Loading News...

Loading News...

VADODARA, February 3, 2026 — An Ethereum address suspected to belong to founder Vitalik Buterin executed a $1.16 million ETH sale over eight hours, according to on-chain data from Lookonchain. This latest crypto news event unfolds as the broader market grapples with extreme fear sentiment, raising questions about strategic positioning versus bearish signaling.

Lookonchain data indicates the address sold exactly 493 ETH for $1.16 million. Market structure suggests the transactions occurred across multiple blocks within an eight-hour window. The address remains "suspected" rather than confirmed, creating immediate narrative friction. On-chain forensic analysis typically relies on historical patterns and known wallet clusters, but attribution carries inherent uncertainty.

Consequently, the market must separate signal from noise. A $1.16 million sale represents a minor liquidity event against Ethereum's $281 billion market capitalization. However, founder-linked activity often triggers disproportionate psychological impact. The timing during extreme fear conditions amplifies this effect, potentially creating a localized Fair Value Gap (FVG) on lower timeframes.

Historically, founder sales have produced mixed outcomes. In 2021, similar transactions sometimes preceded short-term volatility but rarely altered macro trends. The current environment mirrors late-2022 conditions, where extreme fear coincided with structural accumulation zones. Underlying this trend, institutional liquidity remains constrained.

Market analysts note parallel developments in liquidity dynamics. For instance, recent 250 million USDC minting events have sparked debates about stablecoin supply manipulation. , exchange actions like Binance listing new perpetual futures during fear periods often aim to capture retail leverage flows. These events collectively paint a picture of strategic positioning amid weak sentiment.

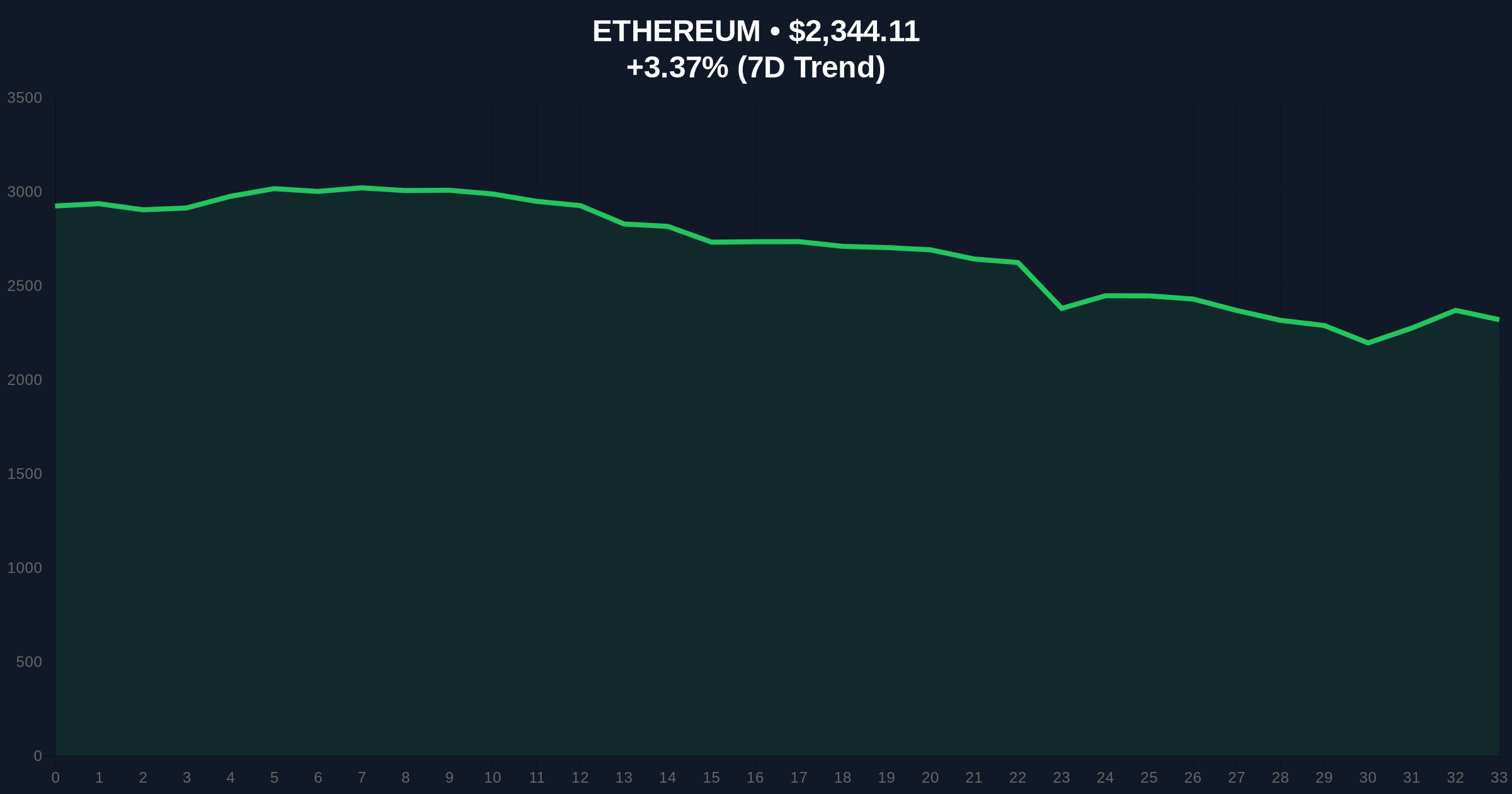

Ethereum currently trades at $2,344.18, showing a 24-hour gain of 3.37%. This move tests the 50-day exponential moving average near $2,350. The Volume Profile Visible Range (VPVR) identifies a high-volume node between $2,280 and $2,320, serving as critical support. A breakdown below this zone would invalidate the current structure.

Additionally, the weekly Relative Strength Index (RSI) sits at 48, indicating neutral momentum. The 0.618 Fibonacci retracement level from the 2024 high to the 2025 low rests at $2,410, creating immediate resistance. On-chain data from Glassnode shows declining exchange balances, suggesting accumulation despite fear sentiment. This divergence between price action and holder behavior warrants scrutiny.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Ethereum Current Price | $2,344.18 |

| 24-Hour Price Change | +3.37% |

| ETH Sold by Address | 493 ETH ($1.16M) |

| Ethereum Market Rank | #2 |

This transaction matters because it tests market psychology during a fragile sentiment period. Extreme fear readings often precede trend reversals when combined with positive divergence. However, founder sales can exacerbate negative momentum if interpreted as loss of confidence. Real-world evidence from past cycles shows that similar events frequently serve as liquidity grabs rather than fundamental shifts.

Institutional liquidity cycles currently favor accumulation in fear environments. The sale's relatively small size suggests it may represent portfolio rebalancing rather than a bearish bet. Market structure indicates that larger players often use such events to trigger stop-loss cascades, creating better entry points. The Ethereum network's underlying fundamentals, including EIP-4844 adoption and staking ratios, remain robust despite price volatility.

Market structure suggests this sale is noise, not signal. A $1.16 million transaction represents 0.0004% of Ethereum's market cap. In extreme fear environments, minor sells often get amplified by algorithmic trading and social sentiment. The critical level remains the $2,280 VPVR support. If that holds, this event likely becomes a footnote in the next liquidity cycle.

Two data-backed technical scenarios emerge from current conditions. The bullish scenario requires holding the $2,280 support and breaking the $2,410 Fibonacci resistance. The bearish scenario involves a breakdown below $2,280 triggering a test of the $2,150 order block.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles show that extreme fear periods often precede multi-quarter rallies. However, macro liquidity conditions, including Federal Reserve policy, will dictate the magnitude. Ethereum's transition to a full rollup-centric roadmap through the Pectra upgrade could drive fundamental revaluation independent of short-term price action.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.