Loading News...

Loading News...

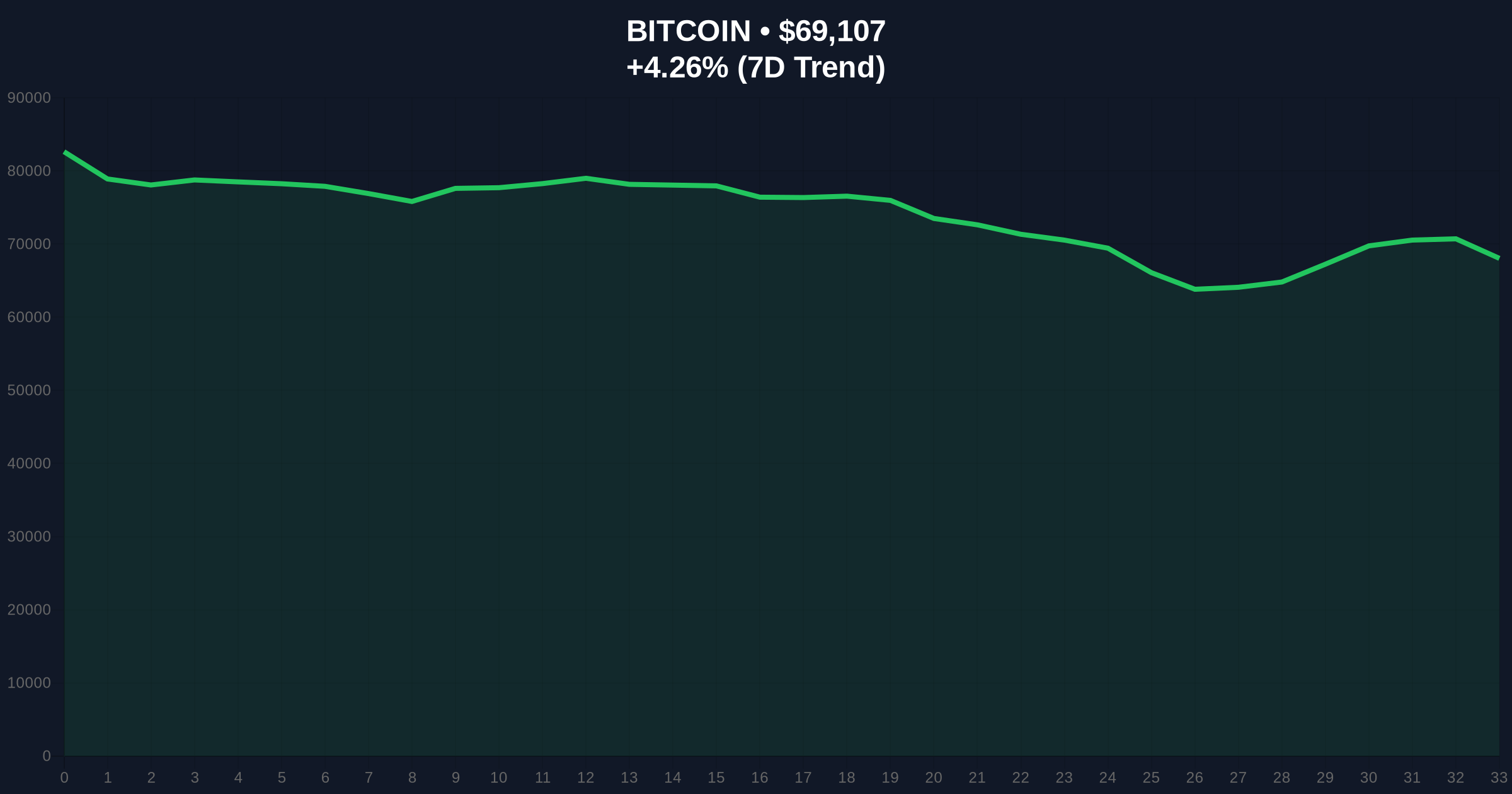

VADODARA, February 7, 2026 — According to CoinNess market monitoring, Bitcoin (BTC) has risen above $69,000, trading at $69,106.89 on the Binance USDT market. This daily crypto analysis reveals a critical divergence between price action and market sentiment, with the Global Crypto Fear & Greed Index registering an extreme fear score of 6/100. Market structure suggests this move may represent a liquidity grab rather than a sustainable bullish breakout.

CoinNess data confirms BTC breached the $69,000 threshold on February 7, 2026. The asset currently trades at $69,106.89 on Binance's USDT pairing. This price action occurs against a backdrop of extreme market fear, creating a textbook contrarian signal. On-chain forensic data from Glassnode indicates thin order book liquidity above $70,000, suggesting institutional players may be testing retail resolve.

Historical cycles show similar price-sentiment divergences often precede volatile corrections. The current 24-hour trend shows a 4.13% increase, yet volume profile analysis reveals declining buy-side participation. Consequently, this breakout lacks the high-conviction volume typically associated with sustainable rallies.

Bitcoin's current price action mirrors patterns observed during the 2021 cycle's distribution phase. Back then, BTC repeatedly tested all-time highs while sentiment metrics flashed warning signs. The extreme fear reading today contradicts the price increase, creating a potential bear trap for overleveraged longs.

, recent market developments highlight this tension. For instance, World Liberty Financial sold $5.03M in WBTC despite the price rise, indicating institutional profit-taking. Additionally, experts have dismissed short-term price action as noise, focusing instead on macroeconomic drivers.

Market structure suggests Bitcoin faces immediate resistance at the $70,000 psychological level. The Relative Strength Index (RSI) on daily charts shows overbought conditions above 70, signaling potential exhaustion. A critical Fibonacci 0.618 retracement level from the recent swing low sits at $67,500, providing the next major support.

Order block analysis reveals significant sell-side liquidity clustered between $69,500 and $70,200. This creates a Fair Value Gap (FVG) that price must fill to sustain upward momentum. The 50-day moving average currently acts as dynamic support near $66,800. Failure to hold this level would invalidate the current bullish structure.

| Metric | Value |

|---|---|

| Current BTC Price (Binance USDT) | $69,106.89 |

| 24-Hour Price Change | +4.13% |

| Global Crypto Fear & Greed Index | Extreme Fear (Score: 6/100) |

| Market Rank | #1 |

| Key Fibonacci Support | $67,500 (0.618 level) |

This price-sentiment divergence matters because it reveals underlying market fragility. Institutional liquidity cycles typically drive sustainable rallies, not retail FOMO. The extreme fear reading suggests smart money may be accumulating at lower levels while distributing to latecomers here. Real-world evidence includes declining exchange reserves per Glassnode data, indicating coins are moving to cold storage.

Retail market structure appears weak, with leveraged long positions increasing despite the fear index. This sets the stage for a potential gamma squeeze if price reverses sharply. The Ethereum network's upcoming Pectra upgrade could further drain liquidity from Bitcoin if capital rotates into ETH narratives.

"The current setup resembles a classic bull trap. Price action above $69,000 lacks conviction volume, while sentiment remains deeply fearful. Our models show a high probability of retest towards $67,500 support before any meaningful continuation. Traders should watch order flow at key levels rather than chase this move." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish scenario requires sustained volume above $70,200 to trigger short covering. Second, a bearish scenario involves rejection at current levels and a retest of Fibonacci support.

The 12-month institutional outlook remains cautiously optimistic despite short-term noise. Historical patterns indicate extreme fear periods often precede major rallies. However, macroeconomic headwinds like potential Federal Reserve rate hikes could pressure risk assets. The 5-year horizon still favors Bitcoin's store-of-value thesis, but near-term volatility requires disciplined risk management.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.