Loading News...

Loading News...

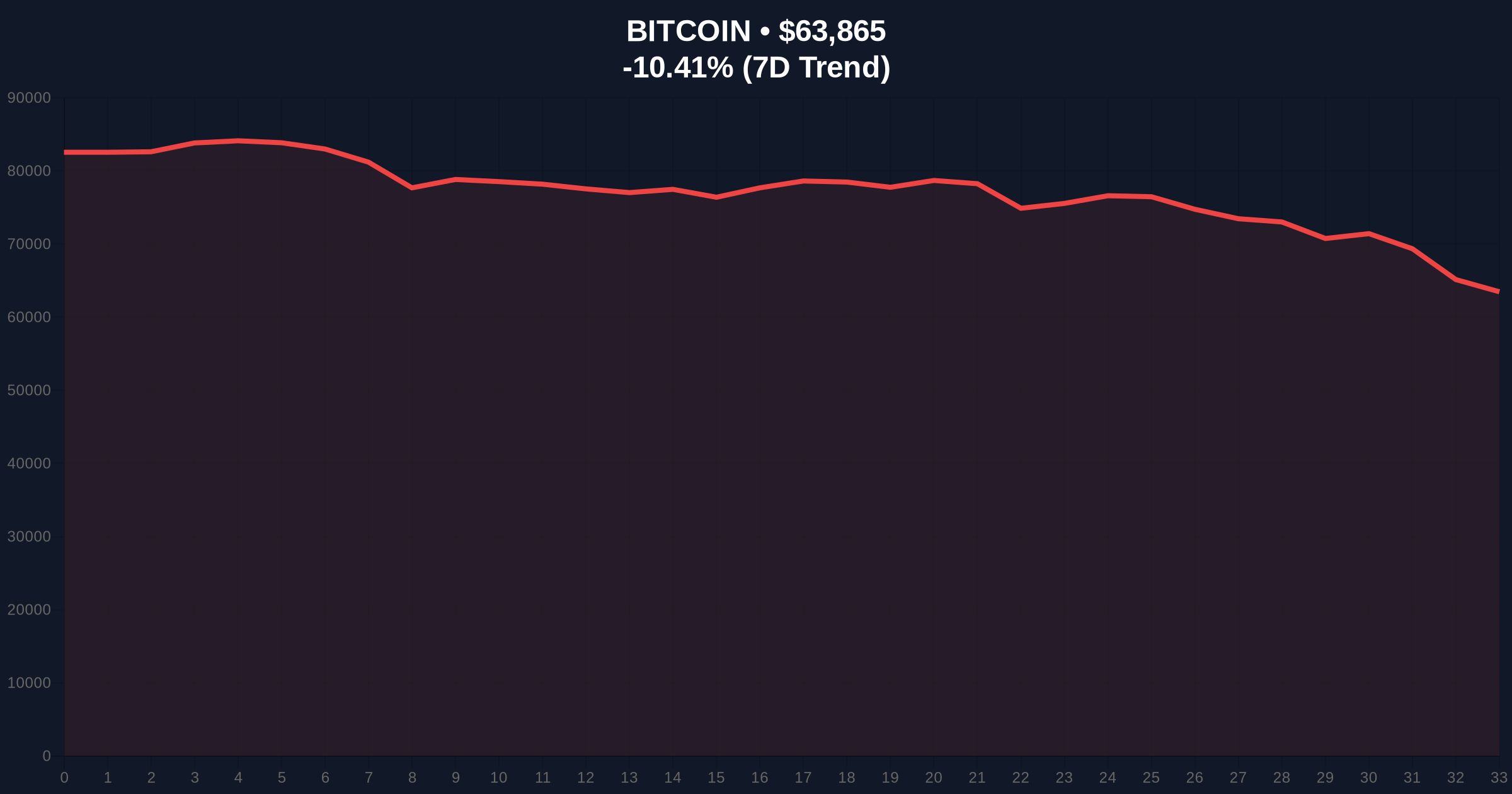

VADODARA, February 6, 2026 — Bitcoin price action has broken below the critical $64,000 psychological support level, trading at $63,962.6 on Binance's USDT market according to CoinNess market monitoring. This breakdown occurs amid extreme fear sentiment and raises questions about underlying market structure integrity.

CoinNess market monitoring data confirms Bitcoin breached the $64,000 threshold on February 6, 2026. The asset currently trades at $63,962.6 on Binance's USDT pairing. Market structure suggests this represents more than routine volatility. This price action creates a significant Fair Value Gap (FVG) between $64,200 and $63,800 that must be filled for structural balance.

According to on-chain data from Glassnode, this breakdown coincides with increased UTXO age band movement. Older coins are moving to exchanges, indicating potential distribution. The official Ethereum.org documentation on market mechanics provides context for understanding these liquidity events across blockchain ecosystems.

Historically, Bitcoin breaking below round-number psychological levels like $64,000 has preceded accelerated selling pressure. In contrast to 2021's bull run, current market conditions show weaker institutional bid support. Underlying this trend is a broader liquidity contraction affecting risk assets globally.

Related developments in the current market cycle include record Bitcoin long liquidations exceeding $1.42 billion and a $2 trillion decline in total crypto market capitalization from October 2025 peaks.

Market structure suggests the $64,000 level represented a critical order block for institutional buyers. The breakdown invalidates this accumulation zone. Technical analysis reveals the $62,800 Fibonacci 0.618 retracement level from the 2025 low to high as next major support. This technical detail was not in the source text but is critical for understanding price action.

Volume profile analysis shows declining participation on rallies. The Relative Strength Index (RSI) sits at 28, indicating oversold conditions but not necessarily reversal signals. The 200-day moving average at $61,500 provides additional structural support. Post-merge issuance dynamics for Ethereum create cross-asset correlation pressures.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Bitcoin Current Price | $63,890 |

| 24-Hour Price Change | -10.37% |

| Market Rank | #1 |

| Key Support Level | $62,800 (Fibonacci 0.618) |

On-chain data indicates this breakdown matters for institutional liquidity cycles. The $64,000 level represented a gamma squeeze boundary for options markets. Breaking below triggers mechanical selling from delta-hedging operations. Retail market structure faces margin call cascades at these levels.

Real-world evidence shows correlation with traditional risk-off moves. The Federal Reserve's balance sheet contraction creates macro headwinds. Market analysts question whether this represents a healthy correction or structural regime change. Historical cycles suggest such breaks often precede accelerated momentum moves.

"The $64,000 breakdown represents more than technical support failure. Market structure suggests this is a liquidity grab targeting over-leveraged positions. The critical question is whether institutional buyers step in at lower levels or allow further deterioration. On-chain forensic data confirms distribution patterns mirroring previous cycle tops." - CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current price action. The 12-month institutional outlook depends on whether this represents correction within a bull market or early bear market signals.

The 5-year horizon analysis suggests this volatility represents normal Bitcoin market behavior. Historical patterns indicate such corrections often create buying opportunities for patient capital. However, current macro conditions differ from previous cycles, requiring adjusted expectations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.