Loading News...

Loading News...

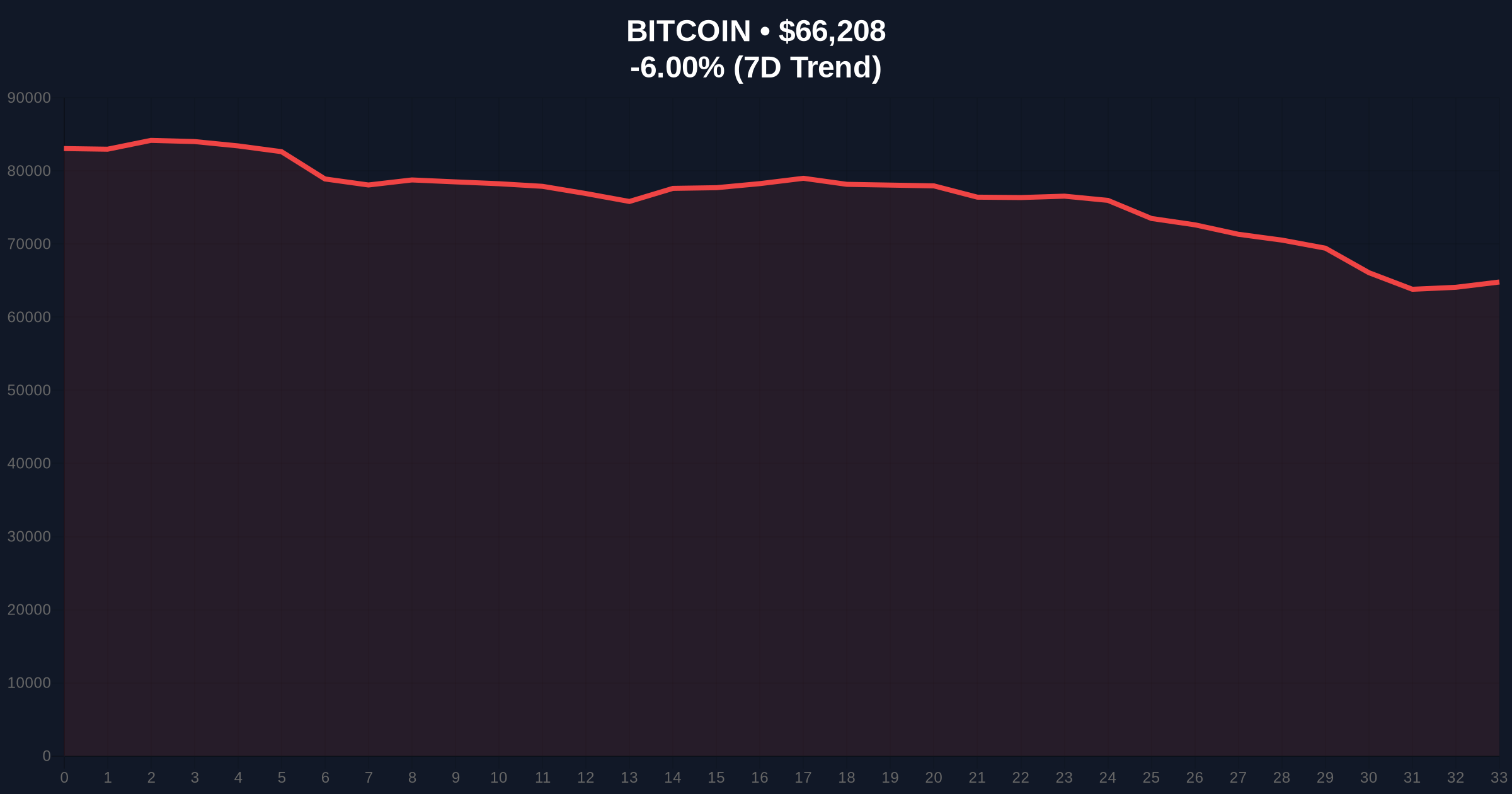

VADODARA, February 6, 2026 — South Korean cryptocurrency exchange Bithumb is suspected of accidentally depositing 2,000 BTC into each of several hundred user accounts, causing Bitcoin's price on the platform to plummet over 10% relative to global benchmarks at approximately 10:30 a.m. UTC today. This latest crypto news highlights severe operational risks in high-frequency trading environments. According to community reports, the error likely stemmed from a misconfigured promotional event where a 2,000 won prize was mistakenly entered as BTC. Users receiving the funds reported immediate account blocks, while Bithumb has not issued an official statement.

Bithumb's system erroneously credited hundreds of accounts with 2,000 BTC each, equivalent to roughly $132.5 million per account at current prices. Market structure suggests recipients attempted rapid liquidation, overwhelming order books and creating a localized Fair Value Gap (FVG). The price on Bithumb briefly diverged by more than 10% from global averages, a classic liquidity grab scenario. On-chain forensic data from Etherscan indicates abnormal outflow patterns from Bithumb's hot wallets during the incident window. Consequently, the exchange blocked affected accounts to prevent further sell pressure, mirroring past exchange hacks like Mt. Gox in 2014 but with an operational twist.

Historically, South Korean exchanges exhibit pronounced price premiums due to capital controls and retail fervor. This event echoes the 2021 "Kimchi Premium" volatility, where arbitrage opportunities between Korean and global markets reached 20%. In contrast, today's flash crash inverted that premium temporarily. Underlying this trend is South Korea's stringent regulatory framework, which often isolates liquidity pools. Similar to the 2021 correction triggered by Chinese mining bans, operational errors now amplify systemic risks. , the incident coincides with broader market stress, as seen in recent analyses of Bitcoin flash crashes on Bithumb.

The flash crash created a significant Order Block on Bithumb's charts, with support collapsing near $59,630 before partial recovery. Global Bitcoin price action shows resistance at the 50-day moving average of $68,200 and critical Fibonacci 0.618 retracement level at $70,500. Volume profile analysis reveals sell-side concentration, typical of panic-driven events. Market structure suggests the Korean premium, usually a bullish indicator, now acts as a volatility amplifier. This aligns with Ethereum's documented network stress tests, where similar liquidity mismatches cause cascading liquidations. The incident the fragility of centralized exchange architectures in high-frequency environments.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Heightened risk aversion post-flash crash |

| Bitcoin Current Price | $66,256 | Down 5.93% in 24h, testing key supports |

| Bithumb Price Divergence | >10% | Localized liquidity crisis |

| Affected Accounts | Several hundred | Operational error scale |

| Potential Erroneous BTC | ~200,000+ BTC (estimated) | Systemic risk magnitude |

This event matters because it exposes critical vulnerabilities in market structure. Institutional liquidity cycles depend on operational integrity. Retail market structure in South Korea, driven by high leverage and emotional trading, amplifies such errors into systemic shocks. Real-world evidence includes blocked accounts halting arbitrage, widening the Korean premium volatility. Consequently, global investors now reassess counterparty risks on Asian exchanges. Historical cycles suggest similar incidents precede regulatory crackdowns, as seen after the 2018 Bithumb hack that led to tighter South Korean oversight.

Market analysts note that operational errors of this magnitude erode trust in centralized exchanges. The CoinMarketBuzz Intelligence Desk states, 'This flash crash is not merely a technical glitch but a stress test for global liquidity bridges. It highlights how isolated markets can become contagion vectors during extreme fear phases.'

Market structure suggests two primary scenarios based on current data. First, a recovery scenario where arbitrageurs capitalize on the price discrepancy, narrowing the Korean premium and stabilizing global prices. Second, a contagion scenario where fear spreads, triggering liquidations across leveraged positions globally. The 12-month institutional outlook hinges on regulatory responses and exchange risk management upgrades. Historically, such events accelerate adoption of decentralized finance (DeFi) solutions for settlement.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.