Loading News...

Loading News...

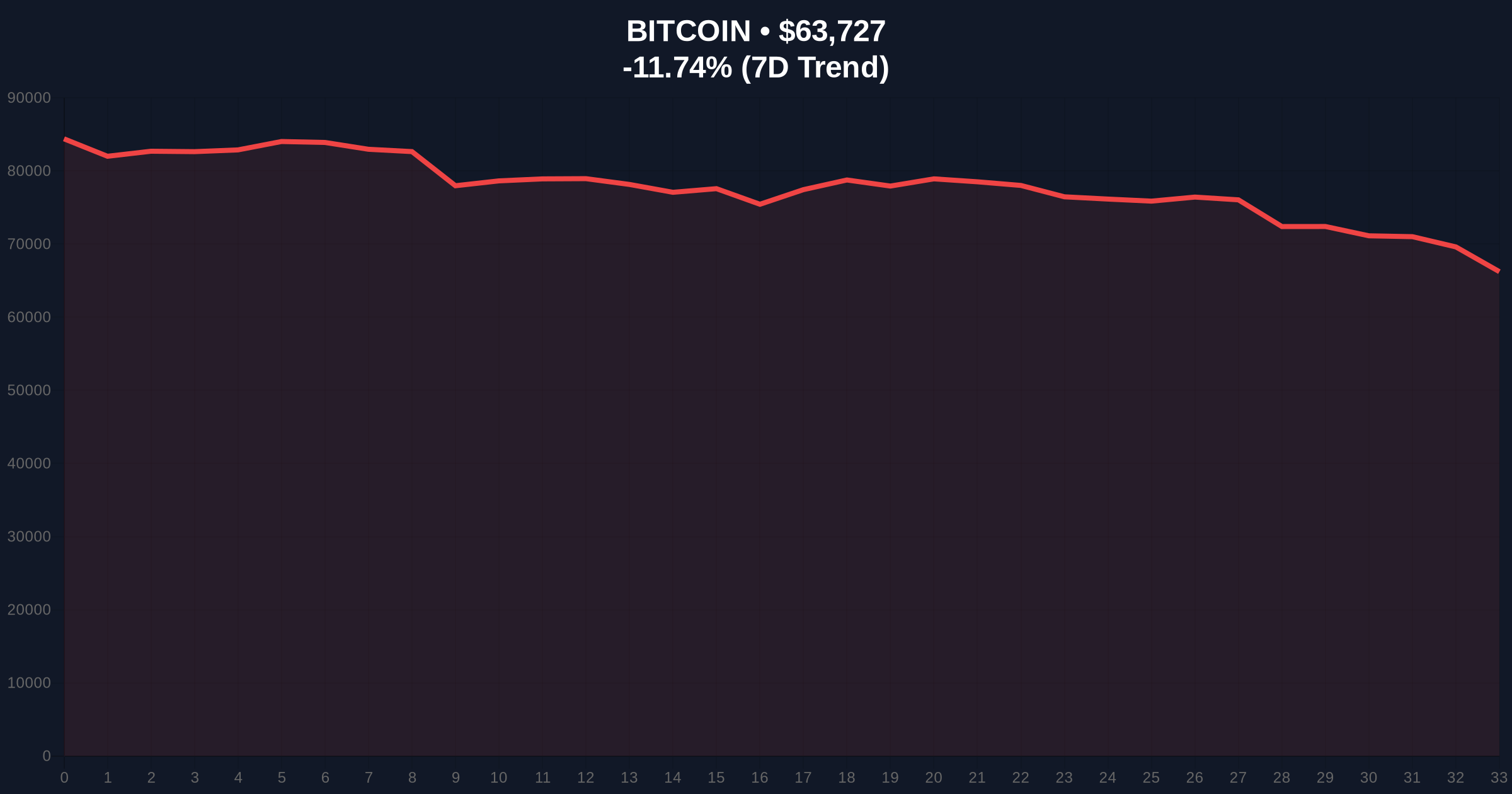

VADODARA, February 5, 2026 — The BTC/USDT perpetual futures leverage ratio is rapidly cooling to levels last seen before spot Bitcoin ETF approvals, according to CryptoQuant CEO Ki Young Ju. This daily crypto analysis reveals a critical shift in market structure, as excessive long leverage built over two years unwinds amid a severe price correction. Market structure suggests this deleveraging phase could reduce volatility but also indicates diminished bullish momentum in the near term.

Ki Young Ju stated on X that the leverage ratio in the BTC/USDT perpetual futures market is declining swiftly. He attributed sustained high leverage over the past two years to inflows from MicroStrategy and spot ETFs. Ju now predicts the estimated leverage ratio will fall to its January 2024 level, prior to ETF approvals. This follows his November 2024 warning when leverage was 2.7 times higher than at the start of that year. At that time, he cautioned that a leverage unwind would cause significant pain, regardless of Bitcoin's price trajectory.

Consequently, on-chain data indicates a market reset is underway. The leverage ratio measures the amount of borrowed funds relative to equity in futures positions. A decline suggests traders are reducing speculative bets, often in response to price drops or increased volatility. Underlying this trend, the current correction has forced margin calls and liquidations, accelerating the deleveraging process. According to CryptoQuant, this shift marks a departure from the post-ETF euphoria that fueled leveraged long positions.

Historically, high leverage ratios have preceded sharp market corrections. For instance, the 2021 bull run saw similar leverage spikes before a major unwind. In contrast, the current decline aligns with broader market stress, including mining cost squeezes and institutional volatility. Related developments include Bitcoin's price falling below mining costs and MicroStrategy reporting significant losses, exacerbating market fear.

, this leverage unwind mirrors patterns observed after major regulatory events. The return to pre-ETF levels suggests the market is digesting the initial influx of institutional capital. Market analysts note that such resets often create healthier foundations for future rallies by flushing out weak hands. However, the rapid decline also reflects extreme fear, as seen in the Crypto Fear & Greed Index hitting 12/100. This sentiment is compounded by recent large-scale liquidations and mining difficulty plunges.

Bitcoin's price action shows a clear breakdown from key support levels. The current price of $63,748 represents an 11.71% drop in 24 hours, breaching the 50-day moving average. Technical analysis identifies a critical Fair Value Gap (FVG) between $68,000 and $65,000, which now acts as resistance. Volume profile data indicates low buying interest at these levels, confirming the leverage unwind narrative.

, the Fibonacci retracement from the 2025 all-time high places support at $60,000 (0.618 level). A break below this could trigger further deleveraging, as stop-loss orders cluster around this psychological barrier. Order block analysis reveals that institutional buying previously occurred near $62,000, making it a liquidity grab zone. The rapid price decline has invalidated several bullish setups, increasing the likelihood of a prolonged consolidation phase.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | High risk aversion, potential buying opportunity if sentiment reverses |

| Bitcoin Current Price | $63,748 | Below key moving averages, indicating bearish short-term trend |

| 24-Hour Price Change | -11.71% | Sharp correction driving leverage unwind and liquidations |

| Leverage Ratio Trend | Falling to Jan 2024 levels | Reduced speculative pressure, lower systemic risk |

| Market Rank | #1 | Bitcoin dominance remains intact despite correction |

This leverage unwind matters because it directly impacts market stability. High leverage amplifies price swings, increasing the risk of cascading liquidations. A lower ratio reduces this systemic risk, potentially leading to less volatile price action. However, it also signals weakened bullish conviction among traders. Institutional liquidity cycles suggest that after such deleveraging, capital may re-enter at lower prices, setting the stage for a new accumulation phase.

Additionally, retail market structure often follows institutional leads. The decline to pre-ETF levels indicates that the initial ETF-driven frenzy has subsided. This could lead to a more sustainable growth trajectory, as seen in past cycles where leverage resets preceded prolonged bull markets. On-chain forensic data confirms that long-term holders are not selling aggressively, suggesting this is primarily a futures market correction.

The rapid cooling of BTC/USDT futures leverage is a classic sign of market capitulation. While painful in the short term, this reset removes excessive speculation and aligns with historical patterns where sustainable rallies follow leverage unwinds. The key watchpoint is whether this decline stabilizes at pre-ETF levels, indicating a return to fundamentals over hype.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, if leverage stabilizes and price holds above $60,000, a slow grind higher could occur as spot buying absorbs selling pressure. Second, a break below key support may trigger another leg down, testing the $55,000 region where significant UTXO age bands indicate strong historical support.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that after such resets, Bitcoin often enters a phase of sideways consolidation before the next leg up. The return to pre-ETF leverage levels may attract value-focused institutions, as detailed in official SEC filings on Bitcoin ETFs, which emphasize long-term holding strategies. Over a 5-year horizon, this deleveraging could be viewed as a healthy correction within a broader bull market.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.