Loading News...

Loading News...

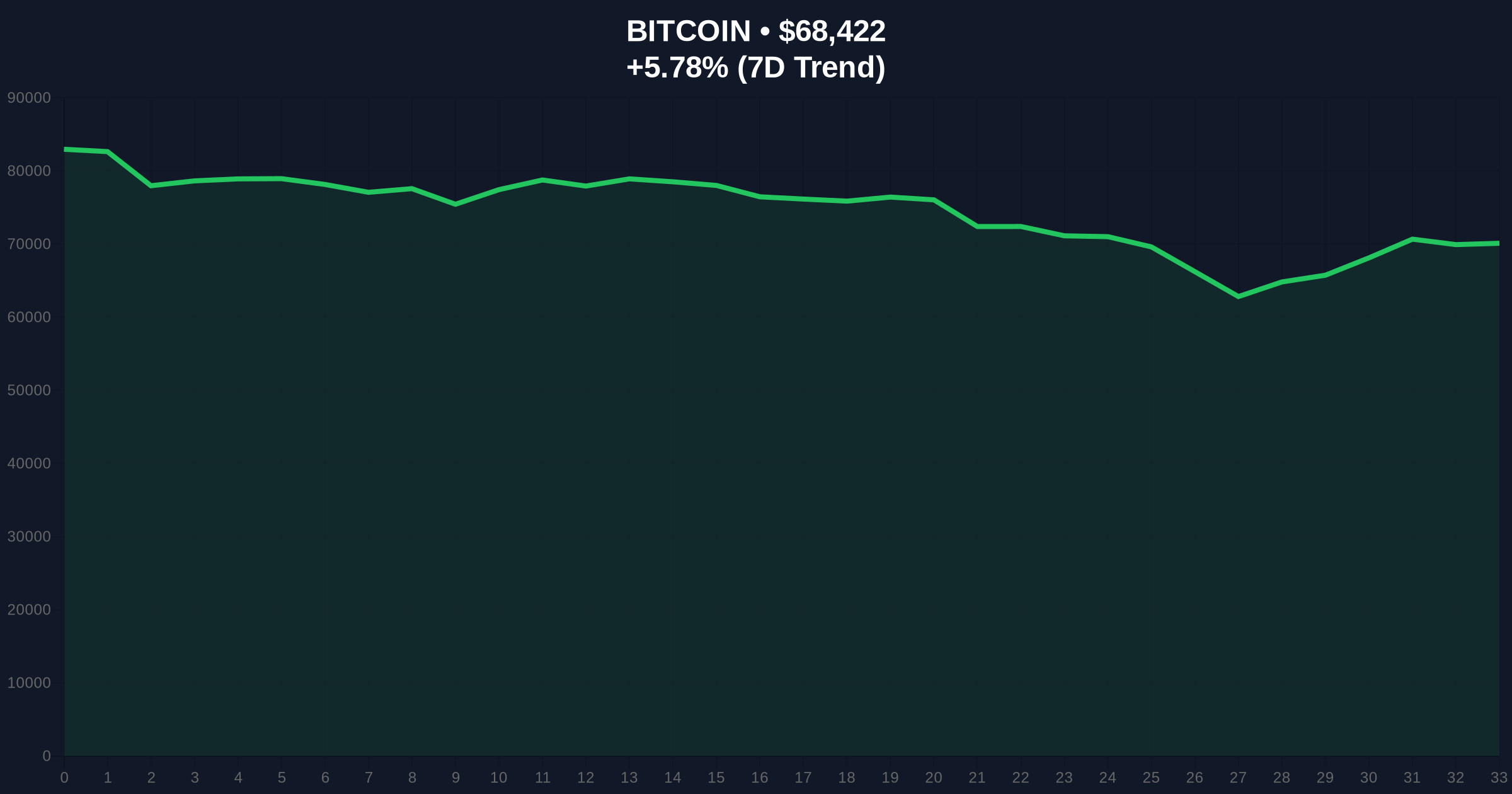

VADODARA, February 7, 2026 — Eugene Ng Ah Sio, a prominent top futures trader on Binance, closed his long positions today, citing a potential liquidity grab from a Bitcoin OG depositing 5,000 BTC ($351 million) into the exchange. This daily crypto analysis reveals how institutional players are navigating extreme fear sentiment to avoid becoming exit liquidity.

According to a Telegram channel statement, Eugene Ng Ah Sio announced the closure of his long positions. He attributed this move to Garrett Jin, the former CEO of the fraudulent exchange BitForex, allegedly deciding to "nuke" his Bitcoin holdings. "I don't want to be his exit liquidity, so I've closed my position," Ng stated. Market data confirms that around 4:00 a.m. UTC today, approximately 5,000 BTC ($351 million) was deposited into Binance, believed to be from Jin. This event follows Ng's earlier comment at 0:00 UTC yesterday, when BTC touched $60,000, advising to "buy when there's blood in the streets." He noted that while a "knife catch" long position at the bottom was good, the result wasn't better, reflecting the market's challenging nature.

Historically, large Bitcoin deposits into exchanges like Binance often precede sell-offs, acting as liquidity grabs that trigger cascading liquidations. Underlying this trend, the current extreme fear sentiment, with a score of 6/100, mirrors conditions seen during the 2022 bear market. In contrast, the 2021 bull run saw similar whale movements but with greed dominating. Consequently, Ng's exit strategy highlights a shift toward risk-averse positioning among top traders. This aligns with broader market developments, such as the recent 4,199 BTC transfer to Binance, which also signaled liquidity concerns amid volatile price action.

Market structure suggests Bitcoin is testing critical support at the $60,000 level, a key Fibonacci 0.618 retracement from the 2025 all-time high. On-chain data from Glassnode indicates increased exchange inflows, correlating with the 5,000 BTC deposit. The Relative Strength Index (RSI) currently hovers near oversold territory, but volume profile analysis shows weak buying pressure. A break below the $60,000 support could trigger a Fair Value Gap (FVG) down to $58,000, based on order block dynamics. For legal context, the SEC's stance on market manipulation, as outlined in official SEC filings, the regulatory risks associated with such large, coordinated moves.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | High liquidation risk, low retail participation |

| Bitcoin Deposit to Binance | 5,000 BTC ($351M) | Potential sell-off pressure, liquidity grab signal |

| Key Support Level | $60,000 | Fibonacci 0.618 retracement, critical for bullish structure |

| BNB Current Price | $639.33 (+3.45% 24h) | Outperforming Bitcoin, indicating exchange token resilience |

| Trader's Exit Timing | Following $60K test at 0:00 UTC | Risk management ahead of whale deposit |

This event matters because it exemplifies institutional liquidity cycles where large holders (OGs) use exchange deposits to create exit liquidity, trapping leveraged positions. Market analysts note that such moves often lead to gamma squeezes in derivatives markets, amplifying volatility. Retail market structure, currently in extreme fear, becomes vulnerable to these liquidity grabs, as seen in recent $101 million futures liquidations. Consequently, top traders like Ng are adapting by prioritizing clear risk-reward ratios, signaling a maturation in crypto trading strategies.

"The closure of long positions by a top Binance trader ahead of a $351 million deposit is a textbook risk management move. Market structure suggests that when OGs move coins to exchanges, it often precedes a liquidity grab, especially in extreme fear environments. This aligns with historical UTXO age band data showing older coins becoming active during sell-offs." — CoinMarketBuzz Intelligence Desk

Based on current market structure, two technical scenarios emerge. First, if Bitcoin holds above $60,000, a rebound toward $68,000 is possible, fueled by oversold RSI conditions. Second, a break below support could target $58,000, invalidating the bullish order block. For the 12-month institutional outlook, this event reinforces the need for robust risk frameworks, as large holders continue to influence liquidity cycles.

Over a 5-year horizon, such liquidity events may decrease as regulatory clarity improves, but for now, they define market dynamics.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.