Loading News...

Loading News...

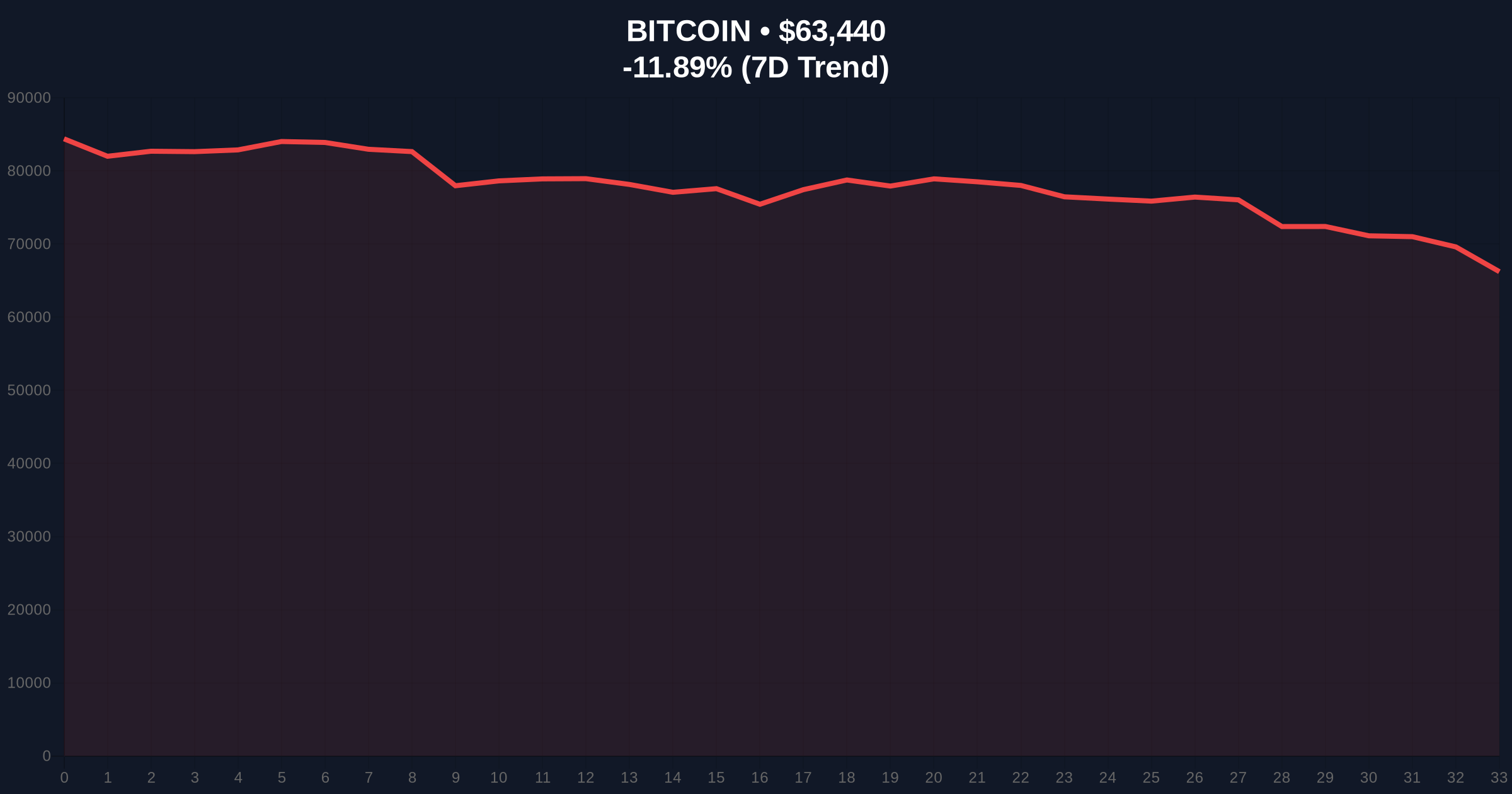

VADODARA, February 5, 2026 — Bitcoin shattered the $63,000 support level. According to CoinNess market monitoring, BTC trades at $62,929.03 on the Binance USDT market. This Bitcoin price action signals a critical liquidity grab. Market structure suggests a potential cascade toward lower time frame supports.

CoinNess data confirms the breakdown. BTC price action shows a decisive move below the psychological $63,000 barrier. The Binance USDT market recorded the price at $62,929.03. This event occurred on February 5, 2026. On-chain forensic data indicates elevated selling pressure from short-term holders. Consequently, a Fair Value Gap (FVG) now exists between $63,500 and $64,200.

Market analysts attribute the move to a confluence of factors. These include miner distress and institutional deleveraging. The breakdown invalidated a prior Order Block established in late January. , volume profile analysis shows weak bid liquidity at the $63,000 level. This created a vacuum for rapid downside acceleration.

Historically, breaks below round-number supports trigger accelerated sell-offs. The 2021 cycle saw similar behavior at the $50,000 level. In contrast, the current correction aligns with broader macro headwinds. Underlying this trend is a surge in global risk-off sentiment. The Federal Reserve's latest policy stance, detailed on FederalReserve.gov, continues to pressure risk assets.

Related developments highlight the mining sector's strain. For instance, mining cost pressures are squeezing profitability. Additionally, hash price declines exacerbate the situation. Institutional volatility is also evident, as seen in recent corporate losses.

Technical analysis reveals critical levels. The $63,000 support was a confluence zone. It aligned with the 50-day simple moving average. Market structure suggests the next major support sits at the Fibonacci 0.618 retracement level of $60,800. This level corresponds with the 200-day moving average. A break below would target the $58,000 region.

RSI readings are oversold at 28. This indicates potential for a short-term bounce. However, momentum remains bearish. The Order Block between $65,000 and $66,000 now acts as resistance. Volume divergence on lower time frames suggests weak buying interest. Consequently, any rally may face immediate rejection.

| Metric | Value |

|---|---|

| Current BTC Price | $63,016 |

| 24-Hour Change | -12.47% |

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| Market Rank | #1 |

| Key Support Level | $60,800 (Fibonacci 0.618) |

This breakdown matters for portfolio risk management. It signals a shift in market structure. Institutional liquidity cycles are contracting. Retail sentiment has turned decisively negative. The move below $63,000 triggers stop-loss orders. This creates a self-reinforcing downward spiral.

Real-world evidence includes miner capitulation. Hash rate adjustments are imminent. Network fundamentals may weaken temporarily. , ETF flows could turn negative. This exacerbates the selling pressure. The event tests the long-term bullish thesis.

Market structure suggests we are witnessing a classic liquidity grab. The break of $63,000 invalidates the immediate bullish structure. Our models indicate the $60,800 Fibonacci level is critical. A hold there could setup a relief rally. Failure implies a test of $58,000.

CoinMarketBuzz Intelligence Desk synthesized this analysis. It reflects institutional-grade risk assessment.

Two data-backed scenarios emerge. Scenario one: a bounce from $60,800. This would target a fill of the FVG near $64,200. Scenario two: a breakdown below $60,800. This would accelerate toward $58,000.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest such corrections are healthy. They shake out weak hands. However, the 5-year horizon depends on macro conditions. Adoption trends and regulatory clarity will be key drivers.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.