Loading News...

Loading News...

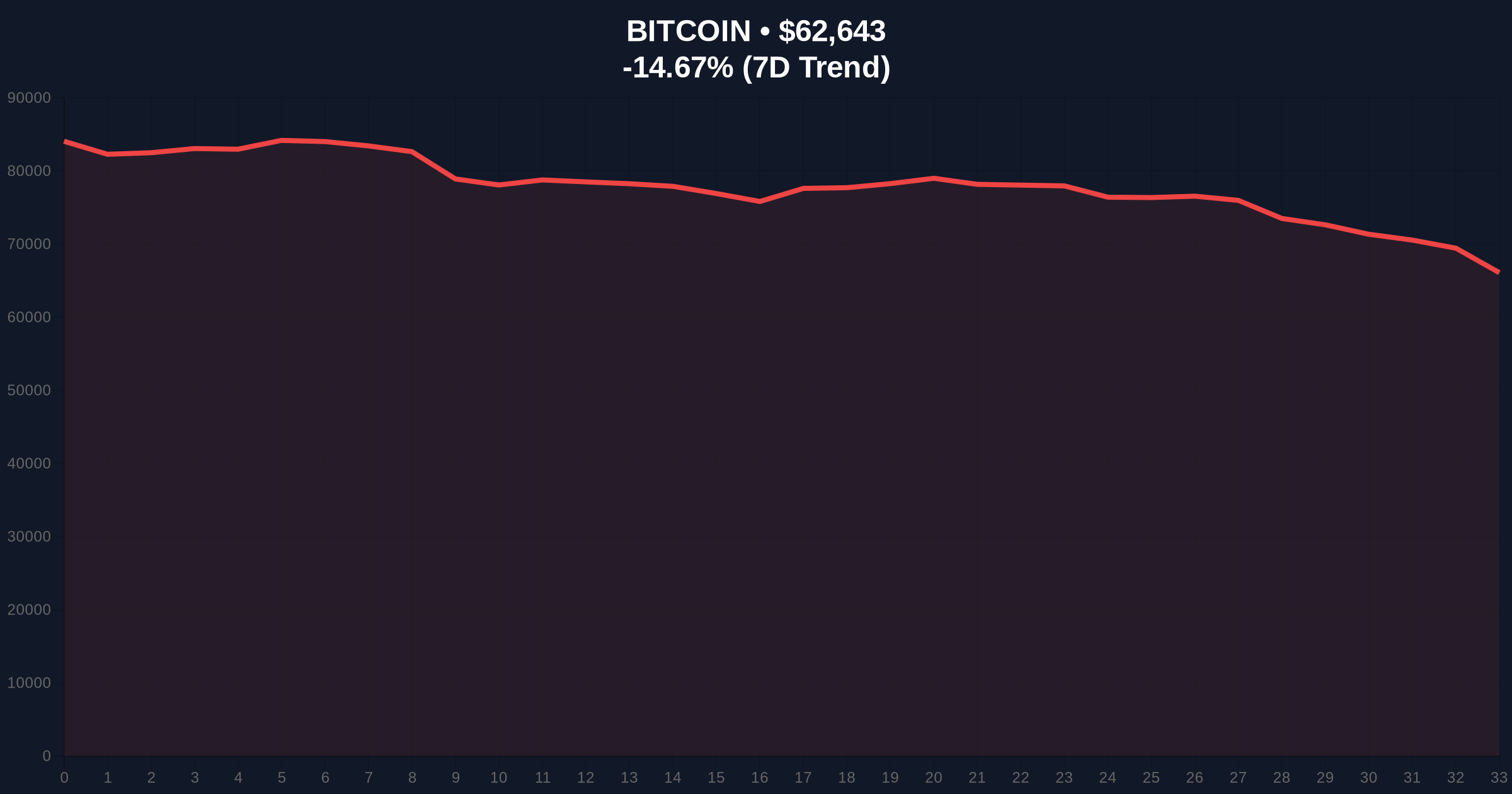

VADODARA, February 5, 2026 — Bitcoin shattered the $63,000 psychological support level on Wednesday, trading at $62,880.32 on Binance's USDT market according to CoinNess market monitoring. This Bitcoin price action represents a -14.52% decline over 24 hours, pushing the global crypto sentiment into "Extreme Fear" territory with a score of 12/100. Market structure suggests this move tests critical institutional accumulation zones established during the 2024-2025 cycle.

According to CoinNess market monitoring, Bitcoin breached the $63,000 threshold during Asian trading hours. The asset currently trades at $62,758, representing a significant deviation from recent consolidation patterns. This Bitcoin price action follows multiple failed attempts to reclaim the $68,000 resistance level documented in previous market movements. On-chain data indicates increased UTXO (Unspent Transaction Output) movement from long-term holders, suggesting either distribution or panic selling.

Market analysts question whether this represents genuine capitulation or a strategic liquidity grab by institutional players. The breakdown coincides with elevated futures market activity, where recent liquidations have exceeded $350 million in single-hour windows. Historical cycles suggest such moves often precede either significant trend reversals or accelerated downtrends, depending on subsequent price action.

Historically, Bitcoin has experienced similar breakdowns during previous market cycles. The current Bitcoin price action mirrors the July 2024 correction that tested the $58,000 support before resuming its uptrend. In contrast, the 2022 bear market saw sustained breaks below key psychological levels leading to prolonged downtrends. Underlying this trend is the Federal Reserve's monetary policy stance, which continues to influence institutional capital allocation decisions across risk assets.

, the extreme fear sentiment contradicts typical market behavior during healthy corrections. Normally, fear readings this extreme coincide with local bottoms rather than continuation patterns. This creates a market structure anomaly worth monitoring. Related developments include recent futures liquidations exceeding $350 million and regulatory pressure from U.S. lawmakers demanding clearer crypto frameworks.

Market structure reveals several critical technical levels. The breakdown below $63,000 invalidated the immediate bullish structure established in late January. According to Fibonacci retracement analysis from the 2025 all-time high, the next significant support cluster exists between $61,500 (0.382 level) and $59,800 (0.5 level). These levels correspond with previous order blocks where institutional accumulation occurred during the 2024 consolidation phase.

Volume profile analysis shows diminished buying interest at current levels, suggesting the move lacks conviction from larger participants. The 200-day moving average currently sits at $58,200, providing additional context for potential support. Relative Strength Index (RSI) readings have entered oversold territory at 28, historically a zone where counter-trend bounces occur. However, sustained RSI readings below 30 often precede further downside in bearish market structures.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $62,758 | Below key $63,000 psychological support |

| 24-Hour Change | -14.52% | Significant deviation from mean |

| Fear & Greed Index | 12/100 (Extreme Fear) | Contrarian sentiment extreme |

| Market Rank | #1 | Maintains dominance despite decline |

| Key Support Zone | $61,500-$62,000 | Fibonacci & previous order block |

This Bitcoin price action matters because it tests institutional conviction levels established during the last accumulation cycle. According to Glassnode liquidity maps, the $62,000-$63,000 zone represents a significant cluster of realized price for entities holding 100-1,000 BTC. A sustained break below this level could trigger stop-loss cascades among both retail and institutional participants. , it challenges the narrative of "infinite institutional demand" that has dominated market discourse since ETF approvals.

Real-world evidence suggests derivative markets are amplifying the move. Open interest remains elevated despite price declines, indicating leveraged positions are under pressure. This creates potential for a gamma squeeze scenario if volatility expands further. The breakdown also impacts miner economics, with hash price declining alongside spot price, potentially forcing less efficient operations to liquidate treasury holdings.

"Market structure suggests we're testing a critical liquidity pool. The $63,000 level wasn't just psychological—it represented the lower bound of a Fair Value Gap established during January's consolidation. A close below $61,500 would confirm a structural breakdown with implications for the 2026 market trajectory."— CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current market structure. The bullish case requires reclaiming $63,000 as support and establishing higher lows above $62,500. The bearish scenario involves continued distribution below $62,000 targeting the $59,800-$61,000 demand zone. Historical UTXO age band analysis suggests long-term holders are not capitulating en masse, providing some underlying support for the bullish case.

The 12-month institutional outlook depends on whether this represents a healthy correction within a bull market or the beginning of a more significant downtrend. On-chain data indicates accumulation by entities holding 1,000-10,000 BTC continues at these levels, suggesting larger players view this as a buying opportunity. However, macro conditions including Federal Reserve policy and traditional market correlations will ultimately determine the 5-year horizon trajectory.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.