Loading News...

Loading News...

VADODARA, February 4, 2026 — Bitcoin's price action now moves in near-lockstep with U.S. software stocks. Breaking crypto news reveals a correlation coefficient of 0.73 with the iShares Expanded Tech Software ETF (IGV). This data comes from ByteTree research reported by CoinDesk. The IGV has fallen 20% year-to-date. Bitcoin has dropped 16% over the same period. Market structure suggests this linkage intensifies systemic risk.

According to research from ByteTree, the correlation coefficient between Bitcoin and the IGV ETF reached 0.73. A coefficient of 1.0 indicates perfect correlation. This 0.73 reading signals strong directional alignment. Year-to-date performance metrics show parallel declines. The IGV ETF fell approximately 20%. Bitcoin dropped 16%. ByteTree analysts noted the average bear market for tech stocks lasts about 14 months. The current Bitcoin downturn began last October. Consequently, the firm suggested Bitcoin could face downward pressure through year-end.

Another analyst highlighted Bitcoin's fundamental nature. As open-source software, it may not be immune to AI-related challenges facing the software sector. This structural similarity creates vulnerability. Market liquidity now flows in unified patterns. The original ByteTree correlation report provides the foundational data.

Historically, Bitcoin exhibited periods of decoupling. The 2021 bull run saw Bitcoin outperform traditional tech. In contrast, 2022's bear market showed early correlation spikes. The current 0.73 coefficient approaches 2022 highs. This suggests macro liquidity drivers dominate. Underlying this trend is Federal Reserve policy. Rising interest rates compress valuation multiples across risk assets.

, the software sector faces AI disruption pressures. Large language models threaten traditional software margins. Bitcoin's network, while decentralized, shares technological DNA. Market analysts now question the "digital gold" narrative. Parallel price action indicates shared investor bases. Institutional capital treats both as high-beta tech exposures.

Related developments in this macro environment include Republican lawmakers urging Treasury Bitcoin purchases and the Treasury denying bailout authority as BTC tests support. Additionally, Fidelity's stablecoin launch on Ethereum and JPMorgan's note on mining stocks defying Bitcoin weakness show sector fragmentation.

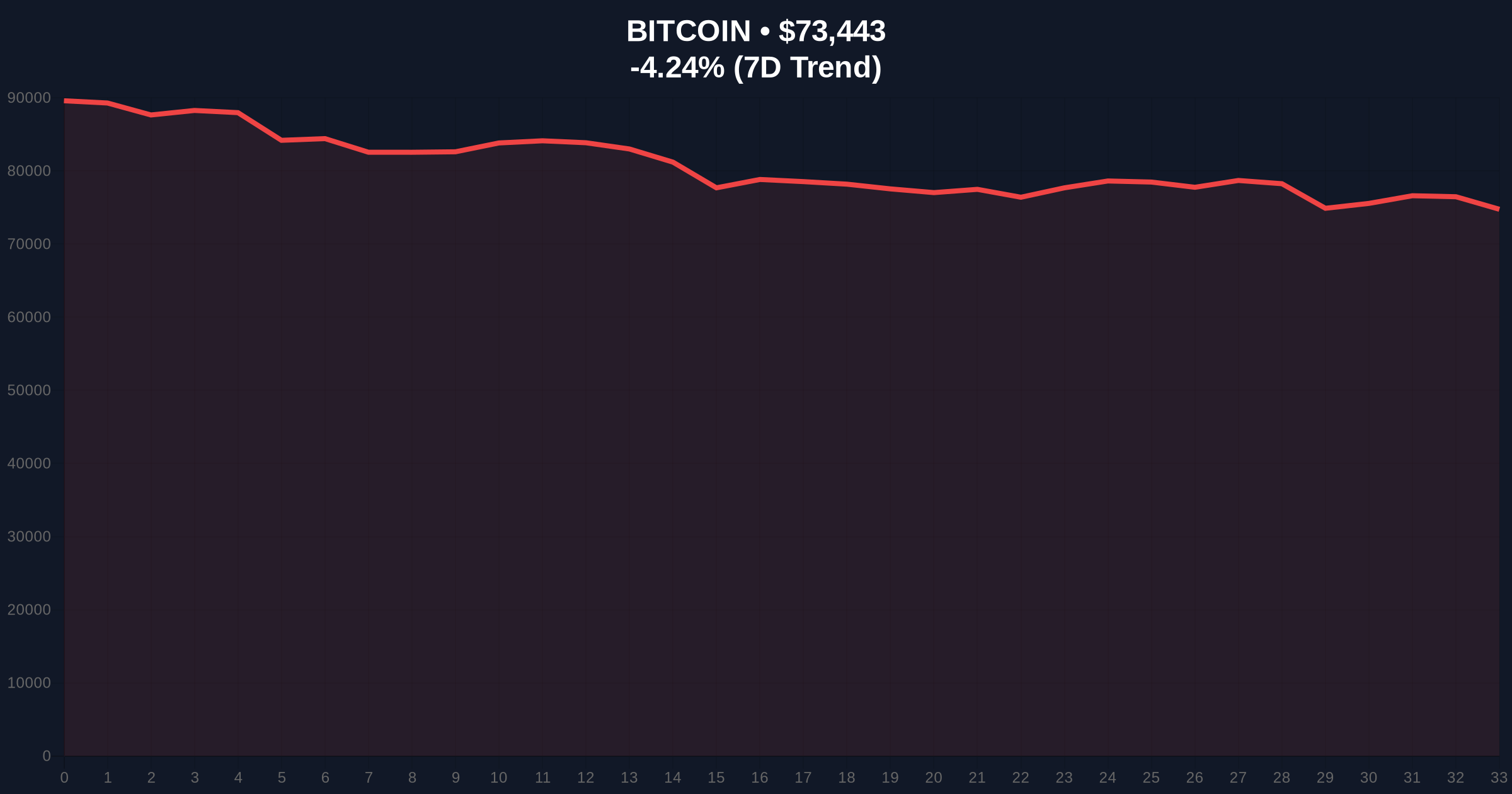

Bitcoin currently trades at $73,611. The 24-hour trend shows a -4.02% decline. Critical support sits at the Fibonacci 0.618 retracement level of $72,500. This level aligns with the 200-day moving average. Resistance forms at $78,000, the previous order block. The Relative Strength Index (RSI) reads 38, indicating oversold conditions.

On-chain data reveals increased exchange inflows. This suggests distribution pressure. The Volume Profile shows high volume nodes at $70,000 and $75,000. A break below $72,500 would invalidate the current consolidation structure. The Fair Value Gap (FVG) between $74,000 and $76,000 remains unfilled. This gap acts as magnetic price attraction.

Market structure suggests correlation strengthens during risk-off periods. The 0.73 coefficient indicates Bitcoin now trades as a risk asset, not a hedge. This challenges long-term portfolio allocation models. Technical confluence at $72,500 becomes the linchpin.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin-Software Stock Correlation | 0.73 | High directional alignment |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Maximum capitulation signal |

| Bitcoin Current Price | $73,611 | Testing key Fibonacci support |

| 24-Hour Price Change | -4.02% | Accelerating downward momentum |

| IGV ETF YTD Performance | -20% | Sector-wide liquidity drain |

This correlation matters for portfolio construction. Bitcoin no longer provides diversification against tech downturns. Institutional allocators must recalibrate risk models. The 0.73 coefficient suggests shared liquidity pools. When software stocks sell off, Bitcoin faces simultaneous outflows.

Real-world evidence appears in ETF flow data. U.S. spot Bitcoin ETFs see net outflows during tech sector declines. Retail market structure mirrors this behavior. Margin calls in tech portfolios trigger Bitcoin liquidations. This creates reflexive downward pressure.

, the correlation impacts Bitcoin's monetary narrative. If Bitcoin trades like software, its store-of-value thesis weakens. This could affect long-term adoption by sovereign wealth funds. The linkage also exposes Bitcoin to regulatory scrutiny targeting big tech. Market analysts now watch SEC software rulings for Bitcoin implications.

The 0.73 correlation coefficient is statistically significant. It indicates Bitcoin's beta to tech stocks has increased substantially. This challenges the asset's diversification benefits. In a prolonged tech bear market, Bitcoin could underperform its historical averages. The key watchpoint is whether this correlation persists during the next Fed easing cycle.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. ByteTree's analysis suggests downward pressure could persist through 2026. This aligns with the average 14-month tech bear market. However, Bitcoin's halving cycle in 2028 provides a structural tailwind. The 5-year horizon depends on correlation persistence. If Bitcoin decouples during the next monetary easing cycle, long-term prospects improve. Otherwise, it remains tied to tech sector fortunes.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.