Loading News...

Loading News...

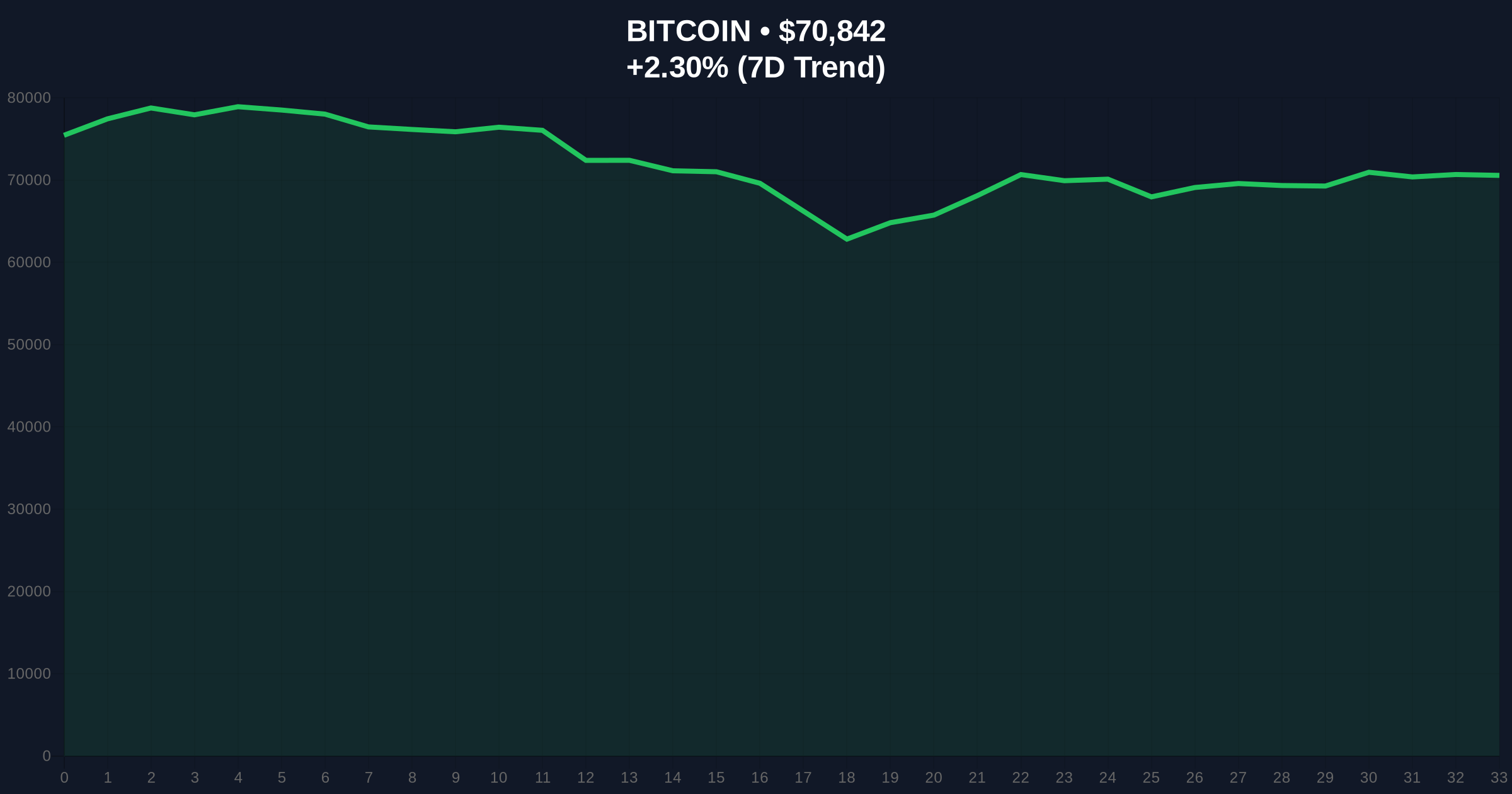

VADODARA, February 9, 2026 — Bitcoin's 12% rebound from $62,822 to $70,846 faces mounting skepticism as institutional analysts question its sustainability. According to Decrypt's reporting, this rally likely represents a technical bounce driven by short covering rather than genuine demand recovery. Market structure suggests this move may be a classic dead cat bounce following large-scale liquidations.

Decrypt's analysis reveals Bitcoin surged from $62,822 to $70,846 after last weekend's sharp drop. Ryan Yoon, a senior analyst at Tiger Research, told Decrypt this rally centers on short covering. Similarly, Andri Pauzan Azima, head of research at crypto exchange Bitrue, confirmed the rebound characteristics match short covering and a short squeeze post-sell-off.

Azima noted long positions cleared out as open interest fell. Spot cumulative volume delta (CVD) improved during the rally. He emphasized the Coinbase Premium remains negative. Consequently, macroeconomic uncertainty persists. This combination makes establishing a sustainable demand base difficult.

Historically, Bitcoin has experienced similar dead cat bounces during bear market transitions. The 2018 cycle saw multiple 15-20% rallies that failed to hold. In contrast, genuine bull market recoveries typically show positive funding rates and sustained CVD momentum.

Underlying this trend, the current market exhibits hallmarks of distribution rather than accumulation. Large-scale liquidations created a vacuum for short covering. This technical rebound lacks fundamental catalysts. For deeper context on market uncertainty, see our analysis on the Fed Chair confirmation stalemate impacting sentiment.

Market structure suggests Bitcoin faces immediate resistance at the $72,000 Fibonacci 0.382 retracement level from the recent high. The 50-day moving average at $71,500 creates additional overhead supply. Support rests at the $68,500 order block formed during the initial rebound.

On-chain data indicates weak holder conviction. UTXO age bands show minimal long-term accumulation. Exchange net flows remain neutral. This technical setup mirrors distribution phases from previous cycles. The negative Coinbase Premium signals institutional selling pressure outweighing buying.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian signal despite price rebound |

| Bitcoin Current Price | $70,829 | 12% rebound from weekend low |

| 24-Hour Trend | +2.28% | Short-term momentum positive |

| Market Rank | #1 | Maintains dominance position |

| Coinbase Premium | Negative | Institutional selling pressure persists |

This analysis matters for portfolio risk management. A dead cat bounce traps bullish retail traders. Institutional liquidity cycles suggest caution. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, continues influencing macro uncertainty.

Retail market structure remains fragile. Open interest declines indicate reduced leverage. Spot CVD improvements lack volume confirmation. This creates vulnerability to further downside. Market participants must distinguish between technical bounces and sustainable trends.

"The rally exhibits classic short-covering characteristics without fundamental demand drivers. Negative Coinbase Premium and macroeconomic headwinds suggest this is a technical rebound within a larger corrective structure. Traders should monitor the $68,500 support level closely." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Without sustainable demand establishment, Bitcoin may consolidate within a $65,000-$75,000 range. This aligns with historical post-halving year patterns. The 5-year horizon depends on macroeconomic resolution and institutional adoption acceleration.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.