Loading News...

Loading News...

VADODARA, February 5, 2026 — Bitcoin's hash price has collapsed to an unprecedented $0.03 per terahash. This latest crypto news reveals a critical stress point in mining economics. According to Bloomberg, citing data from Luxor Technologies, the network's mining difficulty will drop by over 13% in the next adjustment. Market structure suggests severe miner capitulation is underway.

Bloomberg reported the hash price plunge on February 5, 2026. Luxor Technologies data confirms the all-time low. The hash price measures expected daily revenue per unit of hash power. It has never been lower. The network's mining difficulty will adjust downward by more than 13%. This is a direct response to reduced mining activity. Miners face squeezed profit margins. Rising electricity costs and severe weather power outages exacerbate the pressure. Most miners still rely on Bitcoin mining for primary income. Some are diversifying into AI-related data center tasks. This shift remains marginal for now.

Historically, hash price declines precede major network difficulty adjustments. The 13% drop mirrors the 2022 cycle's 15% adjustment. That event coincided with Bitcoin's price bottom near $16,000. In contrast, the 2021 bull run saw hash prices above $0.40. Underlying this trend is the halving cycle's pressure on miner economics. Post-2024 halving, block rewards halved to 3.125 BTC. Consequently, miners now require higher efficiency to survive. Related developments include recent market liquidations. Crypto futures liquidations hit $563 million in one hour amid extreme fear. This highlights broader market stress.

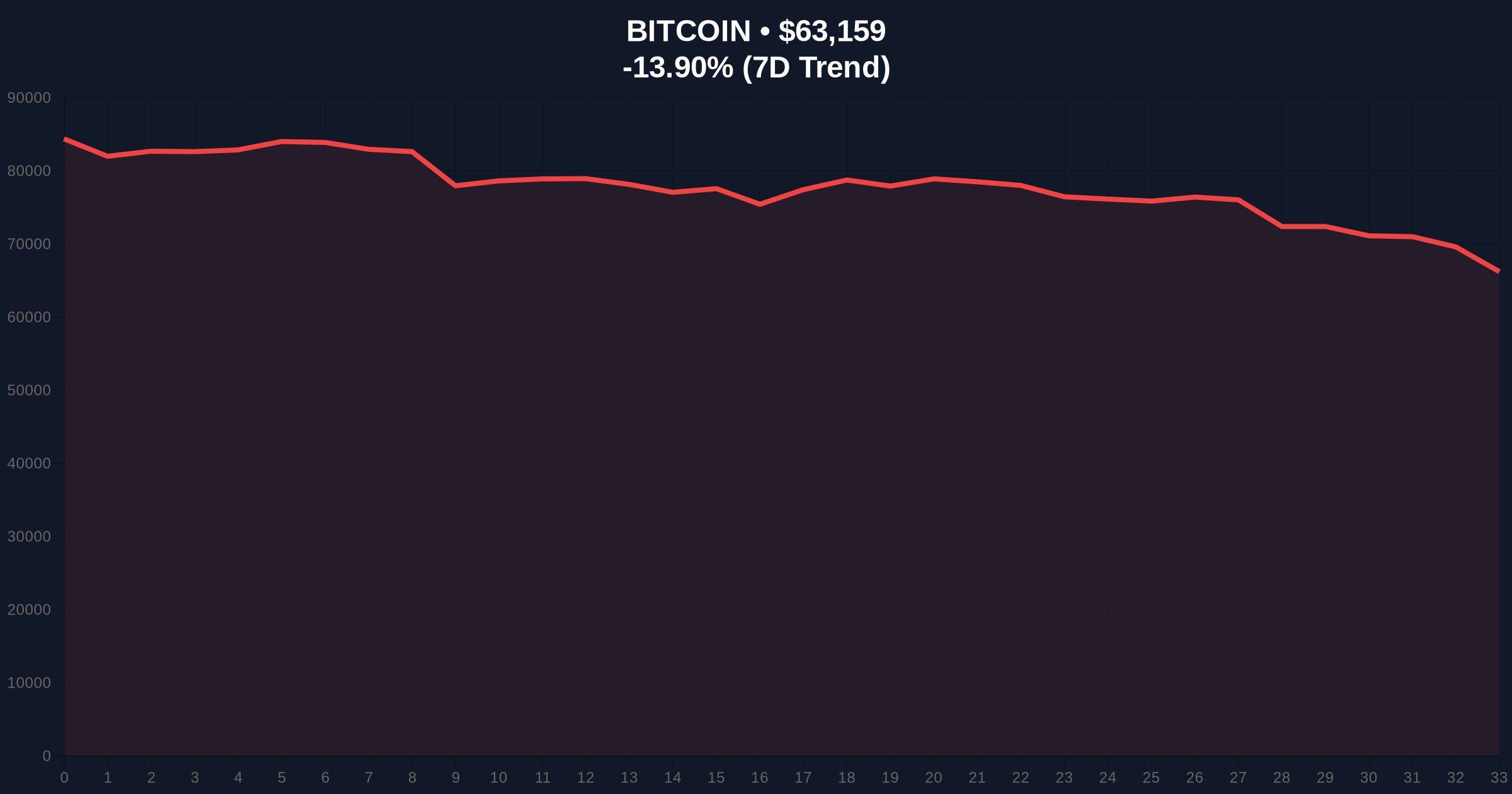

Bitcoin currently trades at $63,393. The 24-hour trend shows a -13.58% decline. Market structure suggests a liquidity grab below the 200-day moving average. On-chain data indicates increased UTXO age bands moving to exchanges. This signals potential selling pressure from long-term holders. The Fibonacci 0.618 retracement level at $61,500 provides critical support. A break below invalidates the current bullish structure. RSI readings hover near oversold territory at 28. This creates a potential bounce scenario. However, miner selling could suppress any recovery. The difficulty adjustment acts as a natural circuit breaker. It reduces competition for remaining miners.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Hash Price | $0.03 per TH/s | Luxor Technologies |

| Expected Difficulty Drop | >13% | Bloomberg/Luxor |

| Current BTC Price | $63,393 | Live Market Data |

| 24-Hour Price Change | -13.58% | Live Market Data |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Live Market Data |

Hash price collapse directly impacts network security. Lower miner revenue reduces hash rate. This increases the risk of 51% attacks theoretically. However, Bitcoin's decentralized mining pool distribution mitigates this. The real impact is on miner profitability. Inefficient miners will shut down operations. This reduces selling pressure from miners covering costs. Consequently, the supply side tightens. Institutional liquidity cycles show miners are major sellers during downturns. Their capitulation often marks local bottoms. Retail market structure remains fragile. Extreme fear dominates sentiment. The Ethereum network's transition to proof-of-stake provides a contrasting model, but Bitcoin's proof-of-work security now faces its sternest test.

Market structure suggests we are witnessing a classic miner capitulation event. The 13% difficulty adjustment is the network's automatic response to hash rate decline. Historically, these events create supply-side squeezes that precede price recoveries. However, current electricity cost pressures add unprecedented strain. - CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on miner survival. If inefficient miners capitulate, hash rate stabilizes at lower levels. This reduces daily selling pressure. The 5-year horizon remains bullish due to Bitcoin's fixed supply and halving cycle. However, short-term volatility will persist. Network security remains robust despite hash price concerns. The difficulty adjustment mechanism proves its resilience once again.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.