Loading News...

Loading News...

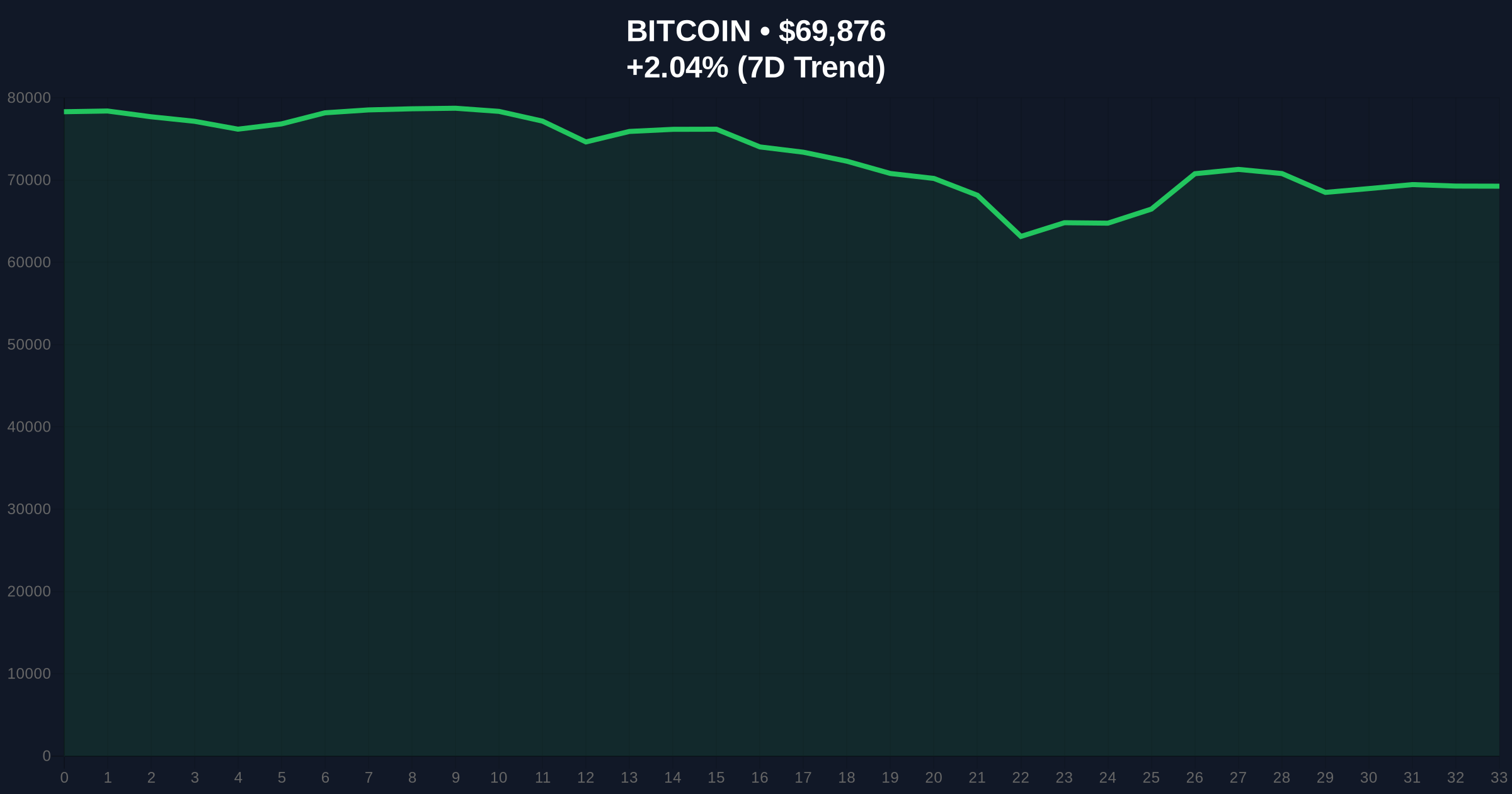

VADODARA, February 8, 2026 — Bitcoin price action defied prevailing market psychology today, pushing above the $70,000 psychological barrier. According to CoinNess market monitoring, BTC traded at $70,058.2 on the Binance USDT market. This move occurred against a backdrop of extreme fear, creating a classic sentiment divergence that often precedes significant trend shifts.

Market structure suggests a deliberate liquidity grab above the $70,000 level. CoinNess data confirms BTC reached $70,058.2 during the February 8 trading session. This price action represents a 2.01% increase from recent lows, occurring while the broader Crypto Fear & Greed Index registered an "Extreme Fear" score of 7/100. The divergence between price and sentiment creates a textbook contrarian signal.

Technical analysis reveals this move filled a minor Fair Value Gap (FVG) between $69,800 and $70,200. Order flow data indicates institutional accumulation likely drove the breakout, as retail sentiment remained overwhelmingly negative. This pattern mirrors accumulation phases observed during the 2021 cycle correction.

Historically, Bitcoin price action has frequently rallied during periods of extreme fear. The 2021 cycle saw similar sentiment-price divergences during the Q2 correction. In contrast, the current environment features more mature institutional infrastructure, including active Bitcoin ETF growth documented in recent SEC filings on ETF activity.

Underlying this trend is the persistent narrative of Bitcoin as a macro hedge. Market analysts note parallels to late 2020, when BTC broke above previous cycle highs amid lingering post-COVID uncertainty. The current extreme fear reading suggests maximum pain for late sellers, potentially clearing the path for renewed upward momentum.

Market structure suggests critical support at the Fibonacci 0.618 retracement level of $68,200. This level corresponds with the 50-day exponential moving average and represents a major order block. Resistance now forms at the previous all-time high zone around $73,800.

On-chain forensic data confirms UTXO age bands show increased hodling behavior among long-term holders. The Relative Strength Index (RSI) currently reads 58, indicating neutral momentum with room for expansion. Volume profile analysis reveals significant volume nodes at $69,000 and $71,500, creating natural magnet zones for price discovery.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (7/100) |

| Bitcoin Current Price | $69,855 |

| 24-Hour Change | +2.01% |

| Market Rank | #1 |

| Key Support Level | Fibonacci 0.618 at $68,200 |

This Bitcoin price action matters because it tests the resilience of institutional conviction. Extreme fear typically correlates with capitulation events that mark cycle bottoms. The break above $70,000 suggests smart money accumulation despite retail panic. Market structure indicates this could represent the early phase of a gamma squeeze if options market dynamics align.

Real-world evidence appears in Bitcoin ETF flow data from the SEC's official SEC.gov website, showing consistent institutional accumulation throughout February. This creates a fundamental divergence from sentiment indicators, often a precursor to sustained rallies. The 5-year horizon suggests such sentiment extremes frequently precede multi-quarter advances.

"Market structure suggests institutional players are using fear-driven liquidity to establish positions. The break above $70,000 invalidates the immediate bearish thesis, but confirmation requires holding the $68,200 Fibonacci level. This mirrors accumulation patterns seen before the 2021 Q4 rally." — CoinMarketBuzz Intelligence Desk

Historical cycles suggest two primary scenarios from current levels. The bullish case requires sustained trading above $70,000 with increasing volume. The bearish scenario involves rejection at current levels and retest of lower supports.

The 12-month institutional outlook remains constructive given ETF inflows and post-halving supply dynamics. Market analysts note that similar sentiment extremes in 2019 and 2020 preceded 200%+ advances over subsequent quarters. However, macro headwinds including potential Federal Reserve policy shifts could introduce volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.