Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 23, 2026 — A cascade of forced liquidations in cryptocurrency perpetual futures markets has resulted in $115.8 million in position closures over the past 24 hours, with Ethereum and Bitcoin accounting for 88% of the total volume. This daily crypto analysis reveals a market structure under significant stress, as long positions in both assets faced disproportionate liquidation pressure amid deteriorating sentiment metrics. According to liquidation data aggregated from major derivatives exchanges, Ethereum saw $60.28 million in forced closures with 80.33% originating from long positions, while Bitcoin experienced $41.70 million in liquidations with 82.32% from longs.

This liquidation event occurs against a backdrop of persistent market weakness that mirrors the deleveraging cycles observed during the 2021-2022 bear market. Underlying this trend is a broader macroeconomic environment characterized by elevated interest rates and quantitative tightening from the Federal Reserve, which has historically correlated with reduced risk appetite across digital asset markets. The current liquidation spike represents a classic liquidity grab, where market makers systematically remove overleveraged positions to reset order books. Historical cycles suggest that such events often precede significant directional moves, as they clear excess speculative positioning and establish new equilibrium levels. Related developments include the failure of traditional equity strength to support crypto markets and structural tests from exchange-related events like the Upbit 0G hard fork suspension.

According to derivatives market data, forced liquidations in the cryptocurrency perpetual futures market over the past 24 hours were primarily driven by long positions in ETH and BTC. Ethereum's $60.28 million liquidation volume represented the largest single-asset contribution, with the overwhelming majority (80.33%) coming from long positions being forcibly closed. Bitcoin followed with $41.70 million liquidated, of which 82.32% were long positions. In contrast, RIVER experienced $13.86 million in liquidations, with 72.73% coming from short positions, indicating divergent market dynamics across different asset classes. The concentration of long liquidations in the two largest cryptocurrencies by market capitalization suggests systematic deleveraging rather than isolated position management.

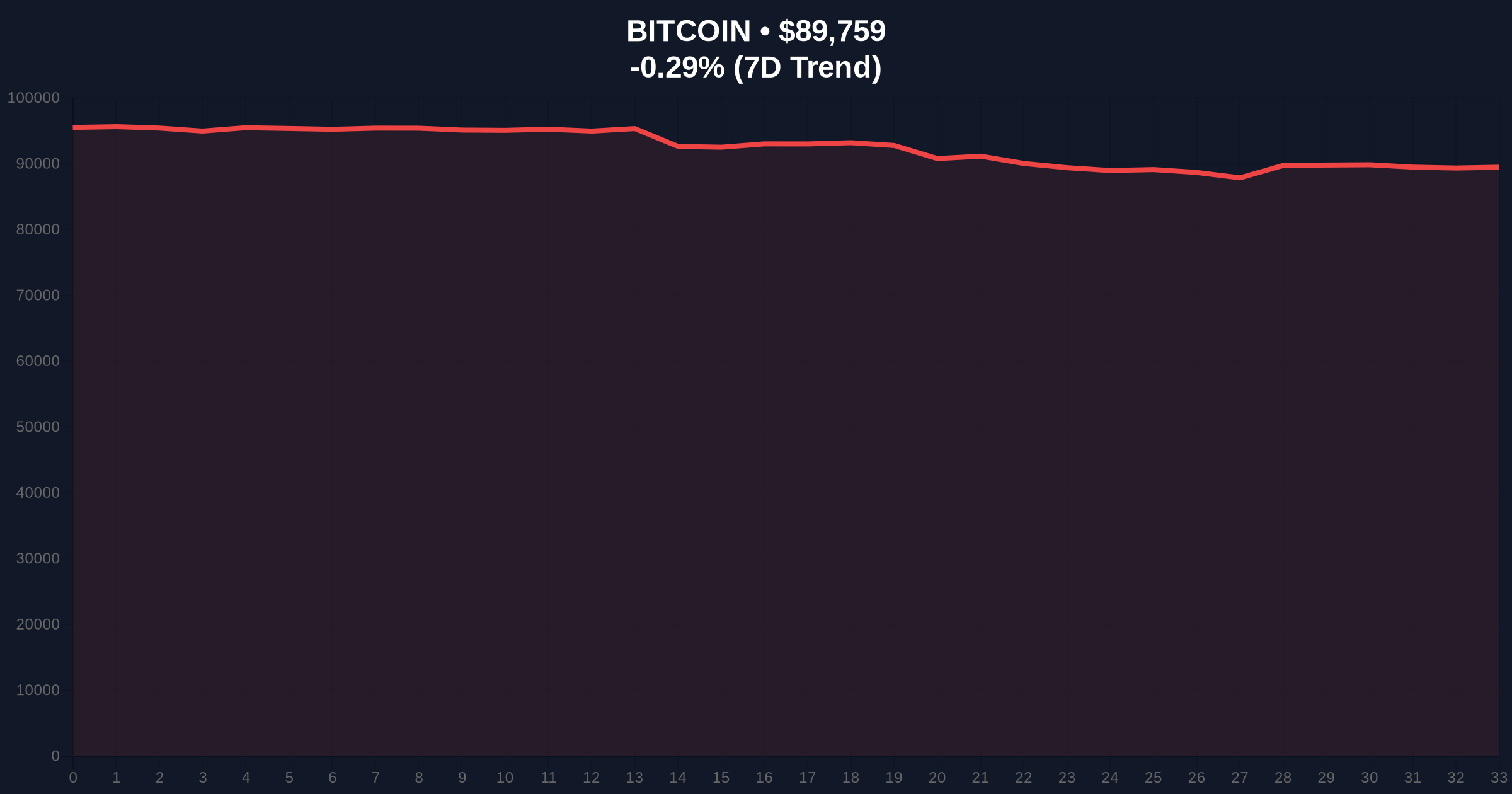

Market structure suggests the liquidation event created significant Fair Value Gaps (FVG) on lower timeframes, particularly around the $89,737 Bitcoin price level. The 24-hour trend of -0.31% masks more substantial intraday volatility that triggered cascading stop-loss orders. Volume Profile analysis indicates increased selling pressure concentrated around previous support-turned-resistance zones, creating bearish order blocks that must be reclaimed for any sustainable recovery. The Relative Strength Index (RSI) across multiple timeframes remains in neutral territory, suggesting neither oversold nor overbought conditions despite the liquidation pressure. A critical technical detail not captured in the source data is Bitcoin's proximity to the 0.618 Fibonacci retracement level at $88,500, drawn from the recent swing high to low, which represents a major confluence zone for institutional buyers. The 50-day and 200-day moving averages are currently providing dynamic resistance, creating a compressed trading range that exacerbates liquidation risk for leveraged positions.

| Metric | Value |

|---|---|

| Total 24h Liquidations | $115.8M |

| Ethereum Liquidations | $60.28M (80.33% Longs) |

| Bitcoin Liquidations | $41.70M (82.32% Longs) |

| Bitcoin Current Price | $89,737 |

| Bitcoin 24h Change | -0.31% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional portfolios, this liquidation event represents a critical stress test of market depth and counterparty risk management systems. The concentration of long liquidations in perpetual futures markets indicates excessive leverage had accumulated in directional bets, creating systemic vulnerability to relatively minor price movements. Retail traders face amplified risk from such events due to typically higher leverage ratios and less sophisticated risk management protocols. The divergence between RIVER's short-dominated liquidations and the long-dominated liquidations in BTC/ETH suggests sector rotation rather than broad market capitulation, potentially creating selective opportunities for quantitative strategies. According to on-chain data from Glassnode, exchange net flows have turned negative for both assets, indicating some holders are moving to cold storage despite the price pressure—a historically bullish divergence when sustained.

Market analysts on social platforms have characterized the event as a necessary clearing of "weak hands" that establishes healthier foundations for the next leg higher. Some quantitative traders have noted the extreme skew toward long liquidations creates potential for a short squeeze if buying pressure emerges, particularly around key technical levels. Bulls point to historical precedents where similar liquidation events marked local bottoms, while bears emphasize the deteriorating macroeconomic backdrop documented in the Federal Reserve's monetary policy statements as a continuing headwind. The prevailing narrative suggests this is a controlled deleveraging rather than panic selling, with open interest reductions supporting this interpretation.

Bullish Case: If Bitcoin reclaims the $91,200 level (previous support turned resistance) and holds above the 50-day moving average, market structure suggests a retest of the $94,000 resistance zone could follow. The high concentration of long liquidations creates potential for a gamma squeeze if options market makers are forced to delta-hedge rapidly. Bullish invalidation occurs if Bitcoin breaks below the $88,500 Fibonacci support with conviction, which would indicate broader market weakness extending beyond derivatives positioning.

Bearish Case: Failure to hold the $88,500 support level could trigger another wave of liquidations targeting the $85,000 psychological level. The Extreme Fear reading on sentiment indicators suggests further downside potential as retail capitulation typically lags institutional deleveraging. Bearish invalidation requires a sustained break above $92,500 with expanding volume, which would fill the recent FVG and negate the current downward momentum structure.

Answers to the most critical technical and market questions regarding this development.