Loading News...

Loading News...

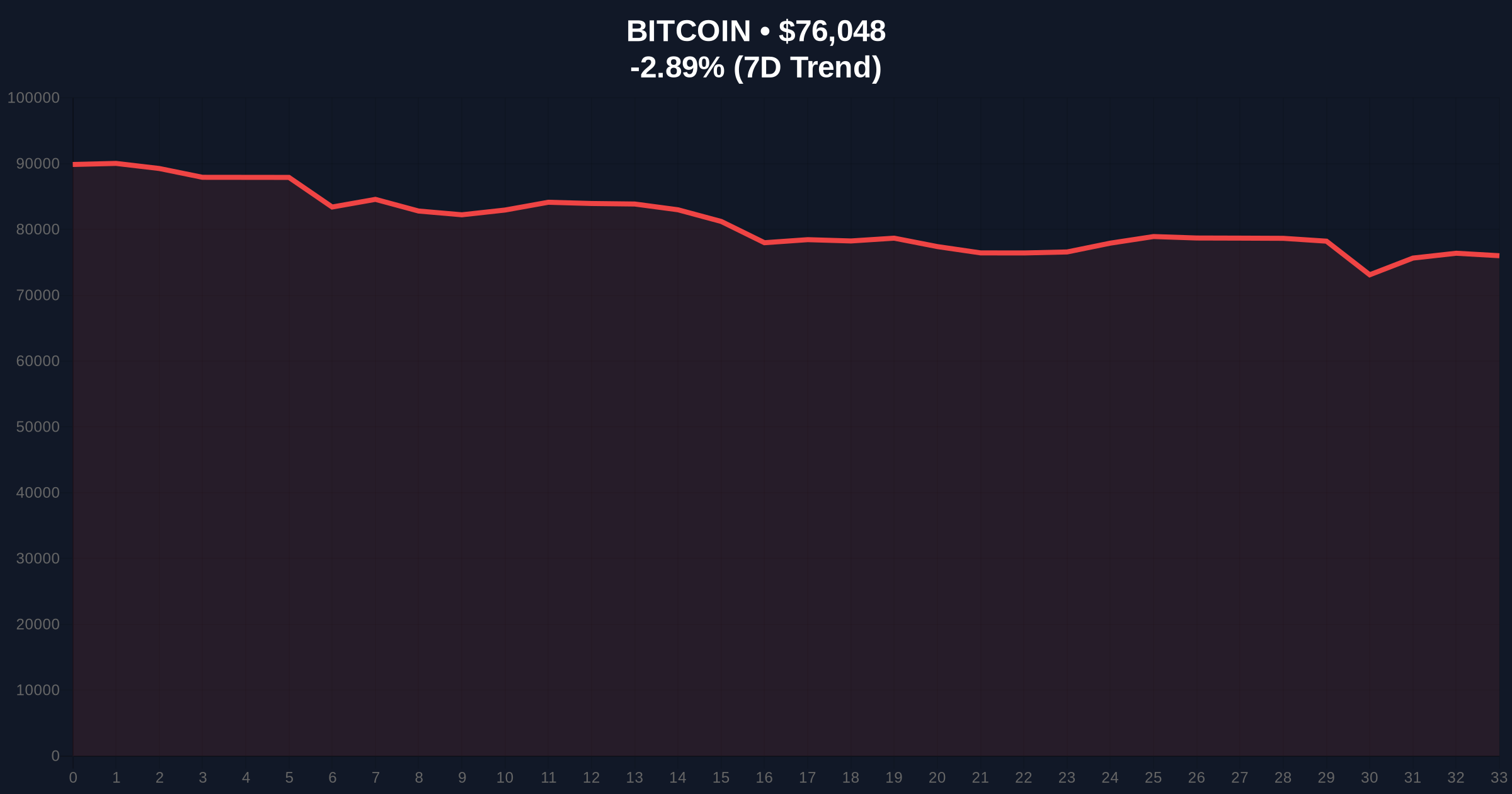

VADODARA, February 4, 2026 — Bitcoin hovers in a precarious low-volume zone, with on-chain data signaling heightened risk of price correction or prolonged sideways action. According to Glassnode analysis cited by CoinDesk, BTC has spent only about 35 days at current levels, insufficient to establish robust support or resistance. This Daily crypto analysis examines the structural vulnerabilities and market implications.

Bitcoin currently trades around $76,028, down 2.95% in 24 hours. Glassnode data reveals a critical weakness: the supply between $70,000 and $80,000 is structurally thin. Market structure suggests this range lacks accumulation from large institutions, creating a liquidity void. An exception is MicroStrategy's purchase of 27,200 BTC at an average price of $74,463 in November 2024. However, this isolated event fails to anchor the price band. Consequently, the URPD (UTXO Realized Price Distribution) indicator shows minimal buy positions, making a rebound unlikely from current levels.

Historically, Bitcoin passes through such ranges quickly, often leading to volatile breaks. In contrast, prolonged consolidation typically requires higher volume and institutional participation. Underlying this trend, the current environment mirrors mid-2021 patterns where low volume preceded significant corrections. , the Extreme Fear sentiment, with a Crypto Fear & Greed Index score of 14/100, exacerbates downside risks. Related developments include recent analyses pointing to potential deeper retests, such as a head and shoulders pattern signaling a drop to $60k and profit-loss supply convergence near $60k.

Technical analysis confirms the vulnerability. The 35-day consolidation period is below the 50-day moving average, indicating weak momentum. RSI (Relative Strength Index) sits near 45, showing neutral but bear-leaning conditions. A key Fibonacci retracement level from the 2025 high to the 2026 low places support at $72,500 (0.618 level), which aligns with the thin supply zone. Market structure suggests that without a volume spike, Bitcoin faces a Fair Value Gap (FVG) that may need filling lower. Order block analysis indicates sell-side liquidity grabs above $78,000 could trigger declines.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $76,028 |

| 24-Hour Change | -2.95% |

| Days in Current Range | ~35 days |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Key Supply Zone | $70,000 - $80,000 |

This low-volume void matters for portfolio risk. Institutional liquidity cycles, such as those hinted in recent USDC minting activity, show capital is cautious. Retail market structure lacks conviction, with many holders in profit-taking mode. On-chain data indicates that without new buyers, price stability is fragile. In the 5-year horizon, such periods often precede major trend shifts, impacting long-term investment strategies.

"The thin supply between $70k and $80k is a red flag. Market structure suggests this is a liquidity desert, not a support base. We see parallels to past cycles where similar voids led to 15-20% corrections. The lack of institutional accumulation, aside from MicroStrategy's move, points to broader skepticism. Traders should watch volume profile shifts closely." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, sideways movement to form a support base, requiring increased volume and holding above $70,000. Second, a retest of lower zones like $60,000, where stronger on-chain support exists. The 12-month institutional outlook remains cautious, with potential accumulation windows later in 2026, as noted in analyses of credit spread signals.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.