Loading News...

Loading News...

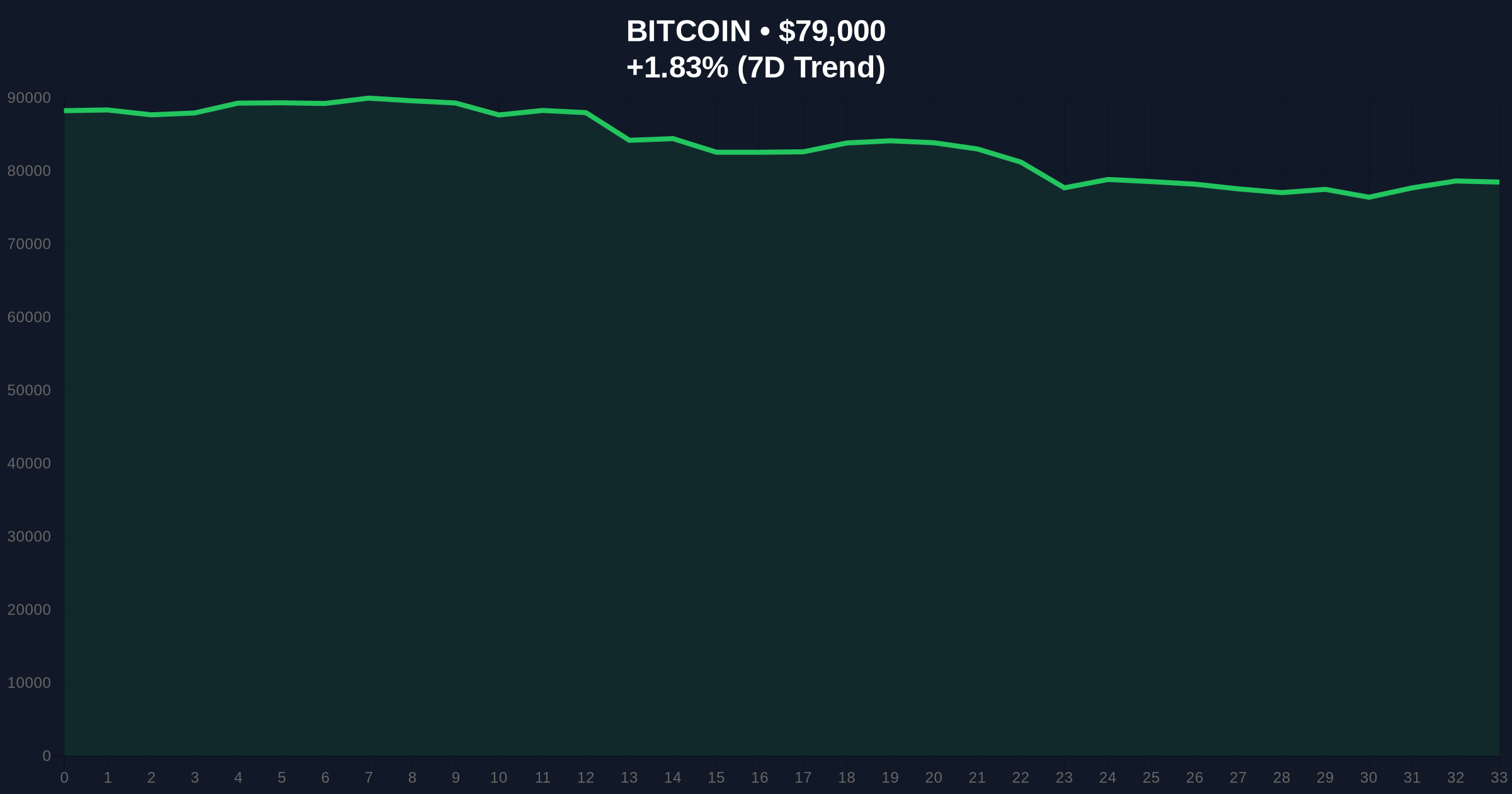

VADODARA, February 3, 2026 — U.S. investment bank Compass Point projects Bitcoin is nearing a bear market bottom. Market structure suggests a support zone between $60,000 and $68,000. Resistance looms at $81,000–$83,000. This daily crypto analysis dissects the institutional outlook.

Compass Point released a research note on February 3, 2026. According to the report, Bitcoin's bear phase is in its final stages. The bank identified a primary support range of $60,000 to $68,000. On-chain data indicates 7% of long-term holders acquired BTC in this zone.

Simultaneously, Compass Point flagged $81,000 to $83,000 as strong resistance. The $70,000–$80,000 range presents an "air pocket." Order book analysis shows less than 1% of long-term holder accumulation here. Prices could fall sharply in this liquidity void.

A breach below $60,000 could target $55,000. The bank noted this scenario requires multiple negative catalysts. These include a U.S. stock market crash and major crypto firm bankruptcies.

Historically, Bitcoin bottoms form where long-term holder cost bases cluster. The 2022 cycle saw a similar pattern near the 200-week moving average. In contrast, the current analysis uses UTXO age bands to pinpoint accumulation zones.

Underlying this trend is extreme fear sentiment. The Crypto Fear & Greed Index sits at 17/100. This mirrors capitulation phases seen in late 2018 and mid-2022. Market analysts view such sentiment as a potential contrarian indicator.

Related developments highlight this pervasive fear. Recent news includes Bitcoin's struggle to hold $79,000 and on-chain data validating long-term trends. , significant Ethereum sell-offs occurred amid this climate.

Market structure suggests a critical Fair Value Gap (FVG) between $70,000 and $80,000. This aligns with Compass Point's "air pocket" assessment. The Fibonacci 0.618 retracement level from the 2025 high sits near $65,000, reinforcing the support thesis.

Resistance at $82,000 coincides with the 50-day exponential moving average. A break above this Order Block would invalidate the immediate bearish structure. The Relative Strength Index (RSI) on weekly charts shows oversold conditions, typical of late-cycle bottoms.

According to Ethereum.org's documentation on blockchain analytics, on-chain metrics like MVRV Z-Score often bottom alongside price. Current data suggests Bitcoin is approaching that zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $79,070 |

| Bitcoin 24h Trend | +1.92% |

| Compass Point Support Zone | $60,000–$68,000 |

| Compass Point Resistance Zone | $81,000–$83,000 |

This analysis provides a data-driven framework for institutional liquidity cycles. The defined support and resistance zones act as magnets for price action. Retail market structure often clusters around these levels, creating self-fulfilling prophecies.

Real-world evidence shows long-term holder behavior drives macro trends. The 7% accumulation in the $60K–$68K range represents a high-conviction cohort. Their inactivity during drawdowns typically signals a local bottom.

"Compass Point's note highlights the importance of on-chain cost basis analysis. The $70K–$80K air pocket is a classic liquidity grab zone. A break below $60K would require exogenous shocks, not just technical selling." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the Compass Point framework.

The 12-month institutional outlook hinges on these levels. A successful hold at $60K–$68K could set the stage for a new accumulation phase. This aligns with a 5-year horizon where Bitcoin's scarcity and institutional adoption remain key drivers. Post-merge issuance dynamics for Ethereum, as detailed in its official documentation, also influence broader crypto capital flows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.