Loading News...

Loading News...

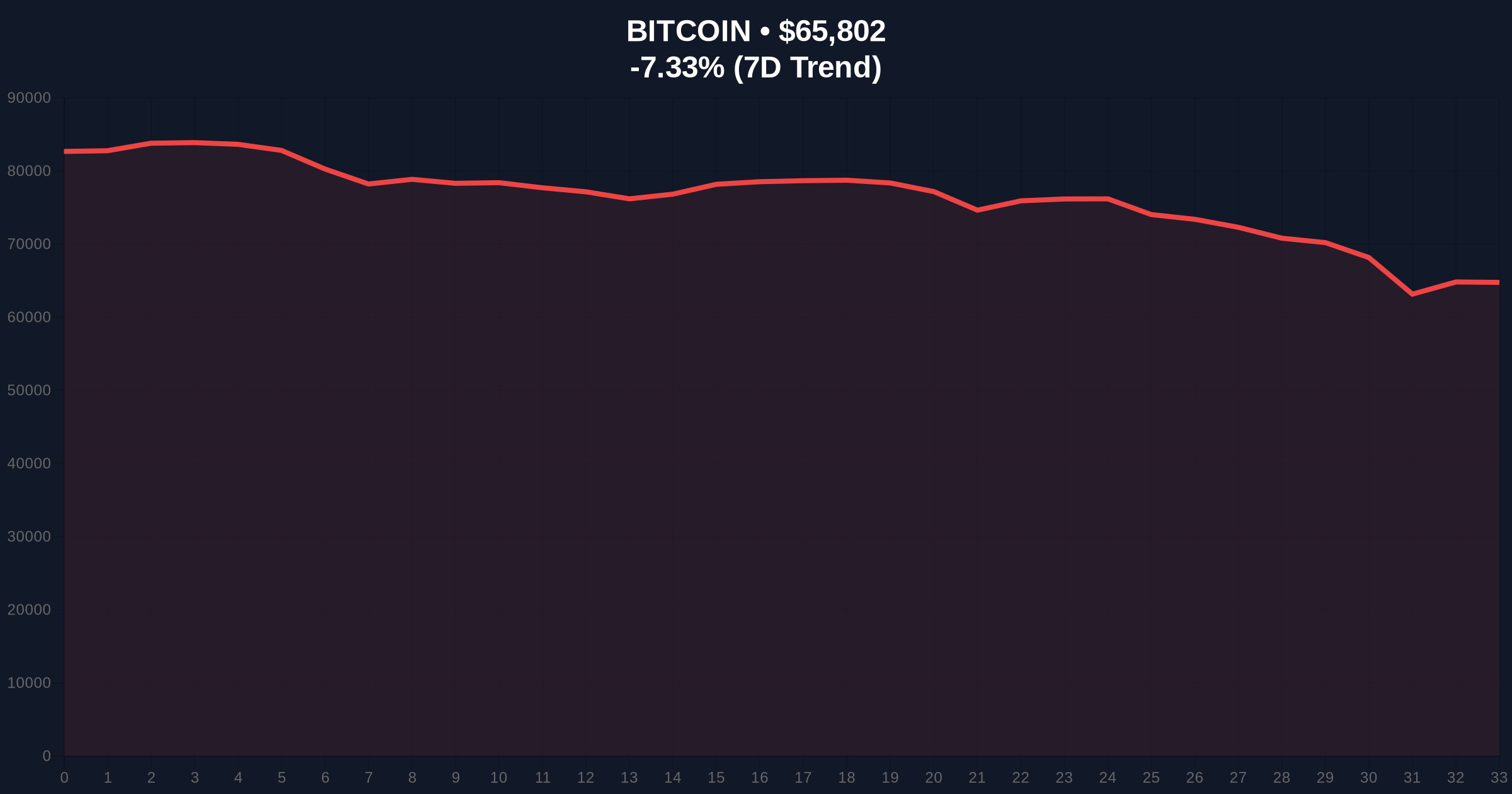

VADODARA, February 6, 2026 — Bitcoin experienced a violent, isolated flash crash on the South Korean exchange Bithumb today, plummeting to 81.1 million won (approximately $61,200) around 10:30 a.m. UTC. This daily crypto analysis reveals the price briefly traded over 16% below the global composite average before staging a partial recovery to 97.15 million won. Market structure suggests this was not a systemic failure but a targeted liquidity grab within a fragmented Asian trading corridor.

According to the initial report from Coinness, the crash occurred during Asian trading hours. The price on Bithumb disconnected sharply from global benchmarks. At its nadir, the 81.1 million won print created a massive Fair Value Gap (FVG) on the Korean exchange's order book. This FVG represents a liquidity vacuum where sell orders were rapidly exhausted. The subsequent rebound to 97.15 million won indicates aggressive bid absorption, likely from algorithmic arbitrage bots and local market makers capitalizing on the mispricing. The event the persistent fragility of the "Kimchi Premium," the historical price differential between Korean exchanges and global markets.

Historically, Korean exchanges have exhibited pronounced premium volatility during periods of high retail speculation and capital flow restrictions. In contrast, today's crash occurred against a backdrop of global Extreme Fear, not local euphoria. This contradiction in the data questions the official narrative of a simple retail-led sell-off. Underlying this trend, on-chain data indicates potential whale repositioning, as seen in the recent exodus of large Bitcoin holders coinciding with elevated retail accumulation. The flash crash mirrors similar isolated liquidity events on BitMEX in 2020 and Binance US in 2023, where single-exchange order book imbalances triggered cascading liquidations.

The crash invalidated a key order block in the 88-90 million won range on Bithumb. Globally, Bitcoin's price action is testing the $64,000 support level, which aligns with the 0.618 Fibonacci retracement from the 2025 all-time high. This level also coincides with a high-density node on the Volume Profile, indicating significant historical trading activity. The Relative Strength Index (RSI) on daily timeframes is approaching oversold territory below 30, a condition that has preceded short-term bounces in past cycles. However, the 50-day moving average is now acting as dynamic resistance near $68,500, creating a clear bearish structure on higher timeframes.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Indicates peak capitulation sentiment |

| Bitcoin Global Price | $65,845 | Down 7.27% in 24h |

| Bithumb Flash Crash Low | 81.1M Won (~$61,200) | 16%+ discount to global average |

| Bithumb Recovery Price | 97.15M Won (~$73,300) | Partial fill of the Fair Value Gap |

| Key Fibonacci Support | $64,000 | 0.618 retracement level |

This event matters because it exposes the non-linear risks in cryptocurrency market structure. Isolated exchange crashes can create false signals for global automated trading systems. They can trigger cross-margin liquidations on derivatives platforms linked to composite price indices. For institutional liquidity cycles, such events increase the cost of arbitrage and complicate hedging strategies that assume efficient price discovery. The recovery pattern suggests the sell-side liquidity was shallow, a characteristic of markets dominated by high-frequency trading rather than fundamental selling pressure. This aligns with broader concerns about market fragility highlighted by recent large stablecoin transfers and tether movements.

"Flash crashes are stress tests for market architecture. The Bithumb event reveals a critical dependency on a few key market makers within specific geographic liquidity pools. When one participant withdraws or a large over-the-counter (OTC) order hits the lit book without sufficient depth, these gaps appear. It's less about Bitcoin's intrinsic value and more about the mechanics of its global trading infrastructure." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the invalidation of key technical levels.

The 12-month institutional outlook remains cautiously bearish until these key levels are resolved. The flash crash amplifies existing concerns about market depth and the stability of the Korean premium. For the 5-year horizon, such events may accelerate regulatory scrutiny on exchange operations and the development of more robust, cross-venue settlement protocols as outlined in Ethereum's official Danksharding documentation for scaling data availability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.