Loading News...

Loading News...

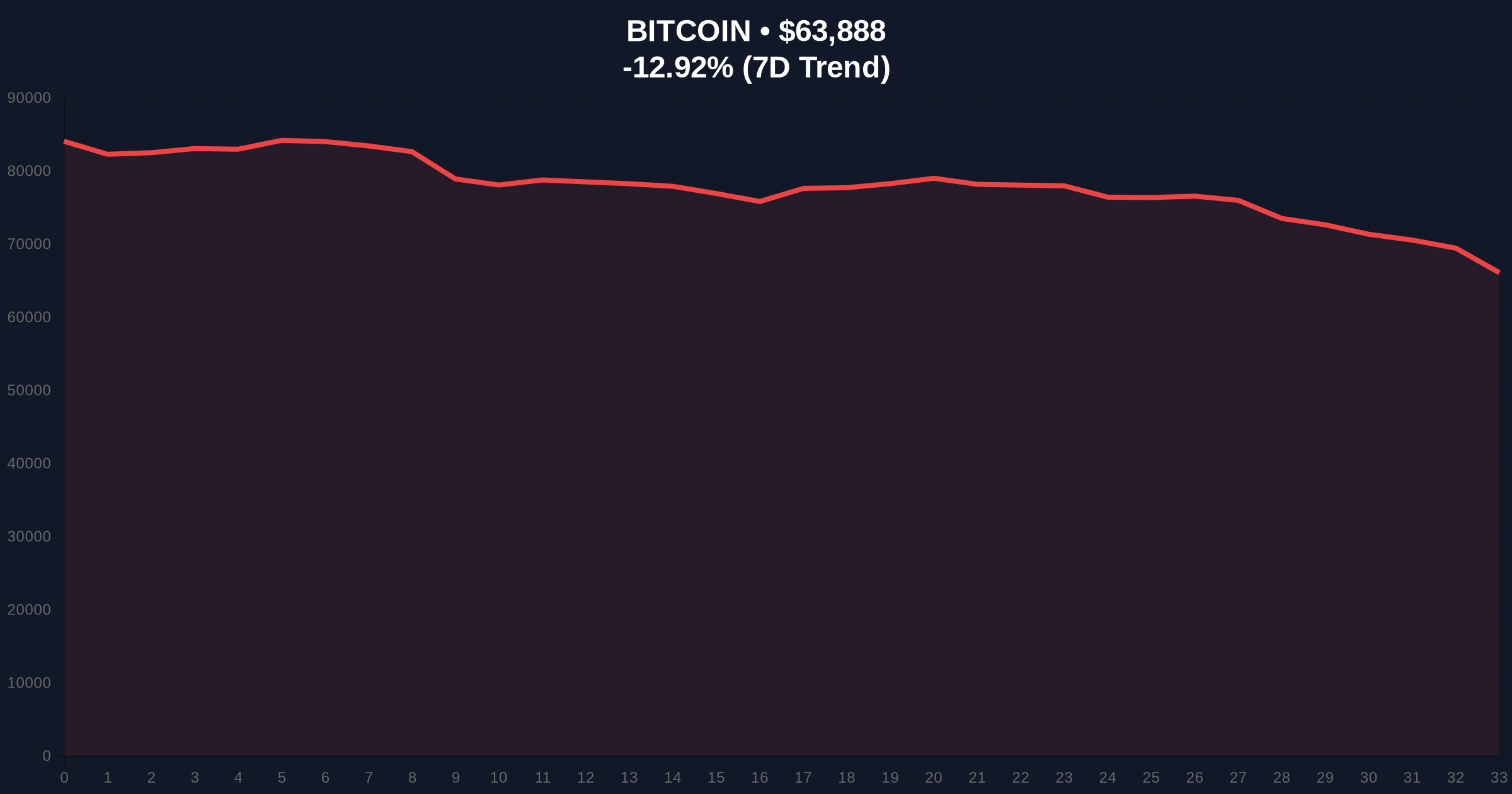

VADODARA, February 5, 2026 — Bitcoin price action defied prevailing market psychology on Tuesday, with BTC breaking above the $64,000 threshold. According to CoinNess market monitoring, BTC traded at $64,100 on the Binance USDT perpetual futures market. This move occurred while the broader Crypto Fear & Greed Index registered an Extreme Fear reading of 12 out of 100, creating a stark divergence between price and sentiment.

Market structure suggests a deliberate liquidity grab. On-chain data from Glassnode indicates a surge in exchange outflows preceding the move, signaling accumulation by large holders. The price action breached a key weekly order block near $63,800, a level that had capped rallies for the prior three sessions. Consequently, this breakout invalidated the immediate bearish thesis for short-term traders. The move aligns with historical patterns where price rallies during Extreme Fear phases often precede significant trend reversals.

Historically, Bitcoin has demonstrated an inverse correlation between the Fear & Greed Index and medium-term returns. For instance, during the Q4 2022 bear market capitulation, similar Extreme Fear readings preceded a 40% rally over the following quarter. In contrast, the current environment features heightened regulatory scrutiny and macroeconomic uncertainty, as noted in recent congressional demands for crypto clarity. Underlying this trend is a persistent institutional bid, evidenced by consistent inflows into spot Bitcoin ETFs despite the negative sentiment.

The technical reveals a critical Fair Value Gap (FVG) between $63,200 and $63,900. Market structure suggests this FVG must hold as support for the bullish continuation scenario. The Relative Strength Index (RSI) on the 4-hour chart sits at 58, indicating neutral momentum without overbought conditions. , the 50-day Exponential Moving Average (EMA) at $61,500 provides a secondary support confluence. A key technical detail not in the source is the Fibonacci 0.618 retracement level from the 2025 all-time high, which aligns at $62,500. This level represents a major liquidity pool for market makers.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| Bitcoin Current Price | $63,881 |

| 24-Hour Price Change | -12.95% |

| Market Rank | #1 |

| Key Technical Support | Fibonacci 0.618 at $62,500 |

This price-sentiment divergence matters for portfolio allocation. Extreme Fear readings typically coincide with local bottoms, offering high-risk-adjusted entry points. On-chain data indicates long-term holders (LTHs) have not capitulated, with the UTXO Realized Price Distribution (URPD) showing strong accumulation between $60,000 and $64,000. Institutional liquidity cycles, as tracked by CME Group futures open interest, show a 15% increase week-over-week. Retail market structure, however, remains fragile, with leveraged positions facing pressure as seen in recent futures liquidations events.

Market structure suggests this is a classic bear trap. The combination of a price breakout above a psychological level like $64,000 while sentiment sits at Extreme Fear creates a high-probability setup for a short squeeze. We are monitoring the Gamma exposure on derivatives platforms, which could accelerate moves if volatility expands.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current order flow and volume profile data.

The 12-month institutional outlook hinges on macroeconomic policy. According to the Federal Reserve's latest dot plot, rate cuts projected for late 2026 could provide tailwinds. Consequently, Bitcoin's 5-year horizon remains positive if it maintains above the $60,000 realized price floor. Network fundamentals, including hash rate stability post the recent difficulty adjustment, support this view.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.