Loading News...

Loading News...

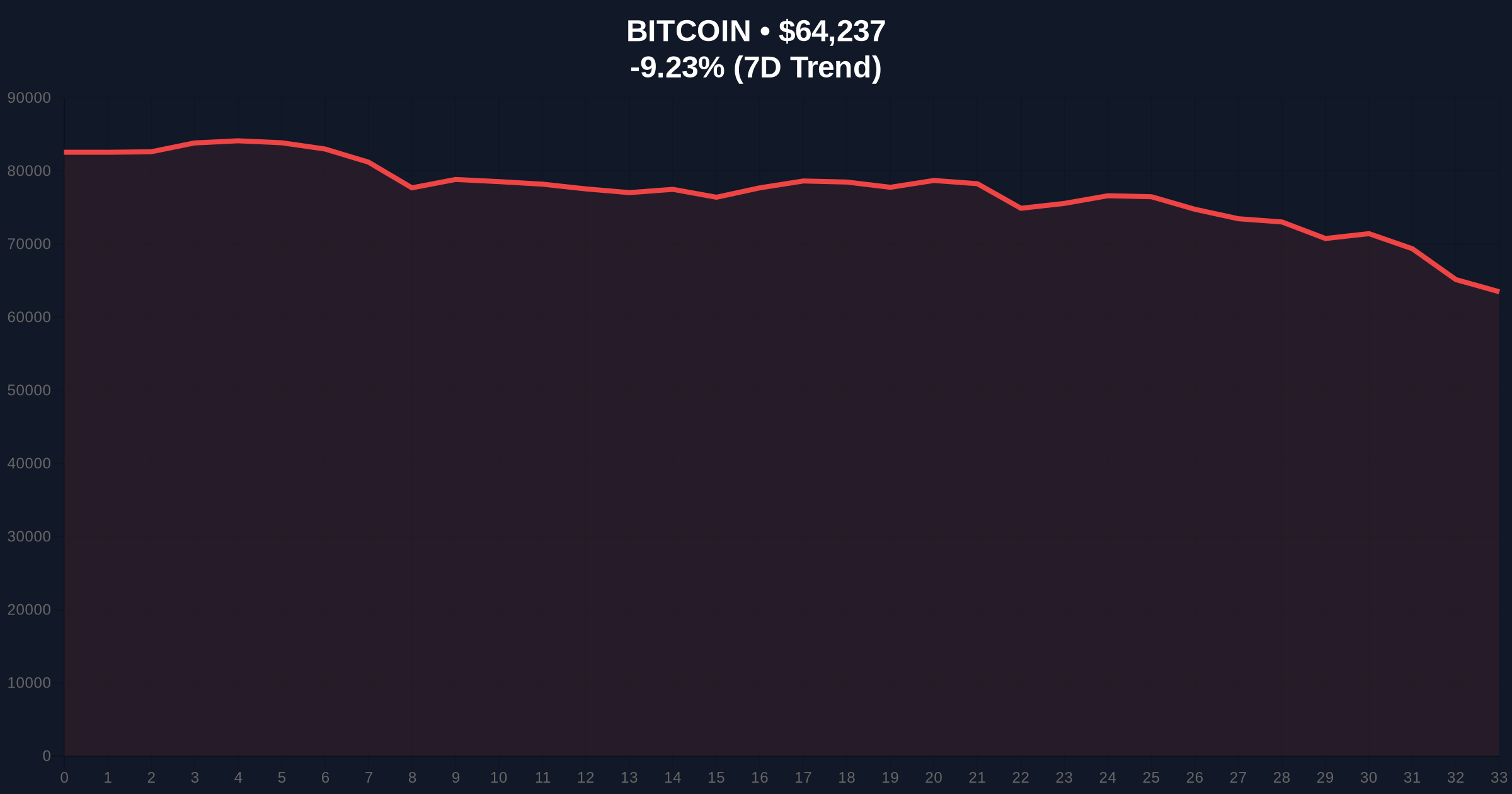

VADODARA, February 6, 2026 — U.S. spot Bitcoin exchange-traded funds (ETFs) recorded net outflows of $434.29 million on February 5, according to data compiled by TraderT. This marks the third consecutive day of net withdrawals, with no ETF posting inflows. The daily crypto analysis reveals a coordinated institutional pullback amid Bitcoin's price decline to $64,340, down 9.08% in 24 hours.

TraderT's data shows BlackRock's IBIT led outflows at -$175.48 million, followed by Fidelity's FBTC at -$109.48 million. Grayscale's GBTC and Mini BTC contributed -$75.42 million and -$35.17 million, respectively. Bitwise's BITB and Ark Invest's ARKB saw smaller withdrawals of -$15.62 million and -$23.12 million. Consequently, total outflows over three days exceed $1.2 billion, creating a significant liquidity gap.

Historically, sustained ETF outflows correlate with bearish phases in Bitcoin cycles. For instance, similar patterns emerged during the 2022 downturn when Grayscale's GBTC discounts widened. Underlying this trend, the current outflow streak coincides with Bitcoin breaking below key psychological support at $63,000, as detailed in our analysis of recent price action. , market-wide liquidations have exacerbated pressure, with Bitcoin long liquidations hitting $1.42B in 24 hours.

Market structure suggests Bitcoin is testing a critical Fibonacci 0.618 retracement level at $61,500, derived from the 2025 rally. This level aligns with a high-volume node in the Volume Profile, indicating strong historical support. The Relative Strength Index (RSI) sits at 28, nearing oversold territory but not yet signaling a reversal. Additionally, the 50-day moving average at $68,200 acts as dynamic resistance, creating a Fair Value Gap (FVG) between current prices and equilibrium.

| Metric | Value |

|---|---|

| Bitcoin ETF Net Outflows (Feb 5) | $434.29M |

| Bitcoin Current Price | $64,340 |

| 24-Hour Price Change | -9.08% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Consecutive Outflow Days | 3 |

ETF outflows directly impact Bitcoin's liquidity profile, as these vehicles represent institutional capital flows. According to on-chain data, the withdrawal streak reduces buying pressure from traditional finance, increasing reliance on retail and algorithmic traders. This shift often amplifies volatility, as seen in the $2 trillion market cap plunge from October 2025 peaks, analyzed in our coverage of broader market trends. , the Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences risk asset correlations, with tightening cycles historically pressuring crypto valuations.

"The ETF outflow data signals a liquidity grab by institutional players, likely rebalancing portfolios amid macroeconomic uncertainty. Market analysts note that sustained withdrawals below the $500M daily threshold could trigger further deleveraging, but historical UTXO age bands suggest long-term holders remain resilient." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, a bullish reversal requires reclaiming the $68,200 resistance, supported by ETF inflow resumption. Second, a bearish extension targets the $61,500 Fibonacci support, with breakdown risking a test of $58,000. The 12-month outlook hinges on institutional adoption cycles, with ETF flows serving as a leading indicator for broader capital allocation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.