Loading News...

Loading News...

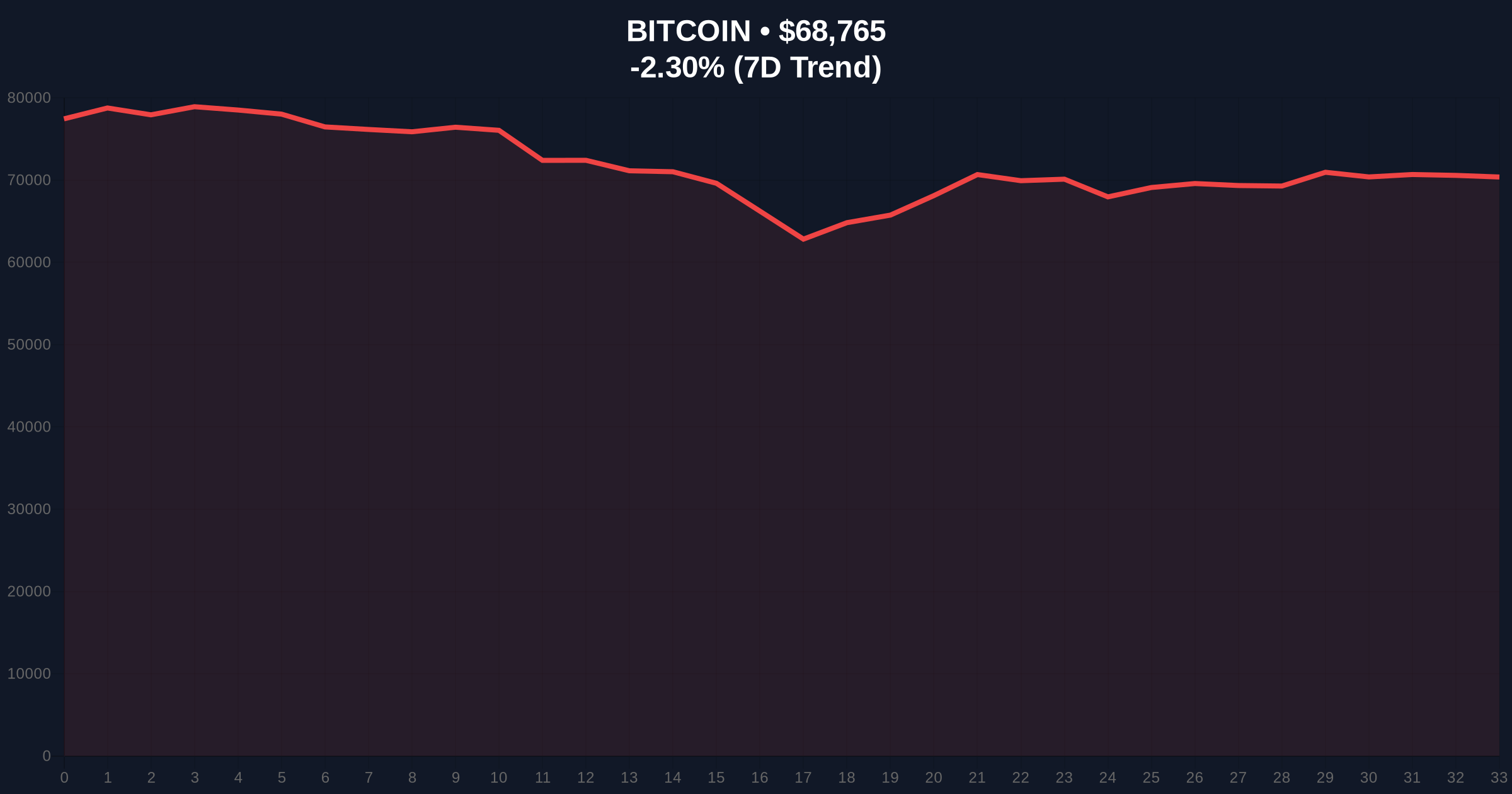

VADODARA, February 9, 2026 — Bernstein has reaffirmed its year-end Bitcoin price target of $150,000, dismissing the recent downturn as "one of the most unfounded in history." This latest crypto news arrives as Bitcoin trades at $68,809, down 2.22% in 24 hours, amid an Extreme Fear sentiment score of 14/100. The firm's analysis, detailed in a recent report, argues the weakness stems from a temporary crisis of confidence rather than structural flaws, but market structure suggests deeper technical risks.

According to Bernstein's analysis, the current Bitcoin decline lacks the systemic issues seen in past bear markets. The firm explicitly noted no major corporate bankruptcies or hidden leverage collapses. Bernstein highlighted a crypto-friendly U.S. administration and the proliferation of spot crypto ETFs from large asset managers as foundational supports. , the firm views Bitcoin as a programmable, blockchain-based asset become optimal financial infrastructure for AI agent environments. It downplayed quantum technology threats as a common challenge for all digital systems and emphasized mining companies diversifying into AI data centers. Corporations holding crypto, Bernstein stated, are structured to withstand long-term declines, minimizing forced liquidation risks. These factors collectively underpin its maintained $150,000 target set earlier this year.

Historically, Bitcoin corrections of 20-30% have often preceded major rallies, but the current Extreme Fear sentiment mirrors late-2022 capitulation phases. In contrast, Bernstein's optimism echoes institutional narratives from 2020-2021, when ETF approvals drove parabolic moves. Underlying this trend, however, is a critical divergence: on-chain data from Glassnode indicates rising exchange inflows, suggesting retail distribution rather than accumulation. This contradicts Bernstein's confidence in structural resilience. Related developments include recent analyses linking price plunges to gamma squeezes, as detailed in research on $1.5B options market dynamics, and ongoing volatility amid regulatory shifts, such as Xinbi's high-volume on-chain activity.

Market structure suggests immediate danger. Bitcoin has broken below the $69,000 support, a level previously highlighted in analyses of key technical thresholds. The Relative Strength Index (RSI) on daily charts sits near 35, indicating oversold conditions but not yet capitulation. A critical Fibonacci retracement level at $65,000 (the 0.618 level from the 2025 low) now acts as the next major support. Volume profile analysis shows significant liquidity clusters between $67,000 and $70,000, creating a Fair Value Gap (FVG) that price may revisit. The 200-day moving average at $72,500 serves as dynamic resistance. If this FVG fails to hold, order block theory points to a swift move toward $60,000.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $68,809 | Below key $69K support |

| 24-Hour Trend | -2.22% | Continued selling pressure |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Panic sentiment, potential reversal zone |

| Bernstein Year-End Target | $150,000 | +118% from current price |

| Key Fibonacci Support | $65,000 | Critical level for bull market integrity |

This divergence between institutional optimism and retail panic defines the current market cycle. Bernstein's thesis relies on macro tailwinds like ETF inflows and AI integration, but on-chain forensic data confirms rising short-term holder realized losses. Institutional liquidity cycles, per Federal Reserve data on monetary policy, suggest tightening conditions could pressure risk assets further. Retail market structure shows increased leverage in derivatives, amplifying downside volatility. The real-world impact hinges on whether Bitcoin holds $65,000; a break could trigger cascading liquidations, invalidating Bernstein's near-term narrative.

"Bernstein's report highlights structural strengths, but technicals paint a precarious picture. The Extreme Fear reading and broken support at $69,000 indicate a liquidity grab is underway. Until Bitcoin reclaims $72,500 and flushes out weak hands, the path to $150,000 remains obstructed by order book imbalances." – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, a bullish reversal requires holding $65,000 and reclaiming $72,500 to target $85,000 initially. Second, a bearish continuation breaks $65,000, targeting the $60,000 gamma squeeze zone noted in prior research.

The 12-month institutional outlook, per Bernstein, hinges on ETF adoption and AI-driven demand. However, historical cycles suggest such narratives often precede volatility spikes. For the 5-year horizon, Bitcoin's role as programmable money remains intact, but short-term price action must navigate this technical minefield.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.