Loading News...

Loading News...

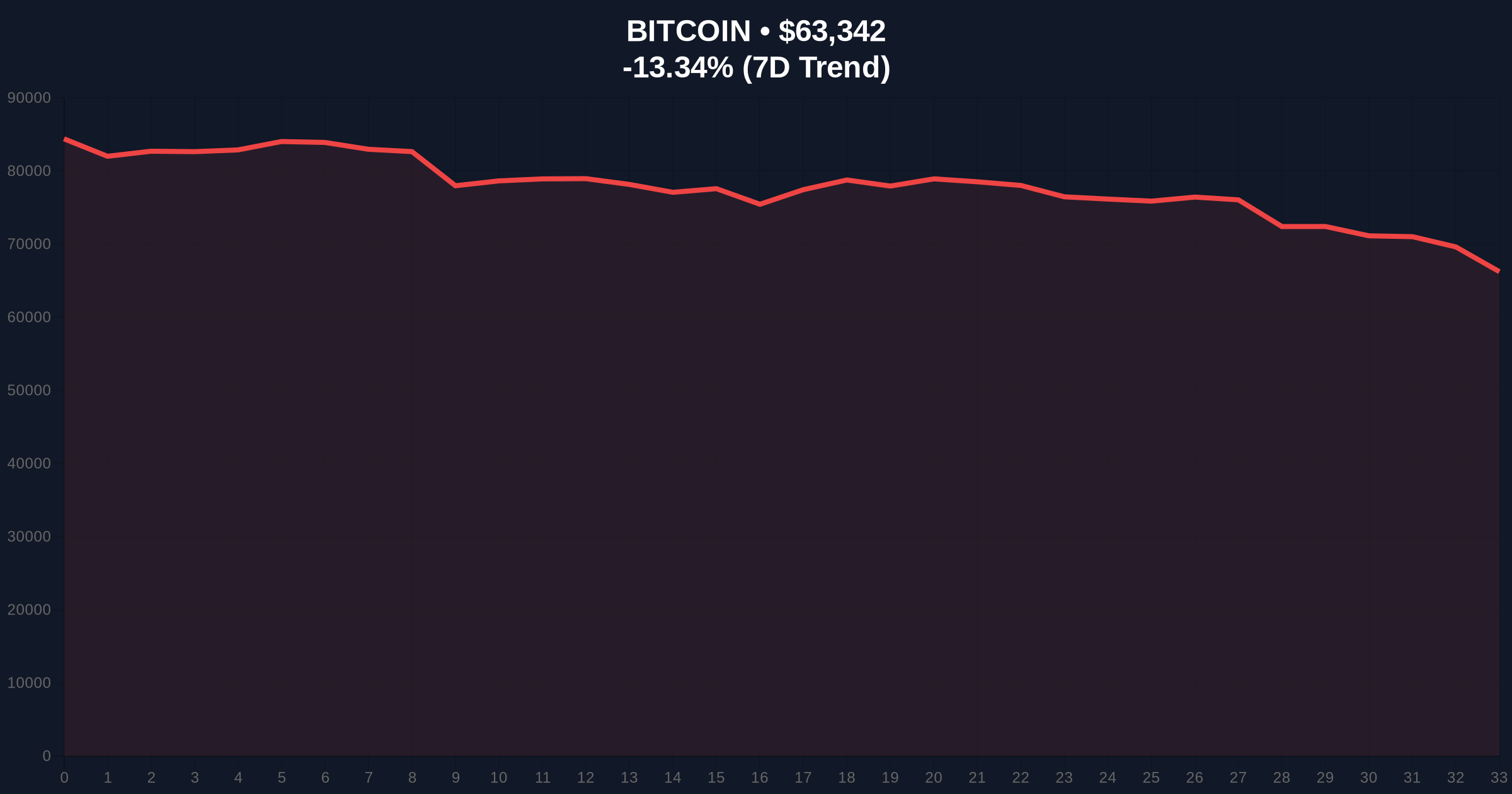

VADODARA, February 5, 2026 — Bitcoin’s price has plunged nearly 50% from its October 2025 high, falling below the average cost for miners to produce one BTC. According to CryptoQuant senior analyst Julio Moreno, this cost ranges between $70,000 and $80,000. The current price of $63,365 creates severe pressure on mining operations. This daily crypto analysis examines the technical and historical implications.

Market structure suggests a critical inflection point. Julio Moreno, a senior analyst at CryptoQuant, provided the primary data. He estimates the average mining cost per Bitcoin at $70,000-$80,000. Publicly listed mining companies face costs between $60,000 and $80,000. Consequently, the current price of $63,365 sits below this threshold. This creates a direct profitability squeeze.

On-chain data indicates miners are now operating at a loss. This scenario mirrors past capitulation events. The pressure could intensify if prices remain depressed. According to the original report from Coinness, miners face a potential crisis. The 24-hour trend shows a -13.31% decline, exacerbating the situation.

Historically, Bitcoin prices falling below mining cost precede significant market shifts. Similar to the 2021 correction, where BTC dipped below the $30,000 mining cost, we saw miner capitulation. That event led to a hash rate drop and subsequent consolidation. In contrast, the 2018 cycle saw prolonged periods below cost, triggering a multi-year bear market.

Underlying this trend is the Bitcoin halving cycle. The 2024 halving reduced block rewards, increasing cost pressures. Market analysts note that current conditions resemble the post-2018 environment. , the global macroeconomic backdrop, with potential Federal Reserve policy shifts, adds complexity. You can read more about related market stress in our analysis of recent crypto futures liquidations exceeding $500 million.

Technical analysis reveals key levels. The immediate support sits at the $60,000 psychological level. This aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below this creates a Fair Value Gap (FVG) down to $55,000. Resistance forms at the $70,000 mining cost level, acting as a strong Order Block.

The Relative Strength Index (RSI) on daily charts reads 28, indicating oversold conditions. However, volume profile shows increasing sell-side pressure. The 200-day moving average at $75,000 now acts as dynamic resistance. Market structure suggests a liquidity grab below $60,000 could trigger a cascade.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $63,365 |

| 24-Hour Price Change | -13.31% |

| Average Mining Cost (CryptoQuant) | $70,000 - $80,000 |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Price Drop from Oct 2025 High | ~50% |

This event matters for network security and institutional liquidity. Miners operating at a loss may shut down inefficient rigs. That reduces hash rate, potentially weakening Bitcoin’s security model. Historically, such periods see increased selling from miners to cover operational costs. This adds sell-side pressure to the market.

Institutional investors monitor mining health as a leading indicator. A prolonged squeeze could delay capital deployment. , it impacts the broader crypto ecosystem. Mining companies may face liquidity crises, affecting related equities and infrastructure. For context, explore the impact on corporate holders in MicroStrategy's recent quarterly loss analysis.

“When Bitcoin trades below production cost, it historically signals a bottom formation phase. However, the duration matters. If prices stay suppressed for multiple quarters, it could trigger a hash rate migration similar to 2019,” stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios. First, a bullish reversal requires reclaiming the $70,000 level. Second, a bearish continuation targets the $55,000 FVG. The 12-month outlook depends on miner resilience and macroeconomic factors.

Historical cycles suggest that post-capitulation, Bitcoin often enters a consolidation phase before the next leg up. The 5-year horizon remains positive given adoption trends, but short-term volatility will persist. For deeper insights into mining economics, see our report on Bitcoin hash price hitting all-time lows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.