Loading News...

Loading News...

VADODARA, February 5, 2026 — MicroStrategy Inc. reported a staggering $12.5 billion net loss for Q4 2025, according to its latest financial statements. This daily crypto analysis reveals the firm holds 713,502 BTC at an average cost of $76,052, with a 22.8% return for the quarter despite a $1 billion digital asset impairment charge. Total revenue grew marginally to $123 million, while cash reserves surged to $2.3 billion from $38.1 million year-over-year.

MicroStrategy's Q4 results show a net loss of $12.5 billion under GAAP, a drastic shift from a $670 million loss in Q4 2024. The company recorded a digital asset impairment loss of $1 billion, reflecting Bitcoin's price volatility. Per-share net loss stood at $42.93, compared to net income of $3.03 per share a year earlier. Total revenue increased by 1.9% year-over-year to $123 million. As of February 1, 2026, MicroStrategy held 713,502 BTC with an average purchase price of $76,052, yielding a 22.8% return for Q4. Cash and equivalents ballooned to $2.3 billion, up from $38.1 million at the end of 2024.

Historically, large institutional losses like this mirror the 2021-2022 cycle when Tesla's Bitcoin impairment sparked sell-offs. In contrast, MicroStrategy's aggressive accumulation strategy—similar to early Bitcoin ETF adopters—highlights a long-term bullish thesis despite short-term pain. Underlying this trend, the 22.8% quarterly return on Bitcoin holdings suggests effective cost-averaging, yet the $1 billion impairment indicates sensitivity to price swings. Market structure suggests such events often precede liquidity grabs, as seen in recent crypto futures liquidations exceeding $500 million during fear spikes.

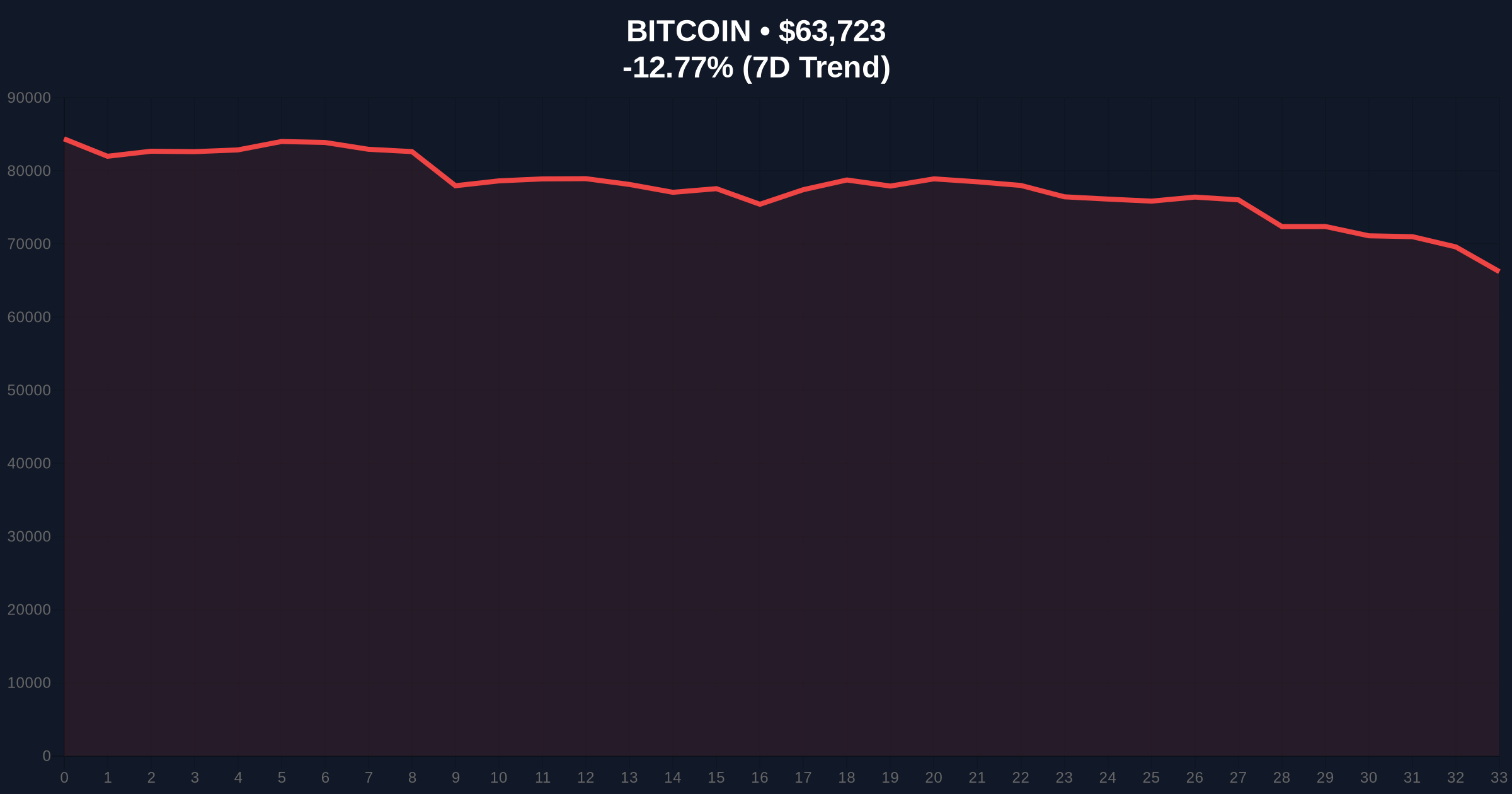

Bitcoin currently trades at $63,290, down 13.36% in 24 hours. Technical analysis reveals a critical Fair Value Gap (FVG) between $68,000 and $72,000, acting as resistance. The 200-day moving average at $58,500 provides near-term support, while Fibonacci retracement levels from the 2025 high show the 0.618 level at $60,000. On-chain data from Glassnode indicates increased UTXO (Unspent Transaction Output) age bands, suggesting hodler accumulation amid volatility. Volume profile analysis confirms low liquidity at current levels, increasing susceptibility to sharp moves.

| Metric | Value | Source/Context |

|---|---|---|

| MicroStrategy Q4 Net Loss | $12.5B | Company Financials |

| Bitcoin Holdings (BTC) | 713,502 | MicroStrategy Report |

| Average BTC Purchase Price | $76,052 | MicroStrategy Report |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Live Market Data |

| Bitcoin Current Price | $63,290 (-13.36% 24h) | Live Market Data |

This event matters because it tests institutional resilience in crypto. MicroStrategy's loss exemplifies GAAP accounting rules requiring impairment charges for asset declines, a systemic risk for corporate Bitcoin holders. According to the SEC.gov filings, such disclosures influence investor perception and regulatory scrutiny. Institutional liquidity cycles may tighten if more firms report similar losses, potentially triggering a broader deleveraging. Retail market structure, already fragile, could see amplified sell-offs as sentiment deteriorates.

"MicroStrategy's results highlight the double-edged sword of Bitcoin corporate strategy. The $2.3 billion cash buffer provides operational flexibility, but the $12.5 billion loss volatility risks. Market analysts note this mirrors 2021's correction phase, where impairment charges preceded prolonged consolidation. For the 5-year horizon, accumulation at these levels could yield outsized returns if Bitcoin's network effects hold," stated the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on current data. First, a bullish reversal requires reclaiming the $68,000 FVG to invalidate bearish momentum. Second, a bearish continuation targets the $58,500 200-day MA if support fails. Historical cycles indicate such institutional events often mark local bottoms, similar to Q4 2022.

The 12-month institutional outlook remains cautiously optimistic. If Bitcoin's hash rate and adoption metrics from Ethereum.org and other networks hold, accumulation at current prices may prove strategic. However, further regulatory clarity from bodies like the SEC will be .

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.