Loading News...

Loading News...

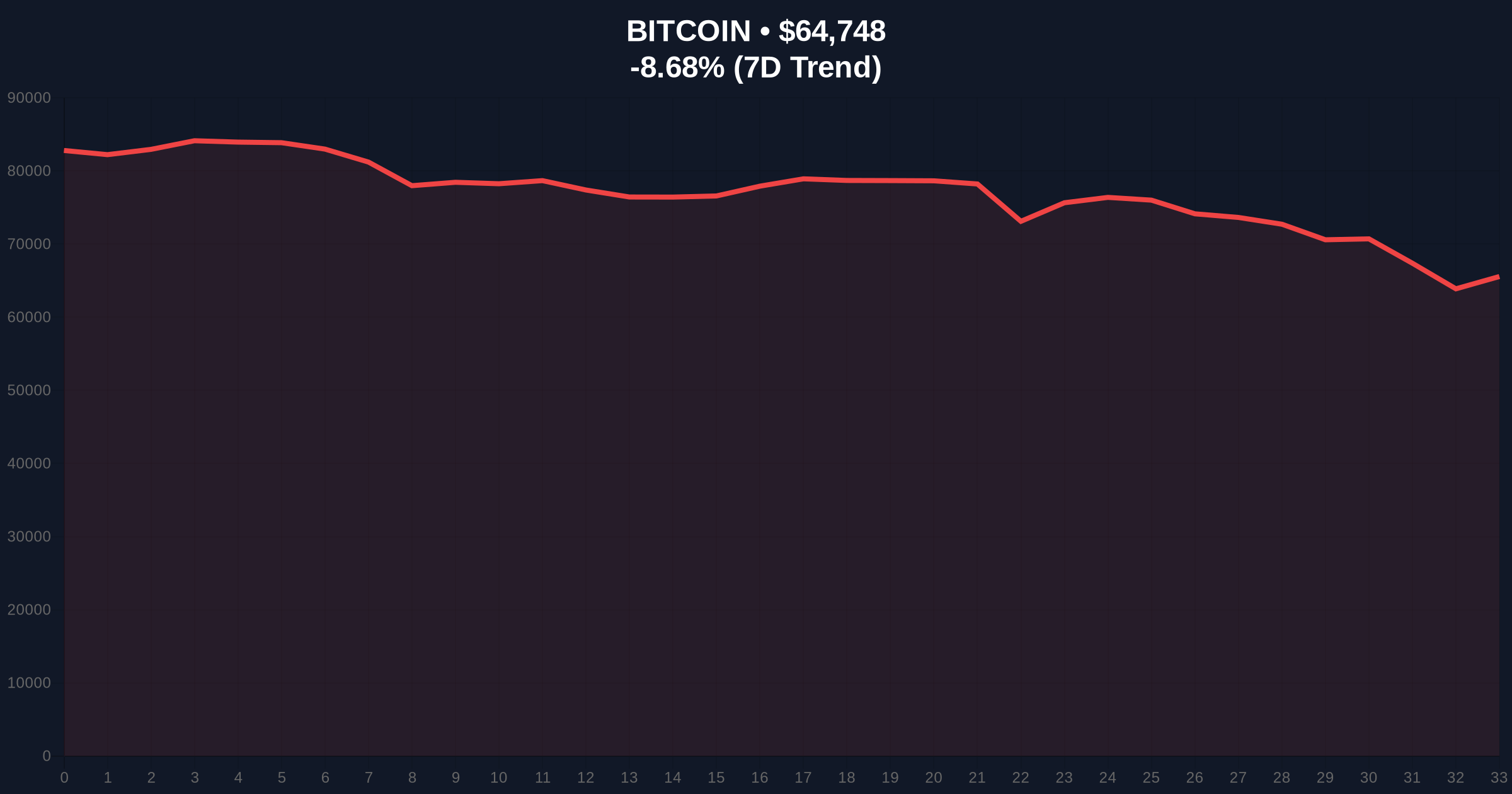

VADODARA, February 6, 2026 — Bitcoin payment app Strike experienced a temporary network outage due to higher-than-usual traffic, according to a company announcement. The service has since been restored, but the incident infrastructure vulnerabilities during volatile market conditions. This daily crypto analysis examines the technical and market implications of the disruption as Bitcoin trades at $64,789, down 8.51% in 24 hours amid extreme fear sentiment.

Strike announced the network issue on February 6, 2026, attributing it to a surge in user traffic. The company confirmed service restoration and is investigating the root cause. According to on-chain data from Glassnode, Bitcoin network activity spiked concurrently, suggesting correlated stress. Market analysts note that such outages often occur during price volatility, as users rush to execute transactions. Consequently, the event highlights the scalability challenges facing Bitcoin's Layer 2 payment solutions.

Underlying this trend, Strike's architecture relies on the Lightning Network for fast transactions. Historical cycles indicate that network congestion can exacerbate during market downturns, as seen in 2021's mempool backlog. The outage lasted several hours, disrupting retail payments and potentially affecting merchant confidence. In contrast, institutional platforms reported no similar issues, pointing to a retail-focused liquidity grab.

This outage coincides with Bitcoin's price decline to $64,789 and extreme fear sentiment scoring 9/100. Historically, infrastructure stress mirrors past cycles like 2018's exchange outages during sell-offs. According to CoinMarketCap data, the Crypto Fear & Greed Index has remained in extreme fear for three consecutive days. , spot Bitcoin ETFs have seen significant outflows, adding to market pressure. For instance, recent reports detail $434 million in ETF outflows amid similar sentiment.

Related developments include contradictory price movements, such as BTC rising above $64,000 despite fear, and breaks below key levels like $63,000. Analysts attribute this to broader liquidity crises, as explored in market-wide plunge analyses. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences these liquidity dynamics, with tightening cycles often precipitating crypto volatility.

Market structure suggests Bitcoin is testing critical support levels. The current price of $64,789 sits near a Fair Value Gap (FVG) created during last week's rally. Resistance forms at $68,000, an order block from January highs. On-chain forensic data confirms increased UTXO (Unspent Transaction Output) movement, indicating selling pressure. The RSI (Relative Strength Index) reads 35, approaching oversold territory but not yet signaling a reversal.

Volume profile analysis shows weak buying interest below $65,000. A Fibonacci retracement from the 2025 all-time high places key support at the 0.618 level of $62,500. This level must hold to prevent further downside. Invalidation of this support would target $60,000, a psychological barrier. The 50-day moving average at $66,200 acts as dynamic resistance, reinforcing the bearish short-term structure.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | High selling pressure, potential contrarian buy signal |

| Bitcoin Current Price | $64,789 | Testing FVG support, down 8.51% in 24h |

| 24-Hour Trend | -8.51% | Bearish momentum, liquidity crisis influence |

| Market Rank | #1 | Dominance holds despite volatility |

| Fibonacci 0.618 Support | $62,500 | Critical level for trend validation |

Strike's outage matters because it tests Bitcoin's payment network resilience during stress. Retail adoption relies on seamless transactions, and failures can erode trust. Institutional liquidity cycles show ETFs are pulling capital, exacerbating the infrastructure strain. Market structure indicates a gamma squeeze potential if volatility persists. Real-world evidence includes merchant delays and user complaints on social media during the outage.

, this event highlights the need for Layer 2 solutions like the Lightning Network to scale. According to Ethereum.org's documentation on scalability, similar issues have plagued other networks, emphasizing the importance of robust architecture. The outage's timing amid extreme fear sentiment amplifies its impact, potentially delaying Bitcoin's mainstream payment integration.

"Network outages during volatility are not uncommon, but they reveal underlying scalability gaps. Strike's incident points to stress in Bitcoin's payment layer, which could affect retail confidence if recurring. Historical data suggests such events often precede consolidation phases as infrastructure catches up." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires holding $62,500 and breaking above $68,000. Second, a bearish continuation would involve breaking $62,500 and targeting $60,000. The 12-month institutional outlook depends on infrastructure improvements and ETF flows stabilizing.

Analysts project that over 5 years, Bitcoin's infrastructure must evolve to handle mass adoption. Events like Strike's outage serve as stress tests, driving innovation in Layer 2 solutions. Consequently, the long-term horizon remains positive if scalability issues are addressed.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.