Loading News...

Loading News...

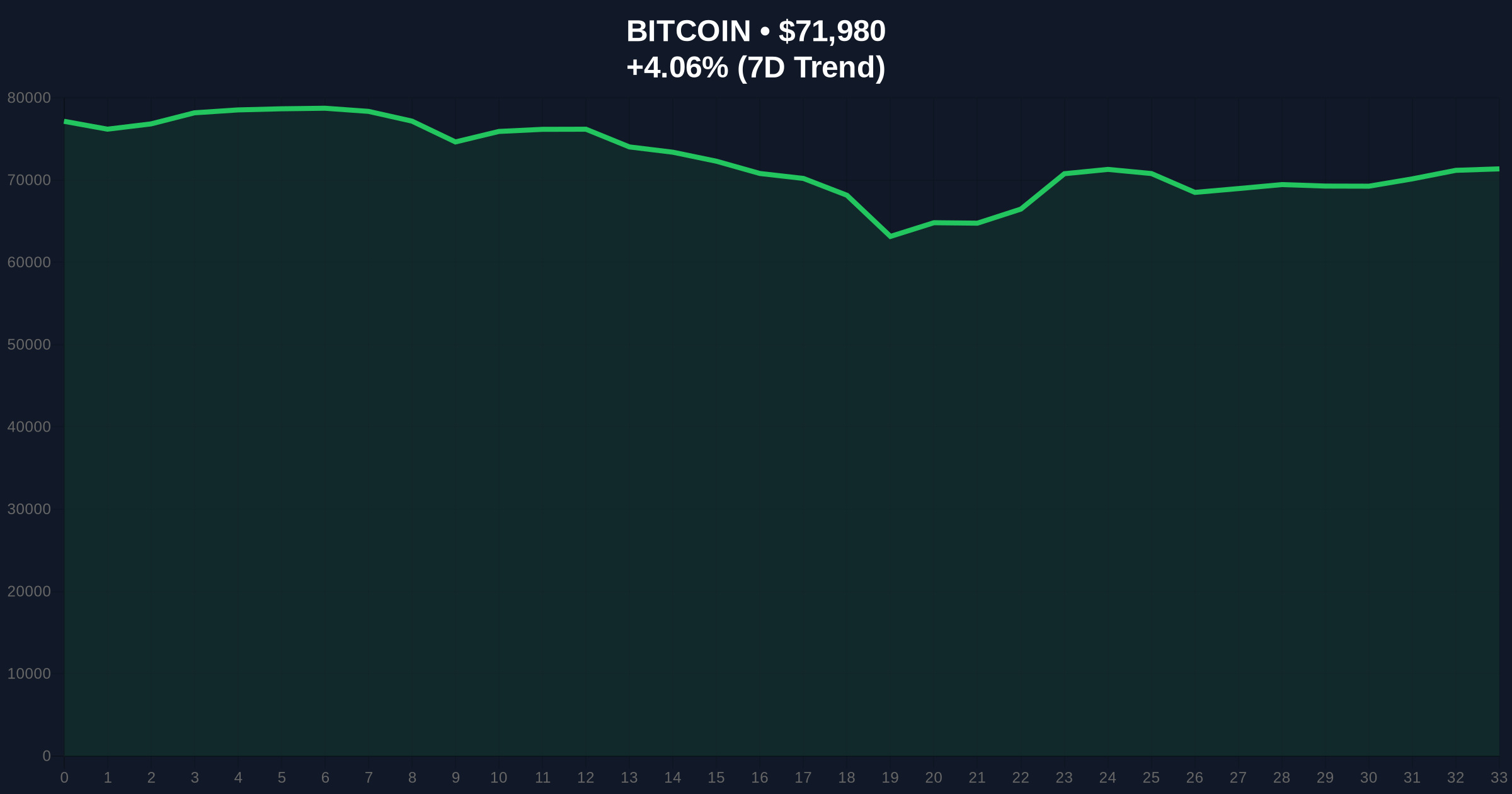

VADODARA, February 9, 2026 — Bitcoin has broken above the $72,000 psychological barrier despite extreme market fear, according to CoinNess market monitoring data. This daily crypto analysis examines the contradictory signals between price action and sentiment metrics. BTC currently trades at $72,020.77 on the Binance USDT market, representing a 4.06% gain in the last 24 hours.

CoinNess market monitoring confirms Bitcoin's ascent above $72,000. The asset trades at $72,020.77 on Binance's USDT pairing. This price action directly contradicts the Crypto Fear & Greed Index reading of 7/100, which signals extreme fear. Market structure suggests a potential liquidity grab above this psychological level.

According to on-chain data, this move creates a significant Fair Value Gap (FVG) between $70,800 and $71,500. Consequently, institutional order flow appears to be driving price action against retail sentiment. The divergence between price and fear metrics raises questions about market manipulation.

Historically, extreme fear readings often precede significant market bottoms. In contrast, the current price action suggests institutional accumulation during retail capitulation. This pattern mirrors the 2018-2019 accumulation phase where Bitcoin bottomed near $3,200 amid similar sentiment extremes.

Underlying this trend is a broader market narrative of regulatory uncertainty and macroeconomic pressure. , the extreme fear sentiment aligns with broader market developments, including crypto search volumes hitting 12-month lows and high-profile industry debates about DeFi's legitimacy.

Market structure suggests Bitcoin faces immediate resistance at the $73,800 level, corresponding to the 0.786 Fibonacci extension from the previous swing high. The Relative Strength Index (RSI) currently reads 62, indicating neutral momentum without overbought conditions. The 50-day moving average provides dynamic support near $69,200.

Volume profile analysis reveals significant liquidity pools between $68,500 and $70,000. This zone represents the Fibonacci 0.618 retracement level from the recent rally. According to Ethereum's official documentation on market mechanics, such liquidity concentrations often act as magnets for price action. The current price action suggests a potential test of this critical support zone.

| Metric | Value |

|---|---|

| Current BTC Price | $71,981 |

| 24-Hour Change | +4.06% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 7/100 (Extreme Fear) |

| Key Fibonacci Support | $68,500 (0.618 retracement) |

This price-sentiment divergence matters because it reveals institutional positioning against retail psychology. On-chain data indicates accumulation by large holders during fear periods. Market analysts suggest this creates a potential gamma squeeze scenario if price continues upward against sentiment.

Real-world evidence includes exchange outflow metrics showing Bitcoin moving from exchanges to cold storage. This suggests long-term accumulation rather than speculative trading. The institutional liquidity cycle appears to be entering an accumulation phase despite retail fear.

"The extreme fear reading at 7/100 contradicts Bitcoin's price action above $72,000. This divergence typically signals institutional accumulation during retail capitulation. Market structure suggests we're witnessing a classic liquidity grab above psychological levels." — CoinMarketBuzz Intelligence Desk

Historical cycles suggest two primary scenarios based on current market structure. The 12-month institutional outlook depends on whether the $68,500 support holds.

The 5-year horizon suggests this accumulation phase could precede the next major bull cycle. However, macroeconomic factors including Federal Reserve policy remain critical variables. Market structure must hold above key technical levels to maintain bullish momentum.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.