Loading News...

Loading News...

VADODARA, January 23, 2026 — Bitcoin (BTC) has fallen to third place in trading volume against the South Korean won for the first time in its history, according to a Digital Asset report analyzing data from 2013 to 2025. This daily crypto analysis reveals a significant shift in market structure, with XRP and USDT surpassing BTC in a region historically dominated by the flagship cryptocurrency. The development coincides with a global Crypto Fear & Greed Index reading of "Extreme Fear" at 24/100, testing key technical support near $90,000.

Market structure suggests this event mirrors liquidity rotations seen during the 2021-2022 cycle, where altcoins periodically outperformed Bitcoin during periods of high volatility and fear. According to the Digital Asset analysis, South Korea has been a consistent top-three market for crypto trading volume globally, with Bitcoin historically commanding the lion's share. The shift to third place—behind XRP's approximately 335 trillion won and USDT—indicates a change in on-chain capital allocation patterns. Similar to the 2021 correction, where Ethereum briefly challenged Bitcoin's dominance in certain metrics, this volume decline points to a potential Fair Value Gap (FVG) developing in Bitcoin's regional demand profile. Historical cycles suggest that such divergences often precede broader market revaluations, as detailed in macroeconomic frameworks from the Federal Reserve's research on digital assets.

Related Developments: This volume shift occurs alongside other market stressors, including Bitcoin price action testing $90k support, Bitcoin ETF outflows hitting $32 million, and combined Bitcoin and Ethereum liquidations reaching $115.8 million.

According to the Digital Asset report, which reviewed trading volumes for the top eight digital assets by market cap—BTC, ETH, USDT, XRP, USDC, SOL, TRX, and DOGE—Bitcoin fell to third place in South Korean won trading volume during 2025. XRP recorded the highest volume at approximately 335 trillion won, followed by USDT in second. This marks the first time Bitcoin has dropped out of the top two spots since data tracking began in 2013. The analysis, based on primary exchange data aggregated by Digital Asset, indicates a sustained shift rather than a temporary anomaly, with volume profiles showing consistent altcoin preference over the annual period.

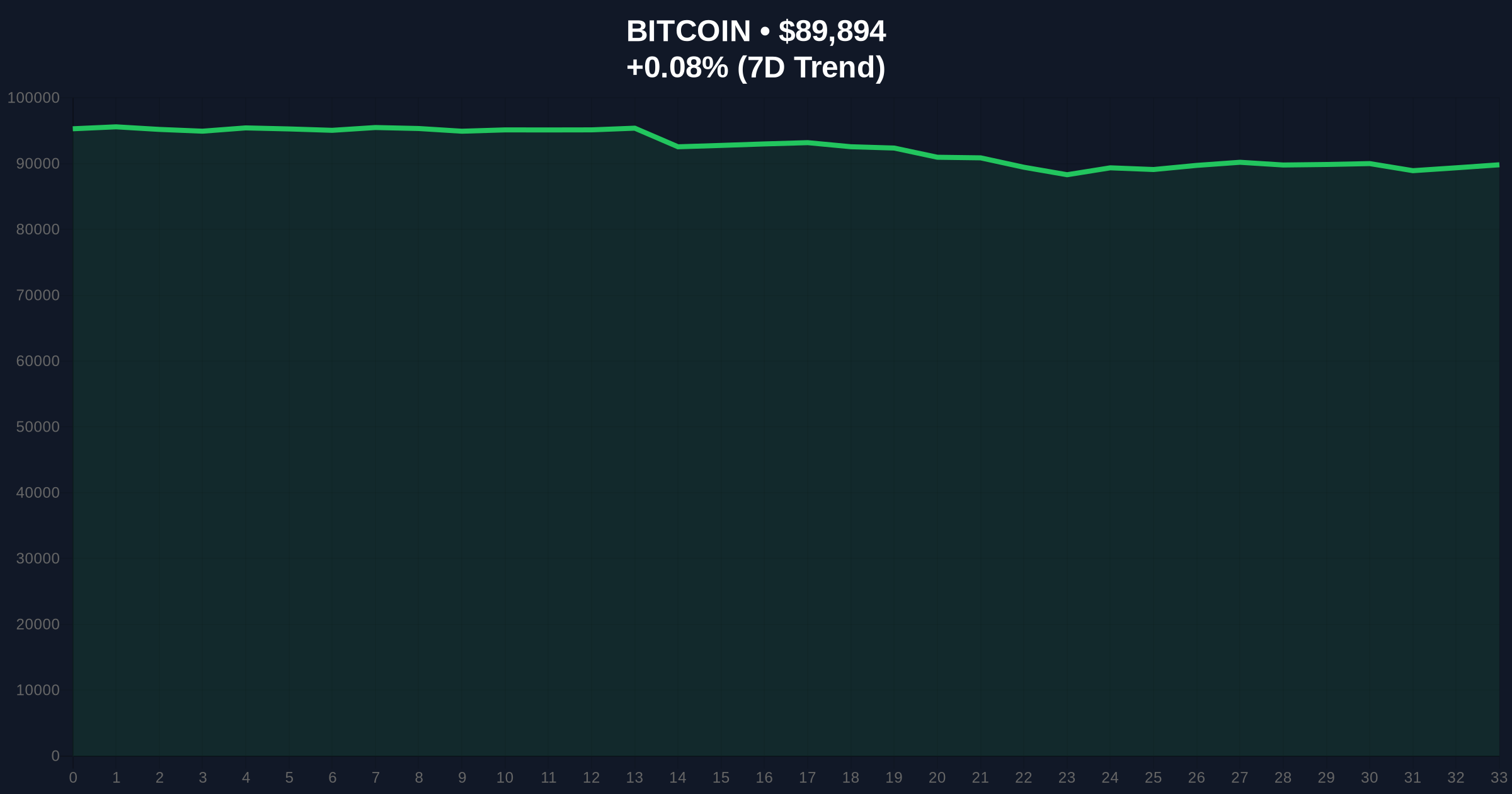

On-chain data indicates Bitcoin is currently testing a critical Order Block near $89,888, with the 24-hour trend showing minimal movement at 0.07%. The Relative Strength Index (RSI) on daily charts is hovering near oversold territory at 32, suggesting potential for a short-term bounce if buying pressure emerges. Key moving averages—the 50-day EMA at $91,200 and 200-day SMA at $87,500—are acting as dynamic resistance and support, respectively. Market structure suggests a Bullish Invalidation level at $88,500 (coinciding with the 0.382 Fibonacci retracement from the last major swing high), where a break below would target lower liquidity pools near $85,000. Conversely, the Bearish Invalidation level is set at $92,500, a previous resistance zone that, if reclaimed, would negate the current downtrend and signal a potential Gamma Squeeze upward.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Current Price | $89,888 | Testing key support zone |

| 24-Hour Trend | 0.07% | Near-flat, indicating consolidation |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically precedes liquidity grabs |

| XRP South Korean Volume (2025) | ~335 trillion won | Topped rankings, surpassing BTC |

| Bitcoin Market Rank | #1 | Maintains global dominance despite regional shift |

This development matters because South Korea represents one of the most liquid and retail-driven crypto markets globally. A decline in Bitcoin's volume share suggests a structural change in regional capital flows, potentially impacting global liquidity distribution. For institutions, this signals the need to reassess geographic exposure models, as post-merge issuance dynamics and regional preferences evolve. For retail traders, the shift highlights increased altcoin volatility and correlation risks, similar to patterns observed during the 2021 altseason. The concurrent Extreme Fear reading amplifies the significance, as historical data shows such sentiment extremes often coincide with major Liquidity Grab events at key technical levels.

Market analysts on X/Twitter are divided. Bulls argue this is a healthy rotation that will ultimately benefit Bitcoin by flushing out weak hands, with one noting, "South Korean volume shifts are noise in the long-term adoption curve." Bears point to the data as evidence of fading retail interest in Bitcoin amid regulatory uncertainty and better-performing alternatives. Sentiment analysis of social media feeds indicates a neutral-to-negative bias, with most discussions focusing on the $90k support test rather than the volume story itself.

Bullish Case: If Bitcoin holds the $88,500 support and reclaims $92,500, market structure suggests a rally toward $95,000 as short covering and institutional inflows resume. This scenario would invalidate the bearish volume narrative, treating the South Korean shift as an isolated regional anomaly.

Bearish Case: A break below $88,500 would confirm the loss of regional dominance as a leading indicator, targeting $85,000 and potentially $82,000 (the 0.618 Fibonacci level). This would align with the Extreme Fear reading, suggesting a prolonged downturn as global liquidity tightens.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.