Loading News...

Loading News...

VADODARA, February 9, 2026 — Bitcoin perpetual futures traders on the world's largest exchanges maintain a slight long bias, according to 24-hour open interest data. This positioning directly contradicts the Extreme Fear sentiment gripping broader cryptocurrency markets. Our daily crypto analysis of this divergence suggests a precarious market structure vulnerable to a rapid unwind.

According to aggregated exchange data, the overall 24-hour long/short ratio for BTC perpetual futures stands at 50.96% long versus 49.04% short. This data, sourced from the three largest crypto futures exchanges by open interest, shows a consistent but marginal preference for long positions. Binance reports 52.22% long, OKX shows 51.44% long, and Bybit leads with 52.53% long positions.

Market structure suggests this narrow long bias is statistically insignificant in isolation. However, its persistence against a backdrop of Extreme Fear creates a notable contradiction. This scenario often precedes a liquidity grab where one side of the market gets violently liquidated to fill a Fair Value Gap (FVG).

Historically, periods of Extreme Fear sentiment, as defined by the Crypto Fear & Greed Index, typically correlate with heavily net-short futures positioning. The current data breaks from this pattern. In contrast, the 2021 cycle saw similar divergences precede sharp, corrective moves as over-leveraged longs were liquidated.

Underlying this trend is a broader climate of regulatory and macroeconomic uncertainty. For instance, the ongoing Fed Chair confirmation stalemate injects policy volatility. , recent legal challenges, such as the FDIC's loss in a transparency lawsuit, add to the complex backdrop against which this futures data exists.

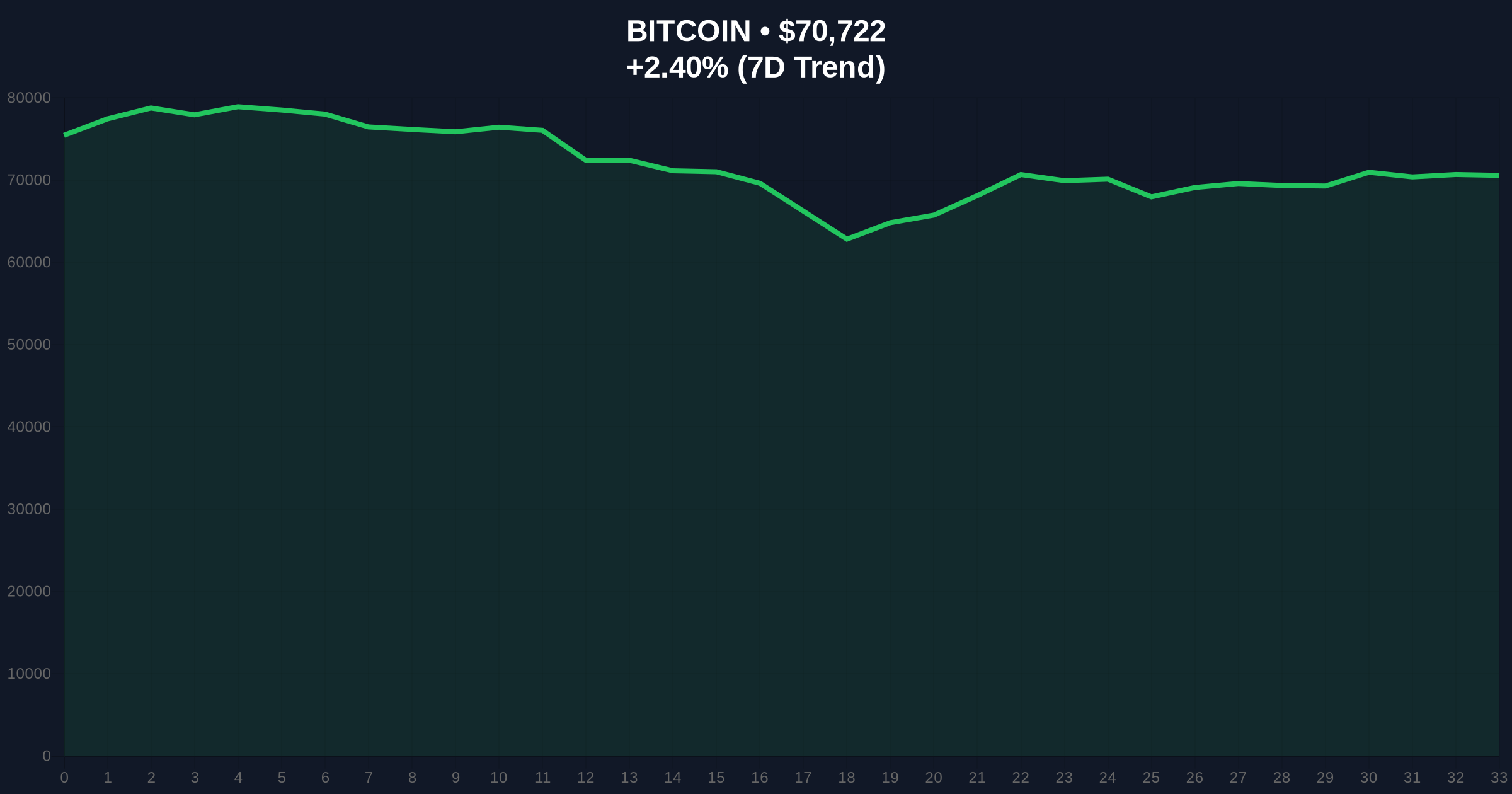

Bitcoin currently trades at $70,803, showing a 24-hour gain of 2.51%. This price action sits within a critical order block defined by the weekly Fibonacci retracement levels from the last major swing high. The immediate resistance forms a cluster around the $72,500 level, coinciding with the 50-day exponential moving average.

On-chain data indicates weak support beneath the current price. The Volume Profile Point of Control (VPOC) sits significantly lower, near $68,000. A break below the key Fibonacci 0.618 support at $68,500 would likely trigger cascading liquidations for the marginally net-long futures positions highlighted in the source data. This technical setup mirrors patterns observed during the Q3 2024 correction.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (14/100) |

| Bitcoin (BTC) Price | $70,803 |

| 24-Hour Price Change | +2.51% |

| Aggregate Futures Long/Short Ratio | 50.96% Long / 49.04% Short |

| Highest Exchange Long Ratio (Bybit) | 52.53% Long |

This data matters because it exposes a fault line in market structure. Retail and leveraged traders, as represented by perpetual futures data, show a complacent long bias. Institutional flows and spot market sentiment, however, scream caution. This divergence creates a high-probability setup for a gamma squeeze or a rapid liquidation cascade.

Real-world evidence supports this. The thin margin between long and short positions means minimal buying pressure is required to trigger a short squeeze. Conversely, minor selling pressure could liquidate over-leveraged longs. This precarious balance explains the market's heightened volatility sensitivity, as seen in Bitcoin's recent 12% rebound facing 'dead cat bounce' scrutiny.

The data presents a classic contrarian signal. A slight long bias in Extreme Fear is not bullish conviction; it's a vulnerability. Market mechanics suggest these positions are weakly held and prime for a liquidity flush if key technical levels break. The critical watch is the $68,500 support zone.

— CoinMarketBuzz Intelligence Desk

We present two data-backed technical scenarios based on the current market structure and futures positioning.

The 12-month institutional outlook remains clouded by macro uncertainty. However, this micro-structure analysis suggests the next major directional move will be dictated by which side of the futures market gets liquidated first. A resolution to the Fed leadership stalemate or clarity from ongoing cases like Dunamu's challenge of a $26.5M fine could provide the catalyst.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.