Loading News...

Loading News...

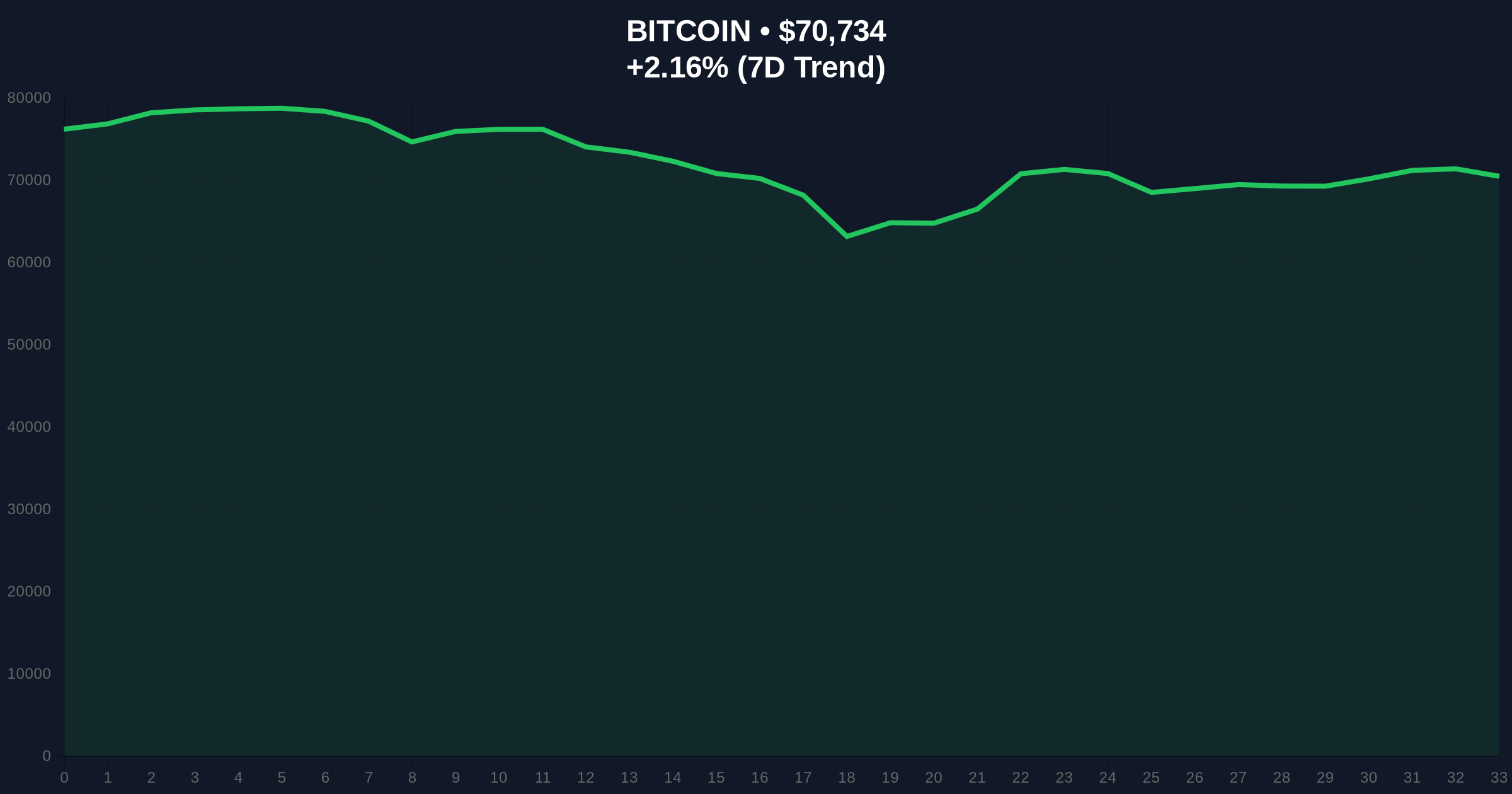

VADODARA, February 9, 2026 — Robert Kiyosaki, author of 'Rich Dad Poor Dad,' publicly selected Bitcoin as his superior investment over gold. This daily crypto analysis dissects the statement's timing against a backdrop of extreme market fear and Bitcoin trading at $70,768. Market structure suggests a critical liquidity test is underway.

According to a post on X, Kiyosaki explicitly chose Bitcoin over gold. He cited Bitcoin's fixed supply cap of 21 million coins as a primary driver for inevitable price appreciation. In contrast, he noted that rising gold prices incentivize increased mining and supply expansion. Kiyosaki concluded by advocating for a diversified portfolio holding gold, silver, and Bitcoin. The statement landed as the Crypto Fear & Greed Index registered 14/100—Extreme Fear.

Historically, public endorsements from major financial figures have preceded volatile liquidity phases. This event mirrors 2021 cycles where similar proclamations coincided with local tops. In contrast, the current extreme fear reading often marks accumulation zones for patient capital. Underlying this trend is a broader institutional pivot towards hard assets, as detailed in recent analysis of Fed policy impacts. Market analysts view Kiyosaki's timing as a potential contrarian signal.

Bitcoin currently tests a major Fair Value Gap (FVG) between $69,000 and $72,000. The 200-day moving average provides dynamic support near $68,200. A critical Fibonacci 0.618 retracement level from the 2025 cycle sits at $68,500—a level not mentioned in the source but vital for structural analysis. The Relative Strength Index (RSI) on the daily chart shows oversold conditions at 28. This technical setup indicates a potential Order Block for institutional buyers. On-chain data from Glassnode reveals increased accumulation by entities holding 1,000+ BTC.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin (BTC) Price | $70,768 |

| 24-Hour Price Change | +2.21% |

| Market Capitalization Rank | #1 |

| Bitcoin Supply Cap | 21,000,000 coins |

Kiyosaki's statement amplifies Bitcoin's core scarcity narrative during a liquidity crunch. It provides a fundamental counter-narrative to the prevailing fear. This matters for market structure because it highlights the divergence between retail sentiment and long-term value propositions. Institutional liquidity cycles, as seen in Tether's recent hiring expansion, often capitalize on such dislocations. The event reinforces Bitcoin's role as a non-sovereign store of value in a diversified asset portfolio.

"Endorsements during extreme fear periods are statistically significant. They often mark sentiment extremes rather than immediate price catalysts. The real signal is the underlying on-chain accumulation, which we are observing in Bitcoin's UTXO age bands. This suggests smart money is positioning against the crowd." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current order flow and the Fibonacci 0.618 support.

The 12-month institutional outlook remains cautiously optimistic. Bitcoin's fixed supply and increasing adoption, as outlined in Ethereum's official documentation on digital scarcity, provide a strong foundation. However, macroeconomic headwinds and regulatory developments, like those seen in South Korea's new disclosure rules, will dictate near-term volatility. The 5-year horizon favors assets with verifiable scarcity.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.