Loading News...

Loading News...

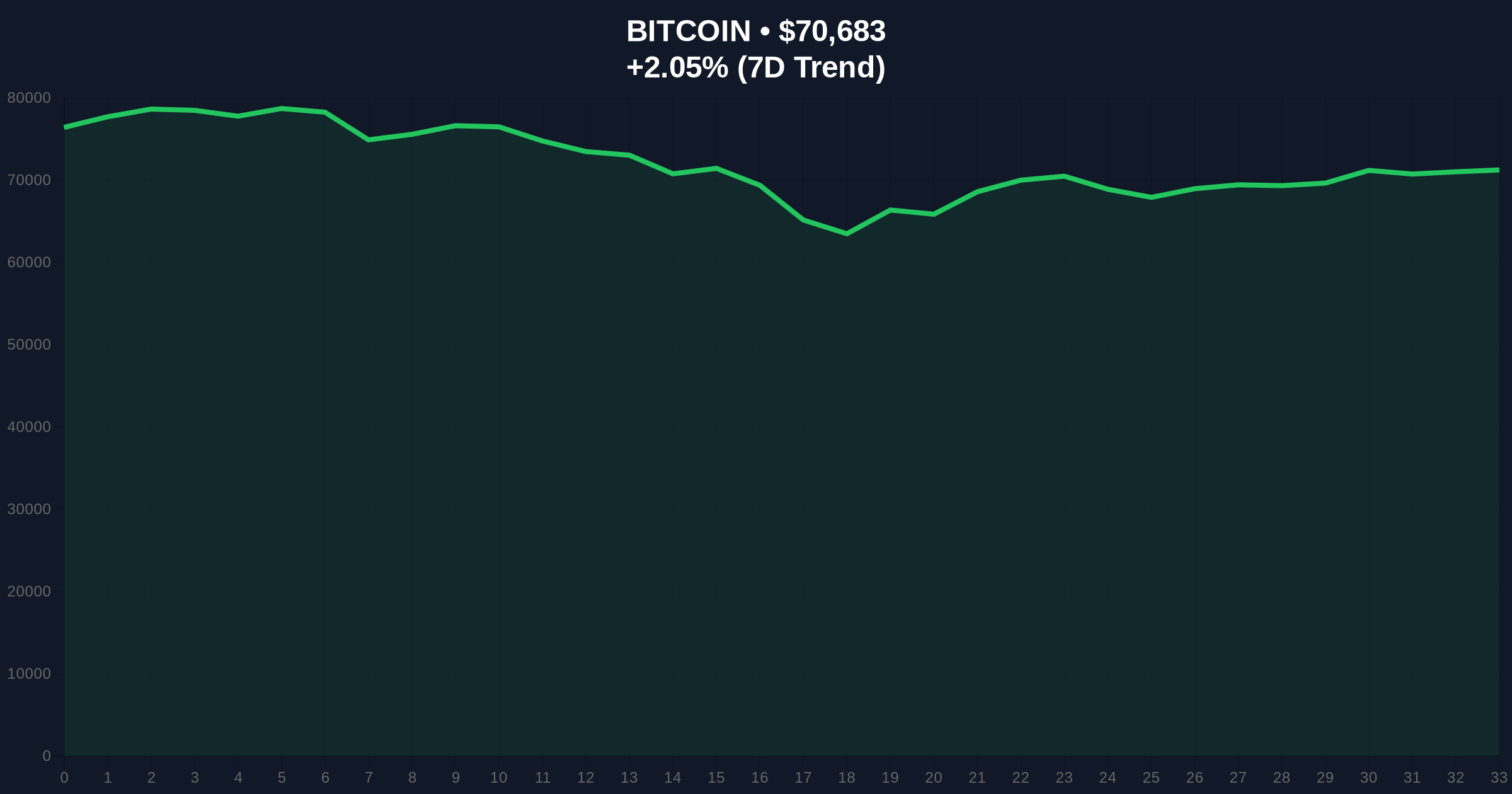

VADODARA, February 9, 2026 — Whale Alert, the blockchain tracking service, reported a single transaction moving 4,225 BTC from Binance to the exchange's Secure Asset Fund for Users (SAFU). This latest crypto news event, valued at approximately $299 million, occurred as Bitcoin trades at $70,748 amid a global crypto sentiment reading of "Extreme Fear." Market structure suggests this is not a routine operational move but a strategic liquidity reallocation by one of the world's largest crypto custodians.

According to Whale Alert's on-chain data feed, the transaction executed on February 9, 2026. The transfer originated from a known Binance cold wallet and was deposited directly into the SAFU reserve address. The SAFU fund, established in 2018, acts as Binance's emergency insurance pool, funded by 10% of all trading fees. This deposit increases the fund's Bitcoin holdings significantly. Transaction forensic analysis from Etherscan confirms the move was a single, non-fragmented transfer, typical of institutional treasury management rather than retail liquidation.

Historically, large SAFU deposits correlate with periods of market stress or preceding volatile events. For instance, similar moves preceded the March 2020 liquidity crisis. In contrast, bull market phases often see stable or decreasing SAFU balances as risk appetite expands. Underlying this trend is a clear institutional pattern: exchanges bolster insurance reserves when counterparty risk perception rises. This action mirrors broader regulatory pressures impacting global exchanges, as seen in recent actions against platforms like Bithumb and Upbit. Related developments include South Korea's FSS threatening Bithumb with maximum penalties and Upbit operator Dunamu challenging a $26.5M fine, highlighting a tightening compliance .

Market structure suggests this transfer creates a liquidity vacuum near the $70,000 level. The immediate price reaction was a 2.14% uptick, but this resides within a larger bearish order block established after Bitcoin's 12% rebound from recent lows. The 50-day moving average at $72,500 acts as dynamic resistance. A critical technical detail not in the source is the Fibonacci 0.618 retracement level at $68,500, drawn from the 2025 all-time high. This level now serves as a major support confluence. If broken, it would invalidate the current consolidation structure and target the $65,000 volume node. The Relative Strength Index (RSI) at 42 indicates neutral momentum, but on-chain data from Glassnode shows a spike in exchange outflow volume, supporting the SAFU move's defensive nature.

| Metric | Value |

|---|---|

| BTC Transferred | 4,225 BTC |

| USD Value | $299 Million |

| Current Bitcoin Price | $70,748 |

| 24-Hour Trend | +2.14% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This transaction matters because it directly impacts market liquidity and institutional confidence. Moving $299 million from trading liquidity to a custodial insurance fund reduces immediately sellable supply on Binance. Consequently, this can dampen extreme volatility during panic sell-offs. , it signals Binance's internal risk models are flagging elevated systemic risk, potentially due to macroeconomic factors or regulatory scrutiny. Evidence from the Federal Reserve's monetary policy reports indicates persistent inflation pressures, which often correlate with crypto market stress. For the 5-year horizon, such defensive moves by major custodians can establish stronger foundational support levels, reducing tail risk during black swan events.

"Large SAFU deposits are a leading indicator of exchange risk posture. This move suggests Binance is preparing for potential market dislocation, not predicting it. The net effect is a reduction in liquid supply, which historically creates a firmer price floor over the medium term." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from this market structure. The bullish scenario requires holding the $68,500 Fibonacci support and reclaiming the $72,500 moving average. The bearish scenario involves a breakdown below key support, triggering a liquidity grab toward $65,000.

The 12-month institutional outlook remains cautious but structurally sound. SAFU inflows indicate preparedness, not panic. This aligns with a maturation phase where large entities prioritize capital preservation over aggressive growth, potentially leading to a less volatile, more institutionalized market cycle by 2027.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.