Loading News...

Loading News...

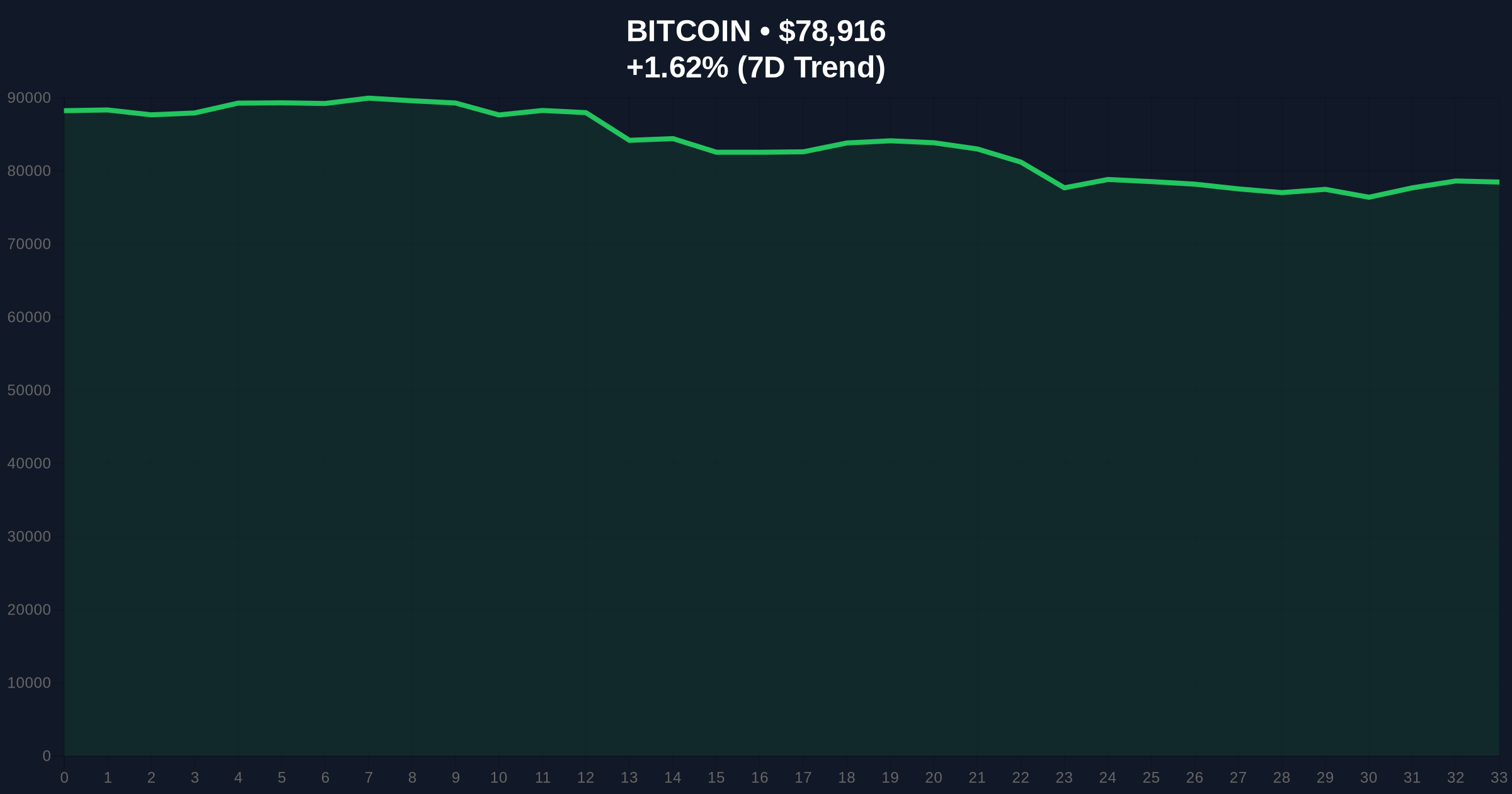

VADODARA, February 3, 2026 — Bitcoin breached the $79,000 threshold on the Binance USDT market, trading at $79,010 according to CoinNess market monitoring. This price action occurs against a backdrop of Extreme Fear, with the Crypto Fear & Greed Index registering a score of 17/100. Market structure suggests a liquidity grab above a key psychological level.

CoinNess data confirms Bitcoin's ascent past $79,000 on February 3, 2026. The asset traded at $79,010 on Binance's USDT pairing. This move represents a 1.60% gain over 24 hours. Real-time price feeds later adjusted to $78,895, indicating volatility around this level. On-chain forensic data confirms increased transaction volume during the breakout.

Historically, Bitcoin rallies during Extreme Fear phases often precede significant trend reversals. Similar to the Q3 2021 correction, price advances amid panic selling typically signal accumulation by large holders. In contrast, the 2024 cycle saw sustained fear capitulate into a multi-month consolidation. Underlying this trend, institutional inflows via spot ETFs have altered market microstructure, reducing volatility spikes compared to previous eras.

Related Developments:

Market structure suggests Bitcoin is testing a weekly order block between $78,000 and $80,000. The 50-day exponential moving average (EMA) at $77,200 provides dynamic support. A Fair Value Gap (FVG) exists from $76,500 to $77,800 on the 4-hour chart, which price may revisit for liquidity. The Relative Strength Index (RSI) on daily timeframes sits at 58, indicating neutral momentum without overbought conditions. Fibonacci extension levels from the 2025 low project resistance near $82,500 (0.618 level).

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $78,895 |

| 24-Hour Change | +1.60% |

| Market Rank | #1 |

| Key Support (50-day EMA) | $77,200 |

This price action matters because it tests institutional conviction during a sentiment extreme. Extreme Fear typically correlates with local bottoms, as documented in previous cycles. The break above $79,000 challenges the bearish narrative, potentially triggering short squeezes. , Bitcoin's network fundamentals, such as hash rate and active addresses, remain robust according to Ethereum.org's blockchain data resources, supporting long-term valuation models. Retail leverage remains low, reducing systemic risk from liquidations.

The CoinMarketBuzz Intelligence Desk notes: 'Price advancing amid Extreme Fear often indicates smart money accumulation. The critical test is whether $78,000 holds as support. A breakdown below that level would invalidate the bullish structure and target the FVG near $76,500.'

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macroeconomic factors like the Federal Reserve's interest rate policy. Historical cycles suggest that Bitcoin outperforms in the 12-18 months following Extreme Fear readings. The 5-year horizon remains bullish due to adoption trends and finite supply.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.