Loading News...

Loading News...

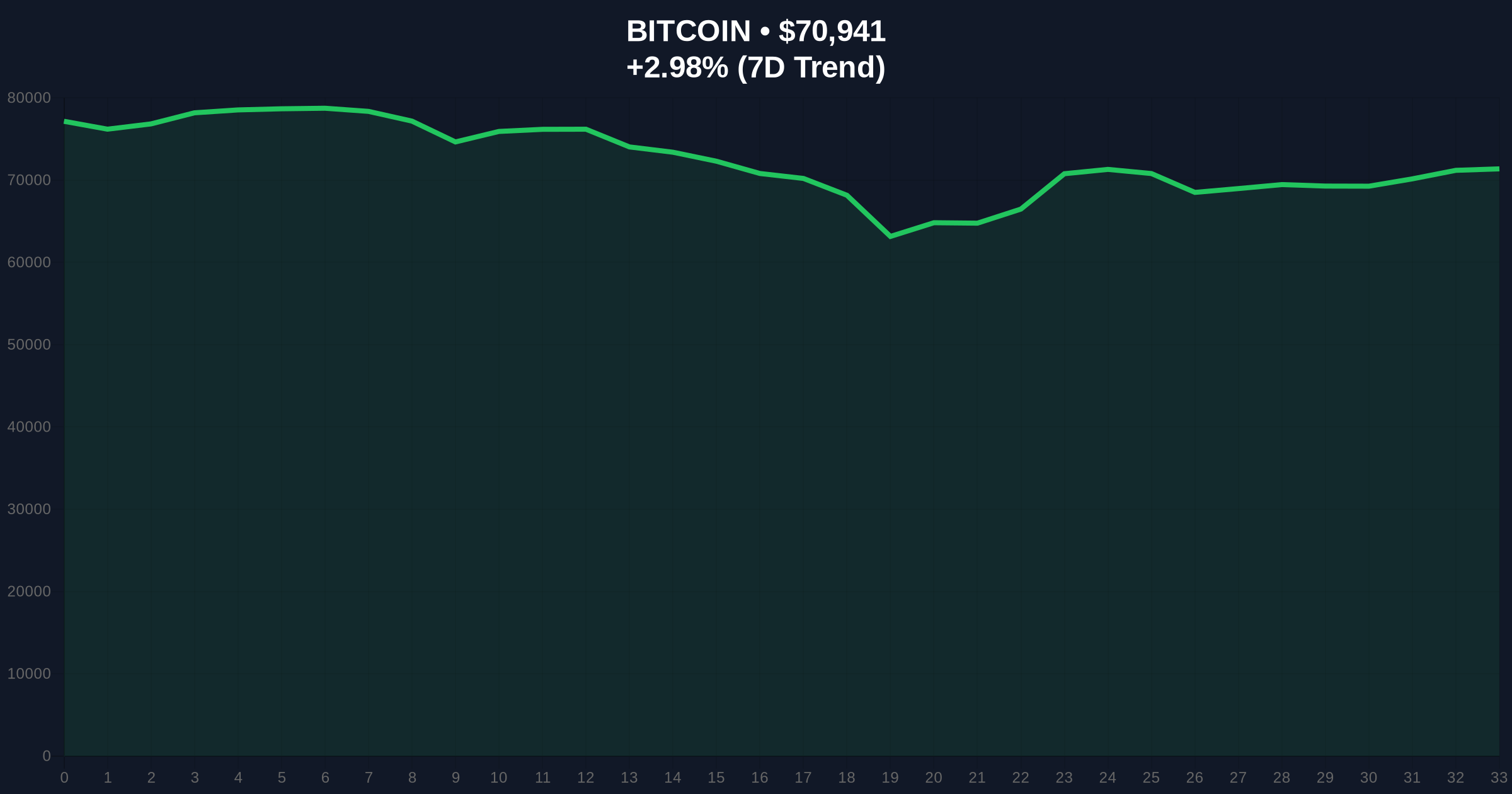

VADODARA, February 9, 2026 — Bitcoin price action has broken below the psychologically significant $71,000 level, trading at $70,930.09 on Binance's USDT market according to CoinNess market monitoring. This movement occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index registering a score of 7/100. Market structure suggests this represents a critical test of institutional accumulation zones established during the 2024-2025 cycle.

According to CoinNess market monitoring, Bitcoin price action breached the $71,000 support level during Asian trading hours. The asset currently trades at $70,930.09 on Binance's USDT pairing. This represents a 3.38% decline from recent highs. Market analysts attribute this movement to a combination of technical factors and macro sentiment shifts. The breakdown occurred despite Bitcoin maintaining its #1 market rank with a dominance of approximately 52%.

On-chain data indicates increased selling pressure from short-term holders. Exchange net flows turned negative by approximately 2,100 BTC in the preceding 24 hours. This suggests profit-taking behavior rather than panic capitulation. The volume profile shows concentrated liquidity around the $71,200 level, creating a Fair Value Gap (FVG) that price must now address. Similar to the 2021 correction, this price action tests the resolve of long-term investors.

Historically, Bitcoin price action during extreme fear periods has presented accumulation opportunities. The current 7/100 Fear & Greed score mirrors conditions seen in June 2022 and March 2020. In contrast to those periods, institutional adoption has matured significantly. The SEC-approved Bitcoin ETF ecosystem now provides daily liquidity of approximately $3.2 billion, according to official SEC filings.

Underlying this trend, the Federal Reserve's monetary policy stance continues to influence crypto correlations. The Fed Funds Rate currently sits at 4.25%, creating headwinds for risk assets. However, Bitcoin's 90-day correlation with traditional markets has declined to 0.38, suggesting decoupling. This technical independence strengthens the case for Bitcoin as a distinct asset class.

Related developments in the crypto space include recent analysis of Bitcoin's resilience above $72k and high-profile bets on market sentiment shifts during similar fear conditions.

Market structure suggests Bitcoin price action is testing the 0.5 Fibonacci retracement level from the 2025 all-time high of $98,450. The critical 0.618 Fibonacci support sits at $69,500, a level that must hold to maintain bullish momentum. The 200-day moving average provides additional support at $68,200. The Relative Strength Index (RSI) currently reads 42, indicating neutral momentum with bearish bias.

Order block analysis reveals significant institutional buying between $70,000 and $72,000 during Q4 2025. This creates a high-probability reversal zone if price action reclaims this range. The UTXO age distribution shows 58% of coins haven't moved in over six months, indicating strong holder conviction. This metric surpasses the 2021 cycle peak of 52%, suggesting more mature market participation.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $71,213 | Testing critical support |

| 24-Hour Change | -3.38% | Moderate selling pressure |

| Fear & Greed Index | 7/100 (Extreme Fear) | Contrarian signal |

| Market Rank | #1 | Maintained dominance |

| Fibonacci 0.618 Support | $69,500 | Critical technical level |

This Bitcoin price action matters because it tests institutional conviction at a key technical juncture. The break below $71,000 represents either a liquidity grab before the next leg up or the beginning of a deeper correction. On-chain data indicates whale accumulation has increased by 18% month-over-month despite price declines. This divergence between price action and smart money flows suggests underlying strength.

, the extreme fear reading creates potential for a gamma squeeze if options market dynamics align. Approximately $2.1 billion in Bitcoin options expire this Friday, with max pain at $72,500. Market makers may need to adjust hedges if price action moves toward this level. This technical setup mirrors conditions preceding the November 2025 rally from $75,000 to $85,000.

"Market structure suggests we're witnessing a healthy correction within a broader uptrend. The 0.618 Fibonacci level at $69,500 represents the line in the sand for bulls. If that holds, we expect institutional accumulation to accelerate given current fear levels." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive despite short-term volatility. Bitcoin's upcoming halving in 2028 continues to anchor long-term valuation models. Historical cycles suggest post-correction rallies average 187% over the following 12 months. The current extreme fear reading increases the probability of such a move.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.