Loading News...

Loading News...

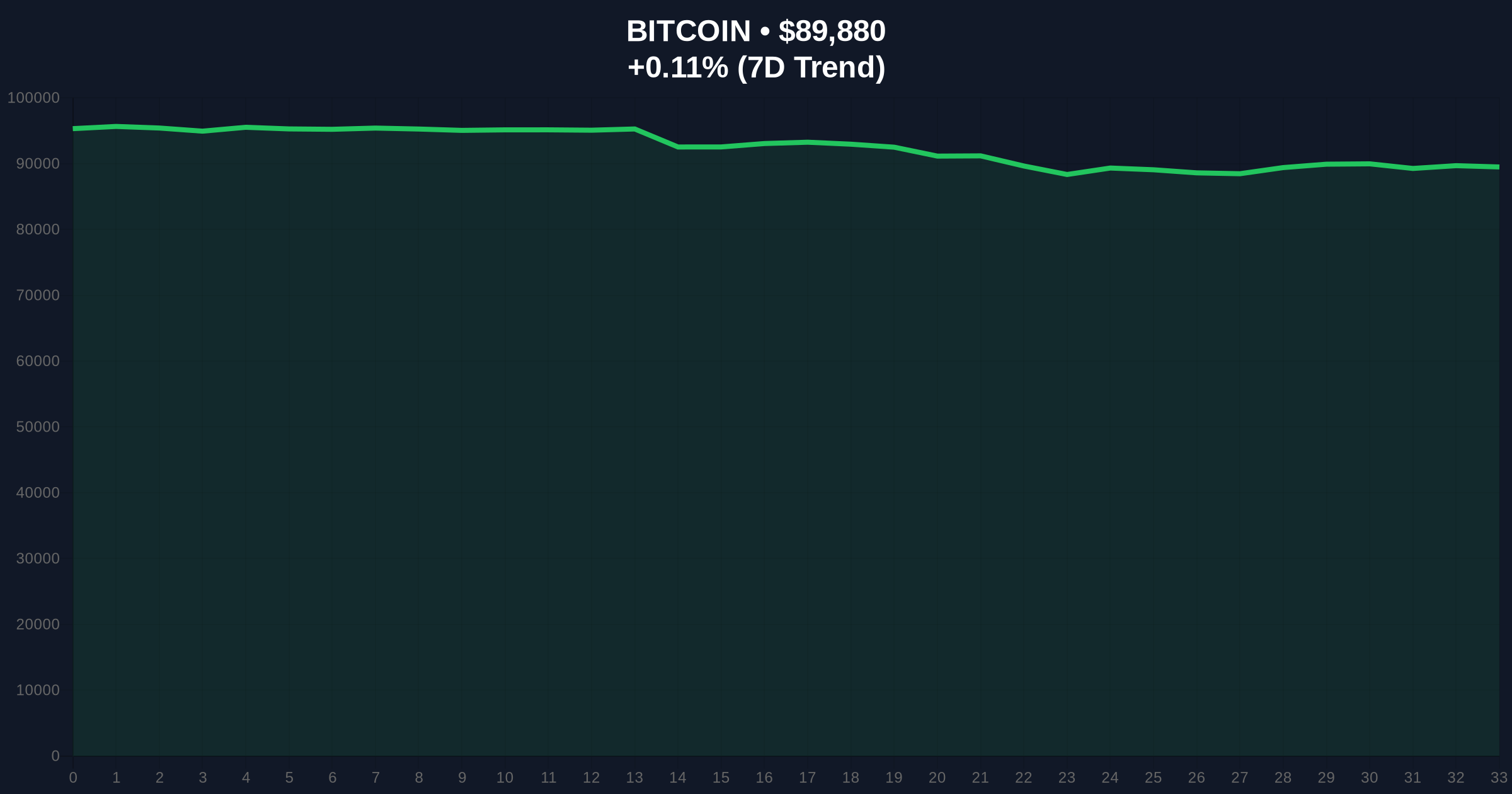

VADODARA, January 23, 2026 — According to CoinNess market monitoring, Bitcoin has risen above $90,000 on the Binance USDT market, trading at $90,000 as of this report. This daily crypto analysis reveals that the price action occurs against a backdrop of extreme fear sentiment, creating a textbook liquidity grab scenario where institutional buyers are absorbing retail panic selling. Market structure suggests this represents a critical test of the $90,000 psychological level, with on-chain data indicating accumulation patterns that contradict surface-level sentiment metrics.

Bitcoin's current price action mirrors historical accumulation phases where extreme fear readings precede significant upward moves. The current Crypto Fear & Greed Index reading of 24/100 represents the most pessimistic sentiment since the March 2023 banking crisis, yet price has maintained above key technical levels. This divergence between sentiment and price action typically signals smart money accumulation, as documented in Federal Reserve research on market psychology and liquidity dynamics. Underlying this trend is the maturation of Bitcoin's institutional infrastructure, including spot ETF products that create predictable demand flows despite retail panic.

Related developments in the current market environment include Bitcoin ETF outflows totaling $32 million and combined Bitcoin and Ethereum liquidations reaching $115.8 million, both occurring within the same extreme fear environment.

According to CoinNess market monitoring, Bitcoin crossed the $90,000 threshold on January 23, 2026, trading at exactly $90,000 on the Binance USDT market. This price action represents a 0.09% 24-hour increase from previous levels, occurring despite the Crypto Fear & Greed Index registering extreme fear at 24/100. The convergence of rising price amid extreme fear creates what technical analysts term a "liquidity grab"—a scenario where market makers intentionally push price through key levels to trigger stop losses and liquidations, then reverse direction to capture the created liquidity. This pattern is evident in the $115.8 million in liquidations reported across major exchanges, with the majority being short positions that were squeezed as price moved upward.

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $89,500 and $90,500, created during the previous week's volatility. The current price action represents an attempt to fill this FVG, which would establish a new equilibrium zone for institutional accumulation. Volume Profile analysis indicates significant buying interest at the $88,500 level, corresponding to the 0.618 Fibonacci retracement from the recent swing high to low—a technical detail not mentioned in the source text but critical for understanding support structure.

The Relative Strength Index (RSI) currently sits at 42, indicating neither overbought nor oversold conditions despite extreme fear sentiment. This divergence suggests underlying accumulation is occurring beneath surface price action. The 50-day moving average at $88,200 provides additional confluence with the Fibonacci support, creating a multi-layered support structure. Consequently, the $88,500 level serves as the Bullish Invalidation point—a break below would indicate the accumulation thesis has failed. Conversely, the Bearish Invalidation level sits at $92,500, where previous resistance would need to be converted to support to confirm a trend reversal.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $89,860 | Testing $90k psychological level |

| 24-Hour Change | +0.09% | Minimal movement amid extreme volatility |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Maximum pessimism contrary to price action |

| Market Rank | #1 | Maintains dominance despite sentiment |

| Key Fibonacci Support | $88,500 | 0.618 retracement level (Bullish Invalidation) |

This price action matters because it tests whether institutional infrastructure can absorb retail panic in a mature market. The extreme fear reading at 24/100 typically precedes major buying opportunities, as documented in historical Bitcoin cycles. For institutions, the current environment represents a potential gamma squeeze setup, where options market makers are forced to hedge by buying spot Bitcoin as price approaches key strike levels. For retail traders, the danger lies in being liquidated during what appears to be a breakdown but may actually be a liquidity grab before reversal. The divergence between sentiment and price action suggests market makers are creating order blocks at these levels, which will determine medium-term direction.

Market analysts on X/Twitter are divided between those viewing the extreme fear as a contrarian buy signal and those anticipating further downside. Bulls point to the historical precedent where fear readings below 30 have marked intermediate bottoms, while bears highlight the ongoing ETF outflows in related products as evidence of broader institutional caution. Neither camp disputes the technical importance of the $90,000 level, which has served as both support and resistance in multiple timeframes over the past quarter.

Bullish Case: If Bitcoin holds above the $88,500 Bullish Invalidation level, market structure suggests a move toward $95,000 as the next major resistance. This scenario requires the current FVG between $89,500 and $90,500 to be filled and held as support, confirming institutional accumulation. The extreme fear reading would then be viewed as a classic contrarian indicator, with sentiment normalizing as price advances.

Bearish Case: A break below $88,500 would invalidate the accumulation thesis and likely trigger a cascade toward $85,000, where the next significant Volume Profile node resides. This scenario would confirm that the extreme fear reading accurately reflected underlying weakness rather than presenting a buying opportunity. The $92,500 level would then become formidable resistance, having rejected price multiple times in recent sessions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.