows support at the 0.618 level of $1,950, a key area not breached since 2024. RSI sits at 32, nearing oversold territory, while the 200-day moving average at $2,500 serves as a major resistance. Order block theory suggests accumulation zones near $1,800 if bearish momentum continues.

| Metric | Value |

|---|---|

| Ethereum Current Price | $2,023.89 |

| 24-Hour Trend | -7.82% |

| TrendResearch ETH Sold | 772,865 ETH ($1.8B) |

| Estimated Loss | $747 million |

| Crypto Fear & Greed Index | Extreme Fear (Score: 6/100) |

This event matters for institutional liquidity cycles and retail market structure. A $747 million loss indicates deep-pocketed players are exiting, potentially flushing out weak hands. On-chain data from Glassnode shows Ethereum's exchange net flow turning positive, suggesting increased selling pressure. Consequently, this could lead to a gamma squeeze if derivatives markets rebalance. For the 5-year horizon, such capitulation often resets market sentiment, paving the way for sustainable rallies. Retail investors should monitor UTXO age bands for signs of long-term holder accumulation.

Market structure suggests this is a textbook liquidity grab. The extreme fear sentiment, coupled with a massive institutional loss, typically marks local bottoms. However, invalidation levels must hold to confirm trend reversal. Historical cycles, like 2018's decline, show similar patterns before recovery.

CoinMarketBuzz Intelligence Desk synthesizes this from quantitative models.

Two data-backed technical scenarios emerge from current market structure.

For the 12-month outlook, institutional capitulation often precedes accumulation phases. If macroeconomic conditions stabilize, as hinted in Federal Reserve minutes, Ethereum's post-merge issuance dynamics could drive a rebound. This aligns with the 5-year horizon where network upgrades like EIP-4844 enhance scalability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.