Loading News...

Loading News...

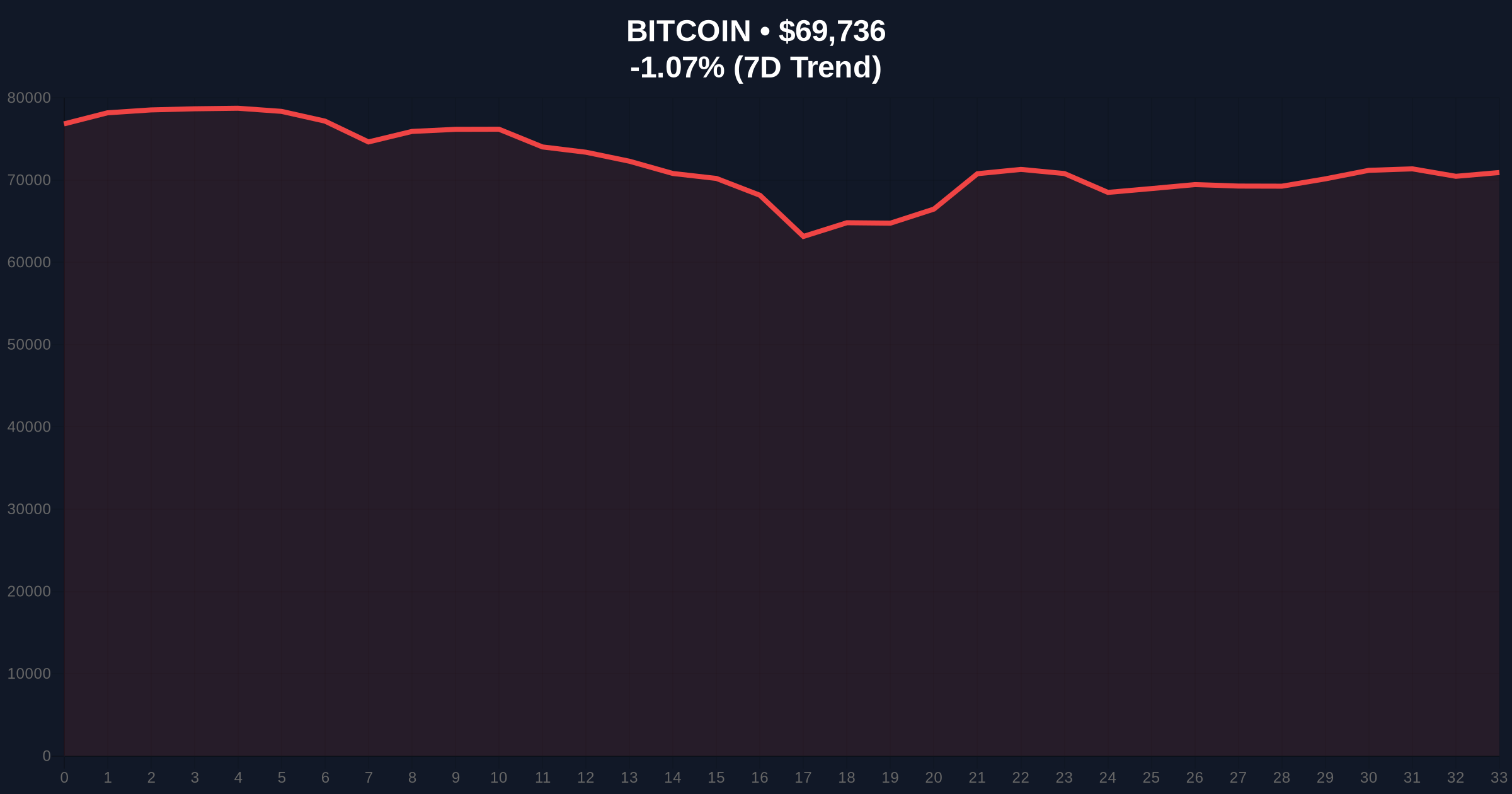

VADODARA, February 9, 2026 — Latest crypto news reveals a stark divergence between analyst forecasts and on-chain reality. According to DL News, London Crypto Club analysts David Brickell and Chris Mills predict a sustained bull market for Bitcoin, citing inevitable Federal Reserve liquidity expansion. Market structure, however, paints a different picture with Bitcoin trading at $69,747 amid extreme fear sentiment.

Analysts base their forecast on U.S. economic strength and Fed balance sheet dynamics. Brickell and Mills argue Treasury purchases will drive liquidity into risk assets. They view President Trump's nomination of hawkish Kevin Warsh as Fed Chair as a temporary suppressant. Their core thesis states money market pressure forces Fed expansion. Consequently, deregulation allows private institutions to fill any liquidity gaps. This creates a "can't lose" narrative for Bitcoin bulls.

Historically, Fed liquidity injections correlate with Bitcoin rallies. The 2020-2021 bull run coincided with unprecedented balance sheet expansion. In contrast, the current environment shows extreme fear at 14/100 on the Crypto Fear & Greed Index. This sentiment contradicts analyst optimism. Market structure suggests a liquidity grab below $70,000 support. Related developments include recent Bitcoin breaking below $70k amid extreme fear and significant whale movements of $277M USDT indicating capital rotation.

Bitcoin currently tests a critical Fair Value Gap (FVG) between $69,200 and $70,500. A breakdown below this zone targets the Fibonacci 0.618 support at $68,500. The 200-day moving average at $67,800 provides secondary structural support. Volume profile analysis shows weak accumulation at current levels. This suggests institutional buyers remain sidelined despite the bullish liquidity narrative. The RSI at 42 indicates neutral momentum, failing to confirm any imminent rally.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contradicts bullish analyst sentiment |

| Bitcoin Current Price | $69,747 | Testing FVG support zone |

| 24-Hour Price Change | -1.05% | Bearish short-term momentum |

| Fibonacci 0.618 Support | $68,500 | Critical structural level |

| 200-Day Moving Average | $67,800 | Long-term trend indicator |

This divergence matters for portfolio allocation. Analyst forecasts rely on macro liquidity cycles. Market structure reflects actual capital flows. The contradiction suggests either analysts are early or wrong. Institutional liquidity typically follows price confirmation, not precedes it. Retail sentiment at extreme fear indicates weak hands may capitulate. This creates potential for a false breakdown and subsequent squeeze. However, the burden of proof remains on bulls to reclaim $70,500.

"The liquidity thesis appears sound on paper, but market microstructure tells a different story. We observe weak order flow and deteriorating momentum across multiple timeframes. Until Bitcoin reclaims the $70.5k FVG, the path of least resistance remains lower. The Fed's balance sheet expansion may be inevitable, but market timing is everything." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current structure. The bullish scenario requires reclaiming the FVG and holding above $70,500. The bearish scenario involves breaking Fibonacci support at $68,500. Historical cycles suggest extreme fear often precedes rallies, but requires a catalyst.

The 12-month institutional outlook depends on Fed policy implementation. According to the Federal Reserve's balance sheet trends, any expansion would likely occur gradually. This creates a potential mismatch between analyst expectations and market reality. The 5-year horizon remains bullish for Bitcoin, but intermediate volatility appears underestimated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.