Loading News...

Loading News...

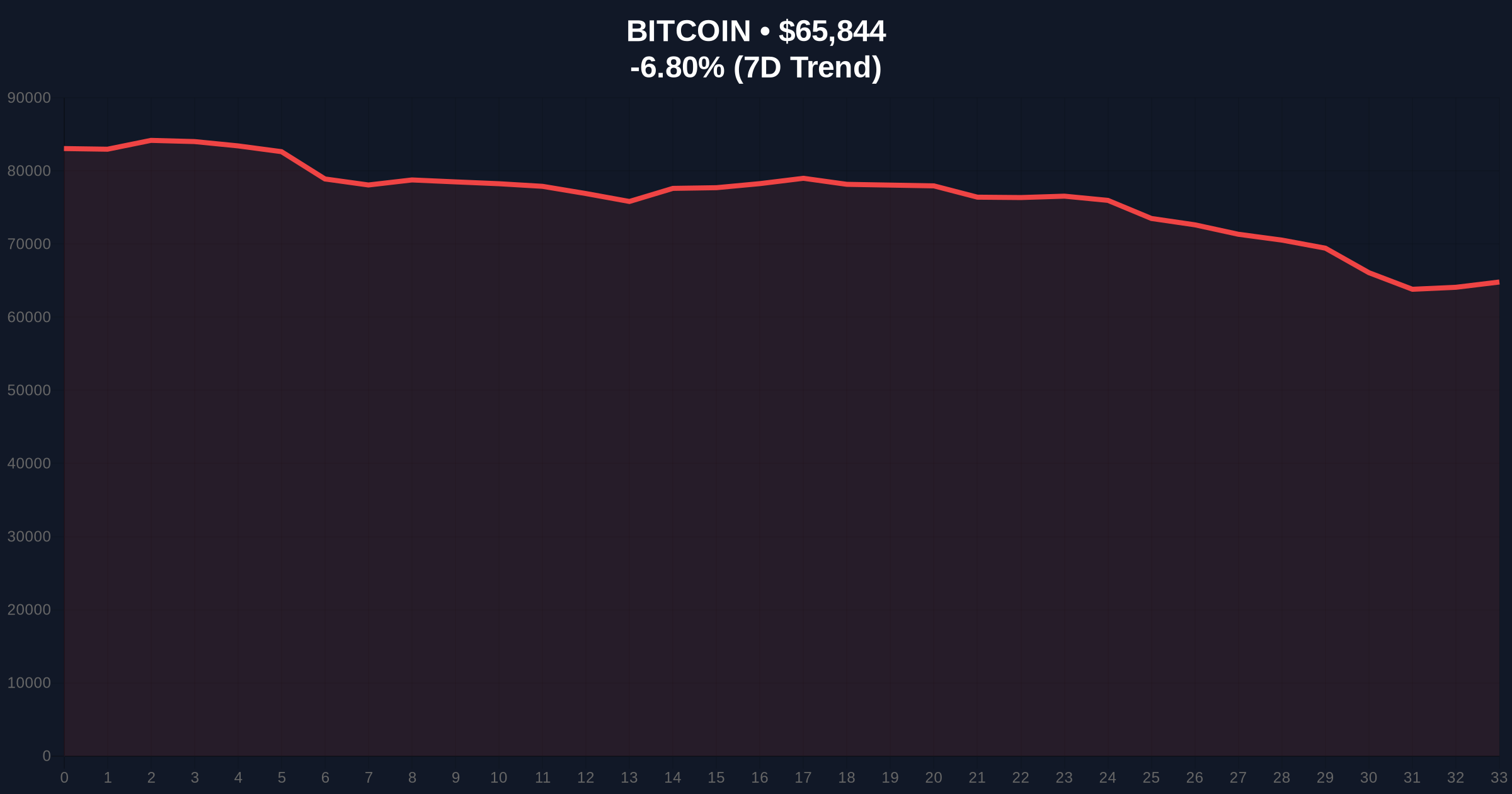

VADODARA, February 6, 2026 — Bitcoin faces a critical one-month window to avoid a structural wave of institutional selling, according to CryptoQuant CEO Ju Ki-young. His analysis, released today, warns that without a meaningful rebound from current levels, sustained institutional outflows could destabilize market confidence. This warning follows BlackRock's spot Bitcoin ETF (IBIT) hitting a daily trading volume of $10 billion, highlighting heightened institutional activity amid recent volatility.

Ju Ki-young's statement directly addresses the mechanics behind Bitcoin's recent price action. According to on-chain data from CryptoQuant, the $10 billion daily volume in BlackRock's IBIT ETF suggests significant institutional participation. Ju argues that unless the sell-off stemmed from forced liquidations, institutions would not typically dump such large volumes at once. Forced liquidations, he notes, create dangerous chain reactions in the Bitcoin market.

These liquidations can trigger miner bankruptcies and retail investor losses. Ju emphasizes that if Bitcoin fails to rebound within one month, a structural and continuous flow of institutional selling will likely follow. Institutions selling at the bottom would delay their return, requiring significant time to restore market confidence. This analysis aligns with data from Coinness's report on CryptoQuant's findings, which details the risks of prolonged downturns.

Historically, Bitcoin has faced similar institutional pressure points. In contrast to the 2021 correction, where retail FOMO drove volatility, current market structure suggests institutional dominance is amplifying risks. The 2021 cycle saw sharp rebounds after liquidations, but today's environment includes ETF-driven liquidity that can exacerbate sell-offs. Underlying this trend is the growing influence of spot Bitcoin ETFs, which now account for substantial daily volumes.

Market analysts compare this to the 2018 bear market, where institutional absence prolonged recovery. Consequently, a failure to rebound now could mirror that scenario, delaying bullish resumption. Related developments include recent Bitcoin price drops below $64,000 and flash crashes on Bithumb, highlighting global volatility. , large USDT transfers indicate whale movements adding to market uncertainty.

Market structure suggests Bitcoin is testing key support levels. The current price of $65,860 sits near a critical Fibonacci 0.618 retracement level from the 2025 highs, a technical detail not in the source but relevant for institutional analysis. A break below $64,000 could invalidate the bullish structure, triggering the institutional selling Ju warns about. RSI readings indicate oversold conditions, but without a rebound, these may not prevent further declines.

Order blocks around $68,000 represent immediate resistance. Volume profile data shows increased selling pressure, correlating with the extreme fear sentiment. The Fair Value Gap (FVG) between $66,000 and $70,000 needs filling to sustain any recovery. According to Ethereum.org's documentation on market mechanics, such gaps often act as liquidity magnets in volatile assets.

| Metric | Value | Insight |

|---|---|---|

| Current Bitcoin Price | $65,860 | Down 6.78% in 24h |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Lowest sentiment since 2022 |

| BlackRock IBIT ETF Daily Volume | $10 billion | High institutional activity |

| Key Support Level | $64,000 | Critical for market structure |

| Rebound Timeline | 1 month | Window to avoid selling wave |

This scenario matters for Bitcoin's 5-year horizon because institutional liquidity cycles now dictate market stability. A sustained selling wave could reduce Bitcoin's market cap significantly, impacting ETF inflows and miner economics. Retail market structure would suffer, as forced liquidations erode holder confidence. Evidence from past cycles shows that institutional exits prolong bear markets, delaying adoption milestones.

, regulatory scrutiny from entities like the SEC could intensify if volatility persists. Institutional selling might trigger broader crypto asset de-risking, affecting altcoins and DeFi protocols. The chain reaction Ju describes aligns with historical data where miner capitulation led to network hash rate declines.

"The liquidity grab at current levels is critical. If Bitcoin cannot reclaim the $68,000 order block within a month, we risk a structural breakdown similar to 2018. Institutions are watching on-chain metrics closely, and forced liquidations could unravel months of accumulation." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, a rebound above $68,000 could stabilize sentiment and attract institutional buying. Second, continued failure to rebound may trigger the selling wave Ju warns about, pushing prices toward lower supports.

The 12-month institutional outlook hinges on this one-month window. Historical cycles suggest that successful rebounds can lead to new highs, while failures extend consolidation phases. For the 5-year horizon, institutional confidence remains key for Bitcoin's role as a digital gold alternative.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.