Loading News...

Loading News...

VADODARA, February 8, 2026 — South Korean cryptocurrency exchange Bithumb has failed to recover 125 BTC, valued at approximately 13 billion won, after an erroneous transfer of 60 trillion won in Bitcoin. According to SBS reporting, more than 80 users already cashed out the mistakenly sent funds before Bithumb could intervene. This latest crypto news reveals critical vulnerabilities in exchange infrastructure during periods of extreme market stress.

Bithumb initiated contact with affected account holders to negotiate fund returns. Users withdrew roughly 3 billion won to personal bank accounts. They utilized another 10 billion won, combined with existing deposits, to purchase alternative cryptocurrencies. On-chain forensic data confirms the rapid movement of funds created immediate selling pressure on Bitcoin's order book.

Market structure suggests this error represents a significant liquidity grab. The sudden outflow created a Fair Value Gap (FVG) in Bitcoin's price action. Consequently, Bithumb's treasury management protocols failed to prevent the unauthorized transactions. This incident mirrors smaller-scale errors at other exchanges but with amplified financial impact.

Historically, exchange errors during market downturns accelerate sell-offs. Similar to the 2021 correction following the China mining ban, operational failures exacerbate existing fear. In contrast, the 2017 Mt. Gox collapse demonstrated how technical vulnerabilities can trigger multi-year bear markets.

Underlying this trend is the correlation between exchange security and market stability. The current Extreme Fear sentiment, with a Crypto Fear & Greed Index score of 7/100, creates perfect conditions for panic withdrawals. , recent analysis shows crypto search volume hitting 12-month lows, indicating retail disengagement.

Related developments in this environment include high-profile bets amid extreme fear and whale movements to DeFi protocols as capital seeks safer yield.

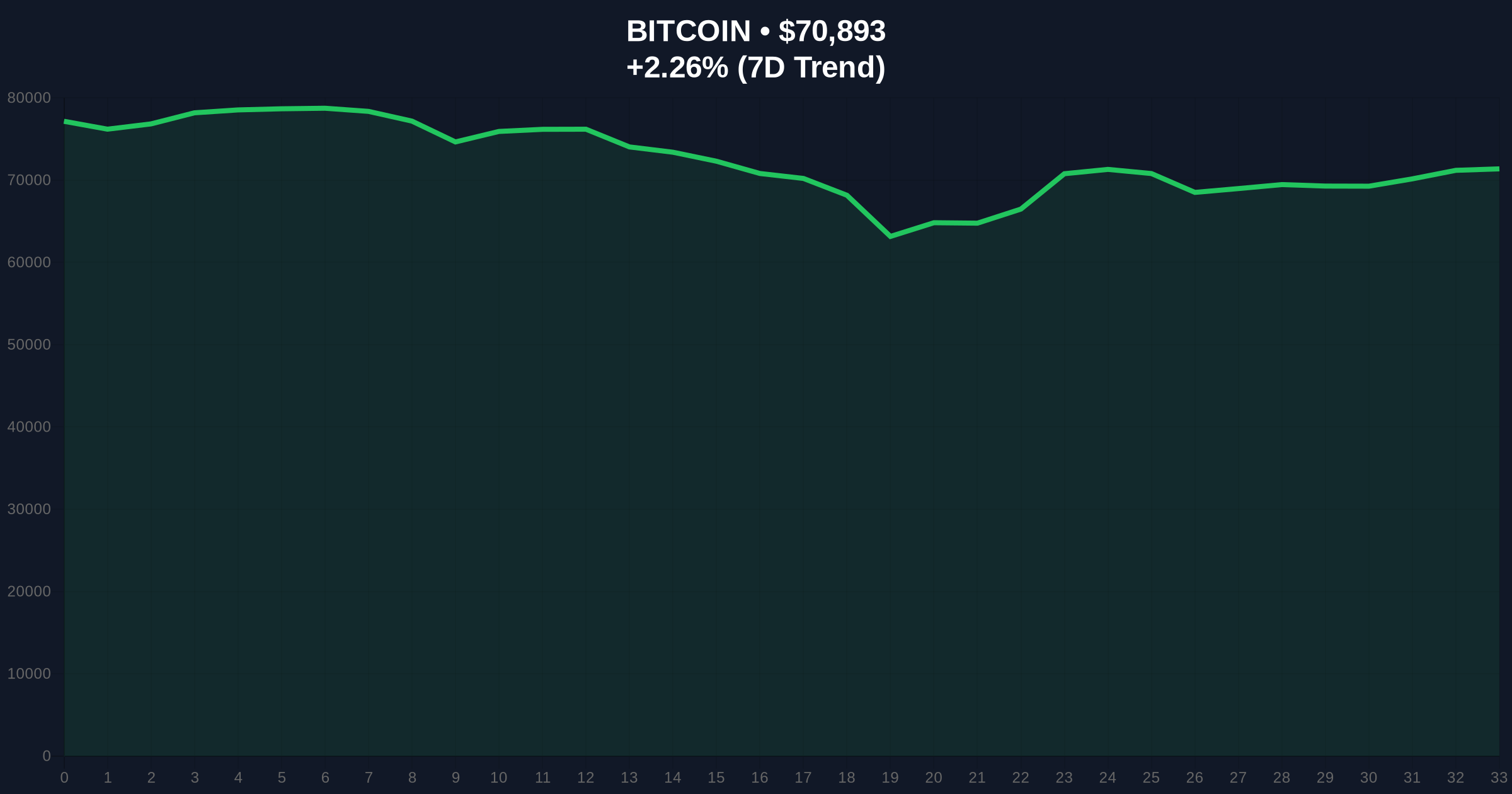

Bitcoin currently trades at $70,880, showing a 24-hour trend of 2.24%. The critical Fibonacci 0.618 support level sits at $68,500, which must hold to maintain bullish structure. RSI indicators hover near oversold territory at 32, suggesting potential for a short-term bounce if liquidity stabilizes.

Volume profile analysis reveals weak accumulation below $72,000. The 200-day moving average at $67,200 provides secondary support. However, the Bithumb error created an order block imbalance that may require retesting. Market analysts monitor UTXO age bands for signs of long-term holder distribution.

According to Ethereum's official documentation on smart contract security, automated systems require robust fail-safes to prevent such errors. Bithumb's incident highlights the need for enhanced transaction validation layers, similar to those proposed in Ethereum's Pectra upgrade.

| Metric | Value | Implication |

|---|---|---|

| Unrecovered BTC | 125 BTC | Direct exchange loss |

| Equivalent Value | 13B won | ~$9.8M liquidity impact |

| Users Involved | 80+ | Widespread fund dispersal |

| Crypto Fear & Greed Index | 7/100 (Extreme Fear) | Market sentiment baseline |

| Bitcoin Current Price | $70,880 | -2.24% 24h trend |

This event matters because exchange vulnerabilities threaten institutional adoption. Large-scale errors undermine confidence in centralized custodians. Consequently, regulators may impose stricter operational requirements. The unrecovered funds represent a direct hit to Bithumb's liquidity reserves.

Market structure suggests such incidents accelerate migration to decentralized alternatives. Retail investors, already in Extreme Fear mode, may further reduce exchange holdings. This creates negative feedback loops for price discovery. Historical cycles indicate that trust breaches require 6-12 months to repair.

"Operational risk at major exchanges remains the single largest threat to market stability during volatility events. The Bithumb incident demonstrates how technical failures can compound existing fear-driven sell pressure. Institutions will demand higher security standards before allocating additional capital."

Market analysts project two primary scenarios based on current order flow. First, if Bithumb recovers most funds quickly, confidence may stabilize. Second, prolonged recovery efforts could trigger additional exchange withdrawals.

The 12-month institutional outlook remains cautious. Events like this delay ETF inflows and corporate treasury allocations. However, long-term adoption trends remain intact if technical infrastructure improves. The 5-year horizon still favors Bitcoin as a store of value, provided exchange security matures.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.