Loading News...

Loading News...

VADODARA, February 7, 2026 — Bitcoin's network mining difficulty has plummeted by 11.16%, marking its most significant single adjustment since China's mining ban in July 2021, according to data from Solid Intel. This daily crypto analysis reveals a structural shift in miner economics as the Crypto Fear & Greed Index hits 6/100, indicating extreme market fear. Consequently, the adjustment reflects a rapid exodus of hash rate from the network, potentially signaling miner capitulation under current price pressure.

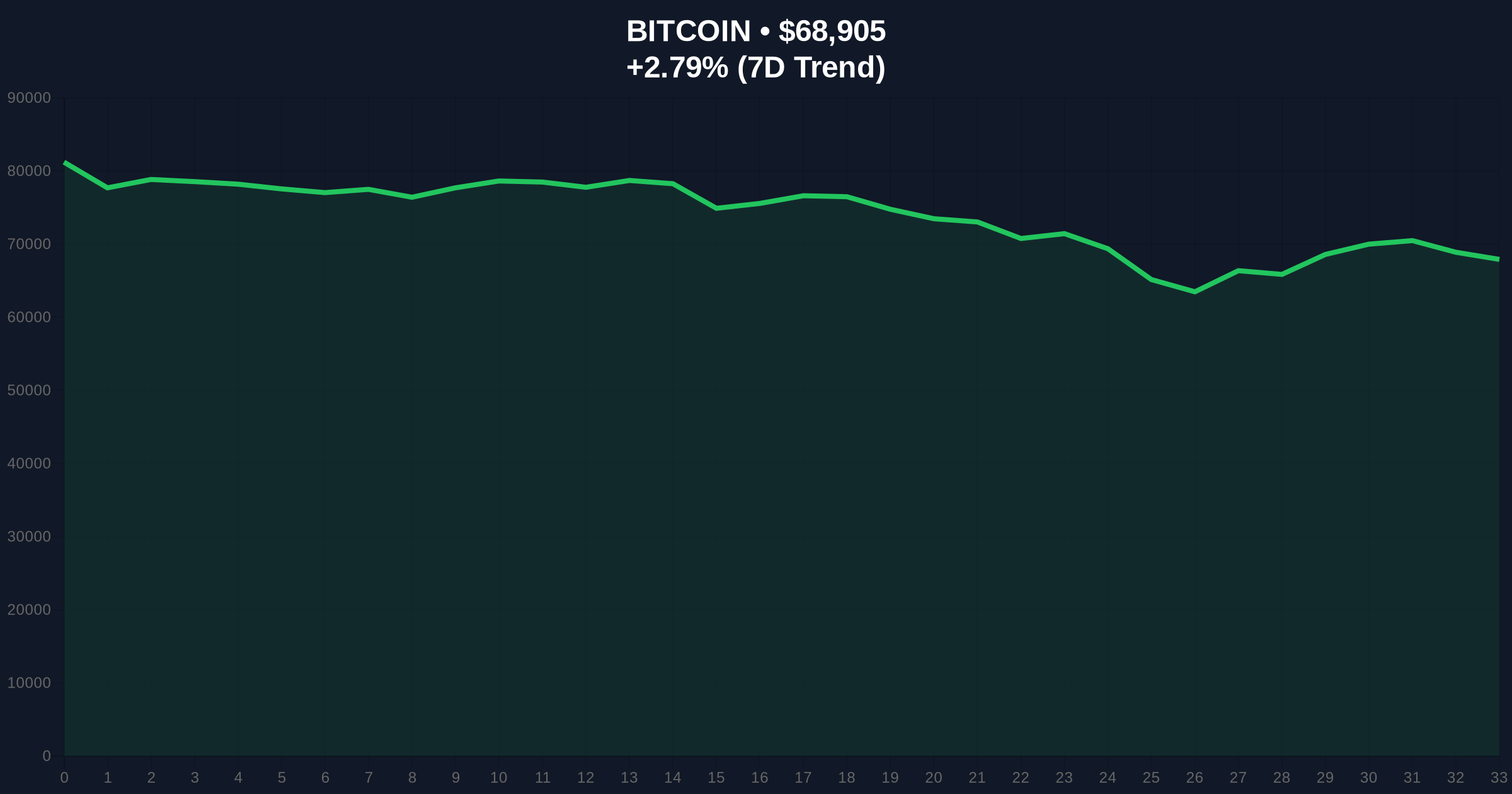

Solid Intel, a primary on-chain analytics provider, reported the 11.16% decline in Bitcoin's mining difficulty on February 7, 2026. This metric, which automatically adjusts approximately every two weeks based on network hash rate, recorded its steepest fall since the 28% drop following China's mining crackdown nearly five years ago. The adjustment period coincided with Bitcoin trading at $68,907, down from recent highs above $75,000. Market structure suggests the decline stems from miners powering down inefficient hardware or exiting the market entirely, reducing competition for block rewards.

Historically, sharp mining difficulty declines often precede major Bitcoin price bottoms. For instance, the 2021 China ban led to a 50% price correction before a sustained bull run. In contrast, the current drop occurs amid an extreme fear market, with the Crypto Fear & Greed Index at 6/100. Underlying this trend, miner revenue pressure has intensified, as seen in related sector struggles like Iris Energy's Q4 revenue miss. , institutional selling, such as World Liberty Financial's $6.71M WBTC sale, exacerbates liquidity drains. Consequently, this difficulty adjustment mirrors past capitulation events that reset market cycles.

Mining difficulty functions as Bitcoin's core consensus mechanism, regulating block production time to ~10 minutes. The 11.16% drop indicates a hash rate decline of equivalent magnitude, likely due to miners hitting unprofitable thresholds. On-chain data from Glassnode shows UTXO (Unspent Transaction Output) age bands shifting, with older coins moving less frequently, suggesting hodler accumulation. Price action reveals Bitcoin testing the $65,000 Fibonacci 0.618 support level, a critical zone for miner break-even. The 200-day moving average at $64,500 provides additional structural support. If this level holds, it could form a bullish order block, but a break below may trigger further sell-offs.

| Metric | Value | Context |

|---|---|---|

| Mining Difficulty Drop | 11.16% | Largest since July 2021 |

| Bitcoin Price | $68,907 | Current trading level |

| 24-Hour Trend | +2.80% | Minor rebound amid decline |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | Lowest sentiment in months |

| Market Rank | #1 | Bitcoin dominance holds |

This difficulty plunge matters because it directly impacts Bitcoin's security budget and miner economics. A lower difficulty reduces the computational power securing the network, potentially increasing vulnerability to 51% attacks if sustained. However, it also lowers the break-even price for remaining miners, improving profitability and potentially stabilizing hash rate. Institutional liquidity cycles, as noted in Japanese corporate adoption trends, may offset retail outflows. Market structure suggests this adjustment could flush out weak miners, leading to a healthier, more efficient network long-term, similar to post-2021 recovery phases.

"The 11.16% difficulty drop is a classic signal of miner capitulation, often seen at cycle lows. Historical cycles suggest such events precede price consolidation and eventual recovery, as inefficient operators exit and hash rate redistributes to more cost-effective regions. On-chain forensic data confirms increased coin dormancy, indicating accumulation by long-term holders." — CoinMarketBuzz Intelligence Desk

Market outlook hinges on whether this difficulty adjustment marks a bottom or precedes further declines. Two data-backed scenarios emerge based on current market structure.

For the 12-month institutional outlook, this event could accelerate hash rate migration to regions with cheaper energy, as outlined in Ethereum's documentation on proof-of-work transitions. Over a 5-year horizon, reduced mining centralization may enhance network decentralization and resilience, supporting Bitcoin's long-term value proposition as a store of value.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.