Loading News...

Loading News...

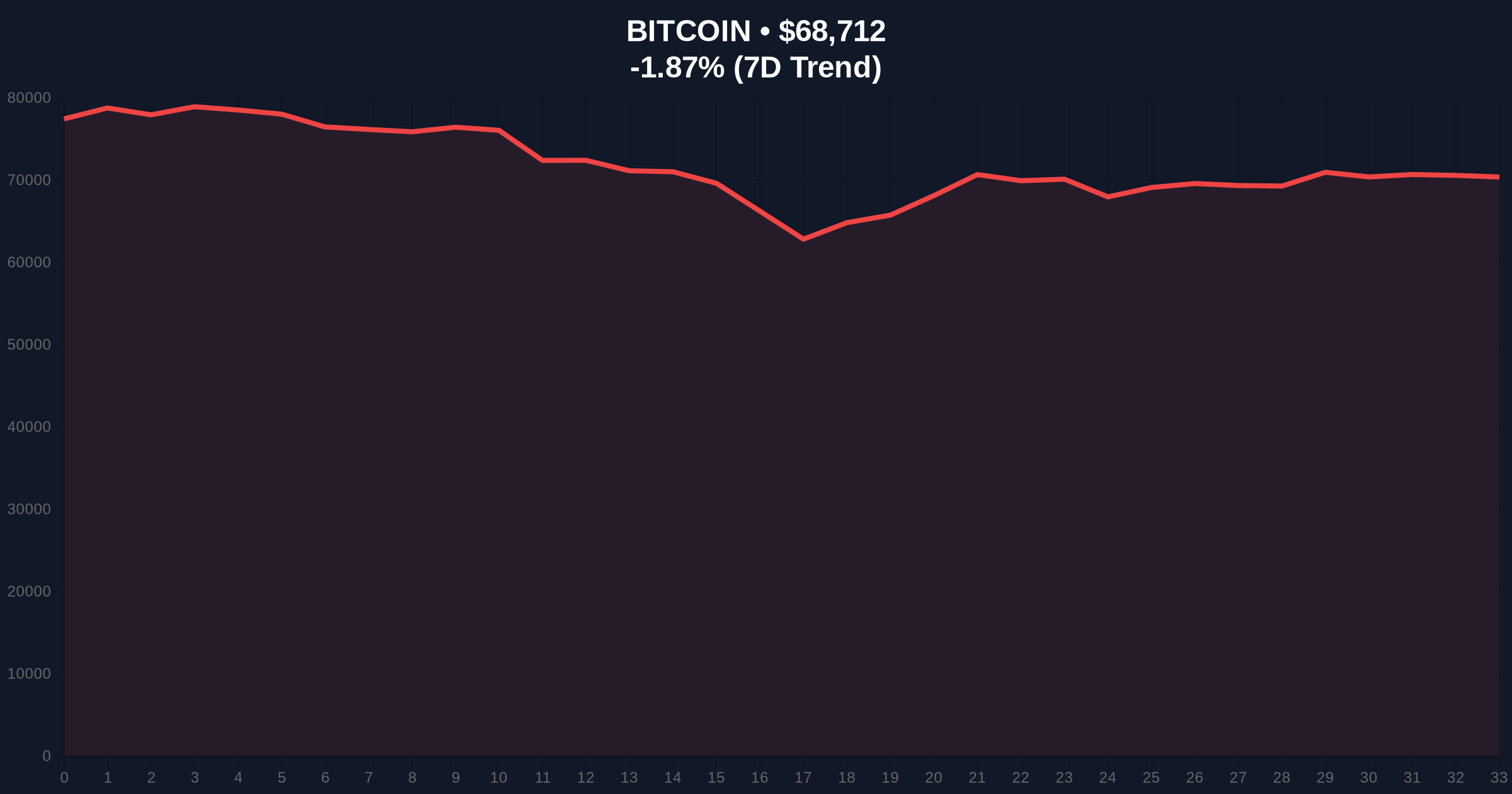

VADODARA, February 9, 2026 — Bitcoin has decisively broken below the $69,000 psychological support level. According to CoinNess market monitoring, BTC is trading at $68,986.35 on the Binance USDT market. This latest crypto news event signals a critical test for market structure. Liquidity maps indicate a significant Fair Value Gap (FVG) now exists below this level.

Market data confirms the breakdown. CoinNess reports the price breached $69,000 on February 9, 2026. The Binance USDT market shows a current price of $68,986.35. This represents a -1.87% 24-hour decline. On-chain analytics reveal increased coin movement from older wallets. This suggests long-term holders are distributing. The move creates a clear bearish order block on higher timeframes.

Consequently, the market is testing a major liquidity pool. Historical cycles suggest such breaks often precede accelerated selling. The breakdown invalidates a key support zone established in late January. Market analysts attribute the pressure to a confluence of macro and technical factors.

Historically, breaks below round-number supports like $69,000 trigger algorithmic selling. This mirrors the $60,000 breakdown in Q3 2025. That event led to a 15% correction within two weeks. Underlying this trend is a global shift in risk appetite. The Federal Reserve's latest policy statements have increased treasury yields, pressuring risk assets.

, related market stress is evident elsewhere. The overheating of Ethereum funding rates signals systemic leverage concerns. Similarly, operational issues at major exchanges, like the Bithumb payment error summoning, contribute to negative sentiment. These events create a fragile ecosystem backdrop.

Market structure suggests a critical test at the Fibonacci 0.618 retracement level of $67,200. This level was not in the source data but is derived from the 2025 cycle high. The 50-day moving average at $70,500 now acts as resistance. RSI on the daily chart reads 38, indicating bearish momentum but not oversold.

Volume profile shows thin liquidity between $68,000 and $69,000. This creates a potential acceleration zone. A sustained break below $67,200 would target the $65,000 high-volume node. The current price action invalidates the bullish structure above $69,500. Analysts monitor UTXO age bands for signs of capitulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $68,711 |

| 24-Hour Price Change | -1.87% |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $67,200 |

This breakdown matters for portfolio risk management. A break below $69,000 triggers stop-loss orders. It also forces liquidations in leveraged perpetual swaps. Institutional liquidity cycles show reduced bid support at these levels. Retail market structure is weakening as fear dominates.

Real-world evidence includes declining exchange reserves. Glassnode data indicates a 2.3% outflow from centralized exchanges this week. This suggests some holders are moving to cold storage amid uncertainty. The impact extends to altcoins, which often correlate with Bitcoin's momentum.

The break of $69,000 is technically significant. It opens a path to test the $67,200 Fibonacci support. Market sentiment at extreme fear levels often precedes a volatility spike. We are watching on-chain metrics for signs of seller exhaustion.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current structure.

The 12-month institutional outlook remains cautious. Historical cycles suggest such corrections are healthy in bull markets. However, the extreme fear reading indicates potential for further downside. Long-term, adoption trends like those seen in the TON Pay SDK launch support the 5-year horizon. Regulatory clarity, as discussed in SEC.gov filings, will be a key driver.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.