Loading News...

Loading News...

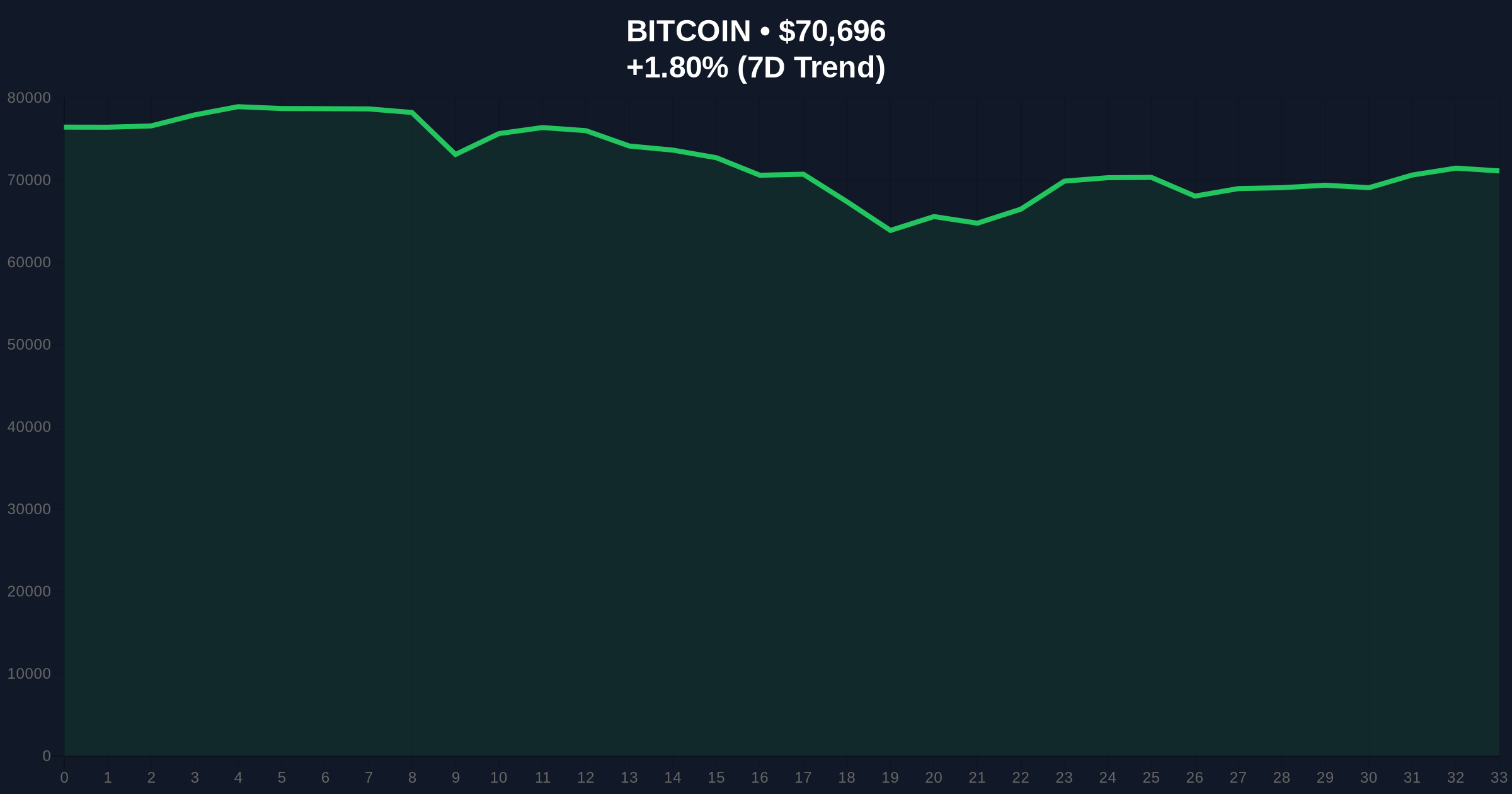

VADODARA, February 8, 2026 — CoinShares released a report today. It reframes the quantum computing threat to Bitcoin. The firm labels it a manageable engineering challenge. Not an imminent crisis. This latest crypto news arrives as market sentiment plummets to extreme fear. Bitcoin tests the $70,675 level.

According to the official CoinShares report, quantum threats are exaggerated. The analysis targets key extraction attacks. These could compromise Bitcoin's private keys. Previous studies suggested 20-50% of BTC supply was vulnerable. CoinShares disputes this. Their forensic assessment reveals a lower figure. Only about 8% of the supply faces exposure. That equates to roughly 1.6 million BTC.

Market disruption requires far less. A mere 10,200 BTC could trigger volatility. The technical barrier remains immense. Decrypting Bitcoin's SHA-256 encryption demands quantum supremacy. CoinShares asserts current systems fall short. They need a 100,000x power increase. This aligns with post-quantum cryptography timelines outlined by institutions like NIST.gov.

Historically, existential threats spark market overreactions. The 2013 Mt. Gox collapse triggered similar fear. In contrast, technological challenges like the 2017 SegWit upgrade were resolved. Underlying this trend is a pattern. Markets often price in worst-case scenarios prematurely.

Current sentiment mirrors this. The Crypto Fear & Greed Index hits 7/100. This extreme fear coincides with other stress signals. For instance, a whale recently moved $300 million in USDT to Aave. , Bitcoin futures show near-perfect equilibrium. These events compound the anxiety.

Market structure suggests Bitcoin is consolidating. The $70,000 level acts as a psychological support. A Fair Value Gap (FVG) exists between $68,000 and $72,000. This zone represents a liquidity grab. The 50-day moving average provides dynamic support at $69,200.

RSI readings hover near 45. This indicates neutral momentum. Volume profile shows accumulation near current prices. A break below the Fibonacci 0.618 retracement at $68,500 would signal weakness. UTXO age bands reveal long-term holders remain steadfast. Their coins haven't moved.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Price | $70,675 | Testing key support |

| 24-Hour Change | +1.77% | Minor rebound amid fear |

| Crypto Fear & Greed Index | 7/100 (Extreme Fear) | Historically a contrarian signal |

| Quantum-Exposed BTC Supply | 8% (1.6M BTC) | Per CoinShares report |

| Disruption Threshold | 10,200 BTC | Minimal amount for market impact |

This report matters for institutional allocation. It reduces perceived tail risk. Long-term investors can focus on fundamental drivers. Like adoption and monetary policy. The extreme fear sentiment creates a potential buying opportunity. Historically, such levels precede rallies.

Retail market structure remains fragile. However, on-chain data indicates accumulation. Large wallets are adding positions. This divergence between sentiment and action is critical. It often marks local bottoms.

"The quantum narrative has been weaponized by fearmongers. Our analysis shows the attack surface is limited. Market participants should prioritize real risks like regulatory shifts or macroeconomic shocks. The encryption challenge is a decade away, not a tomorrow problem." — CoinMarketBuzz Intelligence Desk synthesis of institutional sentiment.

Two data-backed scenarios emerge. First, a bullish reversal if sentiment improves. Second, further consolidation if fear persists.

The 12-month outlook hinges on macroeconomic factors. Federal Reserve policy remains key. Institutional adoption continues apace. The quantum overhang is now reduced. This supports a constructive 5-year horizon for Bitcoin's store-of-value thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.