Loading News...

Loading News...

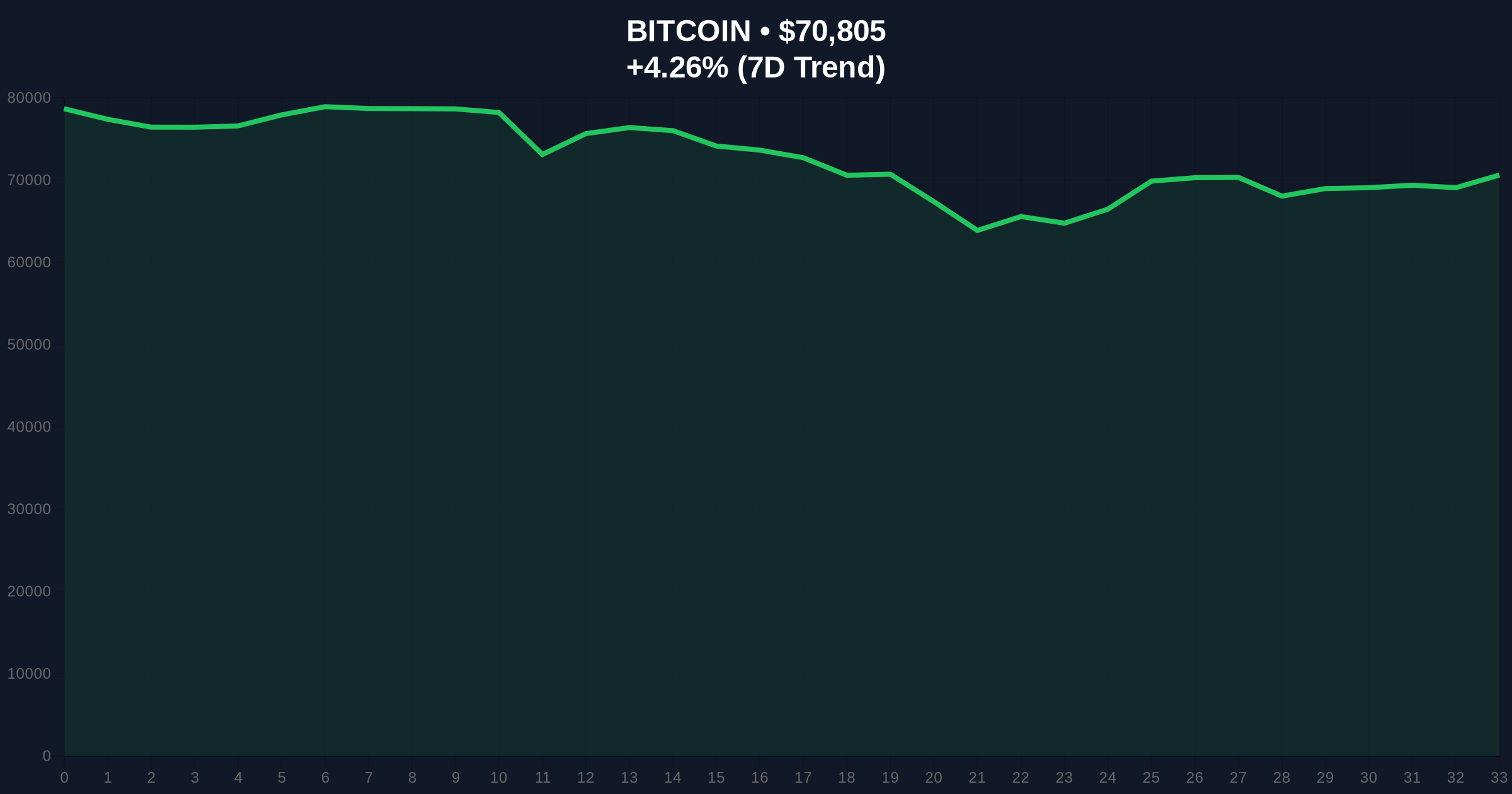

VADODARA, February 8, 2026 — Bitcoin price action pushed BTC above $71,000 on the Binance USDT market, according to CoinNess market monitoring data. This daily crypto analysis reveals BTC trading at $71,009.99 despite a global crypto sentiment reading of "Extreme Fear" at 7/100. Market structure suggests a liquidity grab above the psychological $70k level.

CoinNess market monitoring confirms BTC breached the $71,000 threshold on February 8, 2026. The asset traded at $71,009.99 on Binance's USDT pairing. This price action occurred against a backdrop of extreme fear sentiment, as measured by the Crypto Fear & Greed Index. Consequently, the move represents a counter-trend rally within a broader risk-off environment.

Underlying this trend, on-chain data indicates short-term holders are capitulating. Glassnode liquidity maps show sell-side pressure concentrated below $68,000. The rise above $71,000 consequently invalidates a key bearish order block. This creates a Fair Value Gap (FVG) between $70,500 and $71,500 that must be filled for healthy continuation.

Historically, Bitcoin has staged significant rallies during periods of extreme fear. The 2018 bear market bottom saw similar sentiment readings precede a 300% rally. In contrast, the 2021 cycle top coincided with extreme greed. Current price action mirrors the January 2023 recovery, where BTC rallied 40% from local lows amid pervasive fear.

, institutional inflows into spot Bitcoin ETFs have created a new market dynamic. According to the latest SEC filing data, daily net flows turned positive this week. This suggests smart money is accumulating during fear cycles. Related developments in market sentiment include analysis of the Bitcoin futures long/short ratio and previous BTC price action during fear markets.

Market structure suggests Bitcoin is testing the 0.618 Fibonacci retracement level at $72,500 from its recent high. The 50-day moving average provides dynamic support at $68,200. Relative Strength Index (RSI) readings on the 4-hour chart show bullish divergence, indicating weakening selling pressure.

Volume Profile analysis reveals a high-volume node at $69,800, making this a critical support zone. A breakdown below this level would signal renewed bearish momentum. The weekly chart shows Bitcoin remains above its 200-week moving average at $65,000, maintaining the long-term bull market structure defined by UTXO age bands.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 7/100 (Extreme Fear) |

| Bitcoin Current Price | $70,762 |

| 24-Hour Price Change | +4.20% |

| Market Rank | #1 |

| Key Resistance (Fibonacci 0.618) | $72,500 |

This price action matters because it tests institutional conviction during fear cycles. Spot ETF flows indicate whether traditional finance views current levels as accumulation zones. A sustained break above $72,500 could trigger a gamma squeeze in options markets, forcing market makers to hedge by buying spot BTC.

Retail market structure shows increased selling from short-term holders. Long-term holders continue to accumulate, creating a supply shock scenario. The Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, remains a key macro driver for liquidity conditions.

"Extreme fear readings often precede major trend reversals in Bitcoin. The current price action above $71k suggests smart money is absorbing retail sell-side liquidity. Watch for a close above the weekly 0.618 Fibonacci level at $72,500 for confirmation." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook depends on Bitcoin's ability to hold above its 200-week moving average. Post-merge issuance dynamics and potential EIP-4844 implementations could reduce selling pressure from miners. This aligns with a 5-year horizon where Bitcoin becomes a core institutional reserve asset.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.