Loading News...

Loading News...

VADODARA, February 3, 2026 — A Cointelegraph analysis suggests May to July 2026 could present a prime Bitcoin accumulation window based on historical credit spread patterns. This daily crypto analysis examines whether current market data supports this optimistic projection or reveals fundamental contradictions in the underlying thesis.

According to the Cointelegraph analysis, rising U.S. Treasury yields typically pressure corporate credit markets. The report notes that while government bond yields increase corporate interest burdens, credit spreads remain surprisingly low. This suggests investors may be underestimating corporate default risks.

Historically, during the 2018, 2020, and 2022 cycles, Bitcoin's true bottom occurred three to six months after credit spreads began widening significantly. The analysis projects credit spreads could reach 1.5% to 2% by April 2026. Consequently, this would create a potential accumulation window from May to July based on historical lag patterns.

Market structure suggests this thesis relies heavily on pattern recognition from previous cycles. In contrast, current on-chain data reveals significant deviations from historical norms. The 2024-2025 cycle featured unprecedented institutional adoption through spot Bitcoin ETFs, fundamentally altering market dynamics.

, the Federal Reserve's monetary policy trajectory diverges from previous tightening cycles. According to FederalReserve.gov documentation, current quantitative tightening operates alongside different inflation dynamics than 2018 or 2022. This creates uncertainty about whether credit spread patterns will mirror past behavior.

Related developments in the institutional space include Nasdaq-listed insurance firm TIRX planning a $1.1 billion Bitcoin purchase, demonstrating continued institutional interest despite market volatility. Additionally, Franklin Templeton executives predict digital wallets will store all assets, highlighting long-term infrastructure development.

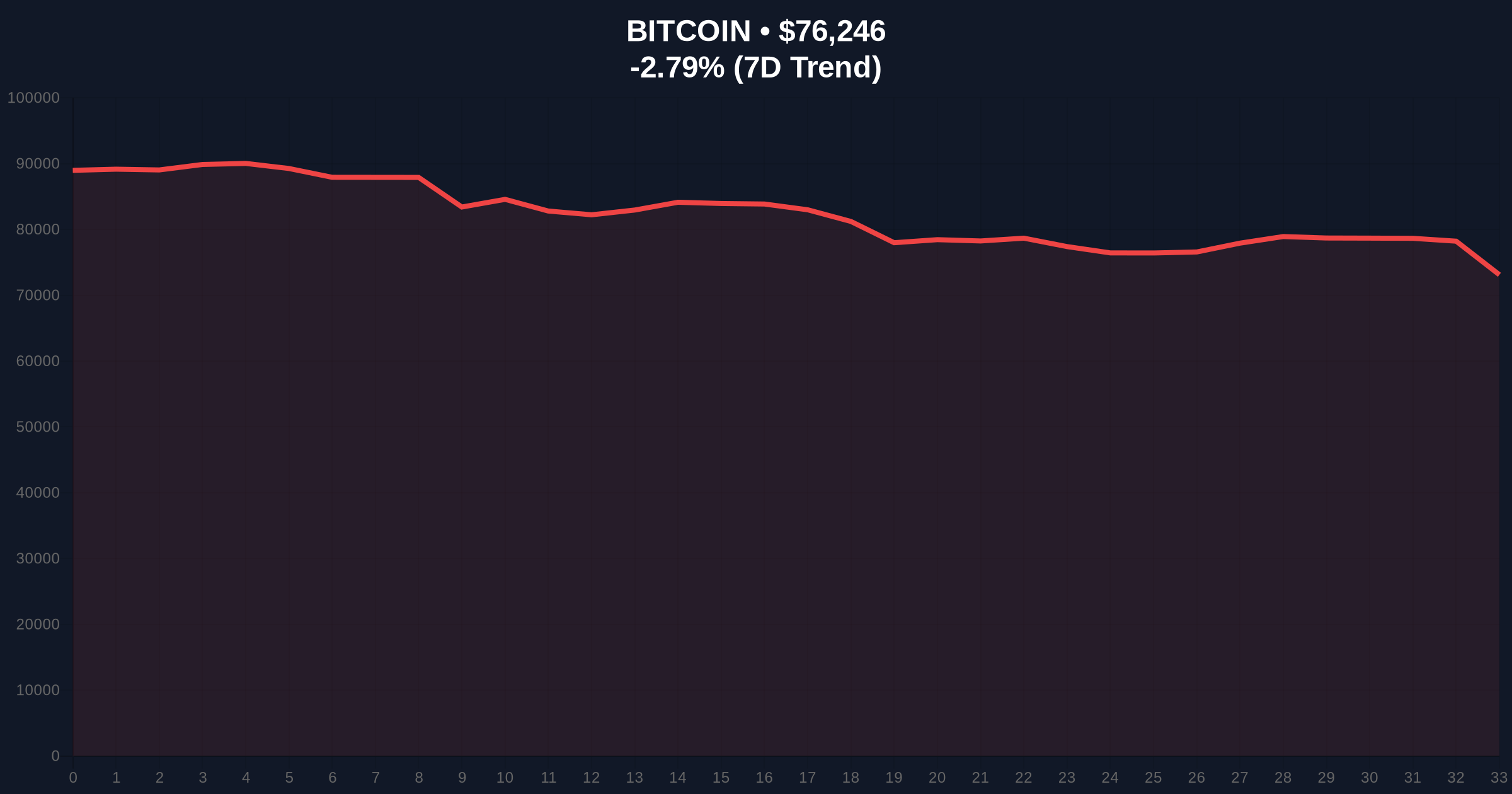

Current Bitcoin price action at $76,212 contradicts the accumulation thesis. The 24-hour trend shows a -2.84% decline, creating a bearish Fair Value Gap (FVG) on lower timeframes. Market structure suggests critical support at the Fibonacci 0.618 retracement level of $74,800 from the 2025 rally.

Volume profile analysis indicates weak accumulation at current levels. The Order Block between $78,000 and $80,000 failed to hold as support, creating a liquidity grab below. RSI readings at 42 suggest neither oversold nor overbought conditions, providing little directional clarity.

On-chain metrics from Glassnode show declining exchange balances, typically a bullish signal. However, the velocity of UTXO movement suggests profit-taking rather than strategic accumulation. The 200-day moving average at $72,500 represents the next major technical support level.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian accumulation signal |

| Bitcoin Current Price | $76,212 | -2.84% 24h change |

| Projected Credit Spread Range | 1.5% - 2% by April | Potential risk indicator |

| Historical Bottom Lag | 3-6 months post-spread widening | Pattern-based projection |

| Fibonacci Support | $74,800 (0.618 level) | Critical technical level |

This analysis matters because it attempts to quantify accumulation timing using traditional financial indicators. Credit spreads typically widen during economic stress, creating capital flight from risk assets. If Bitcoin demonstrates inverse correlation during such periods, it strengthens the digital gold narrative.

Market structure suggests the real test involves whether institutional capital follows this pattern. The 2025 cycle saw unprecedented ETF inflows during market stress. Consequently, future accumulation may differ from retail-dominated past cycles. On-chain data indicates smart money flows remain cautious despite the theoretical accumulation window.

"The credit spread thesis relies on historical patterns that may not account for Bitcoin's evolving market structure. While the May-July window appears mathematically sound based on past data, current extreme fear sentiment and declining prices suggest the market disagrees with this timing. We're watching the $75,000 level as a potential accumulation zone, but need confirmation through on-chain accumulation metrics." - CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish scenario requires credit spreads to widen as projected, creating the historical pattern alignment. The bearish scenario involves continued price decline despite spread behavior, indicating broken historical correlations.

The 12-month institutional outlook remains cautiously optimistic despite current weakness. If the credit spread pattern holds, Q3 2026 could see renewed institutional interest. However, market structure suggests watching for Gamma Squeeze potential around quarterly options expirations that could accelerate moves in either direction.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.