Loading News...

Loading News...

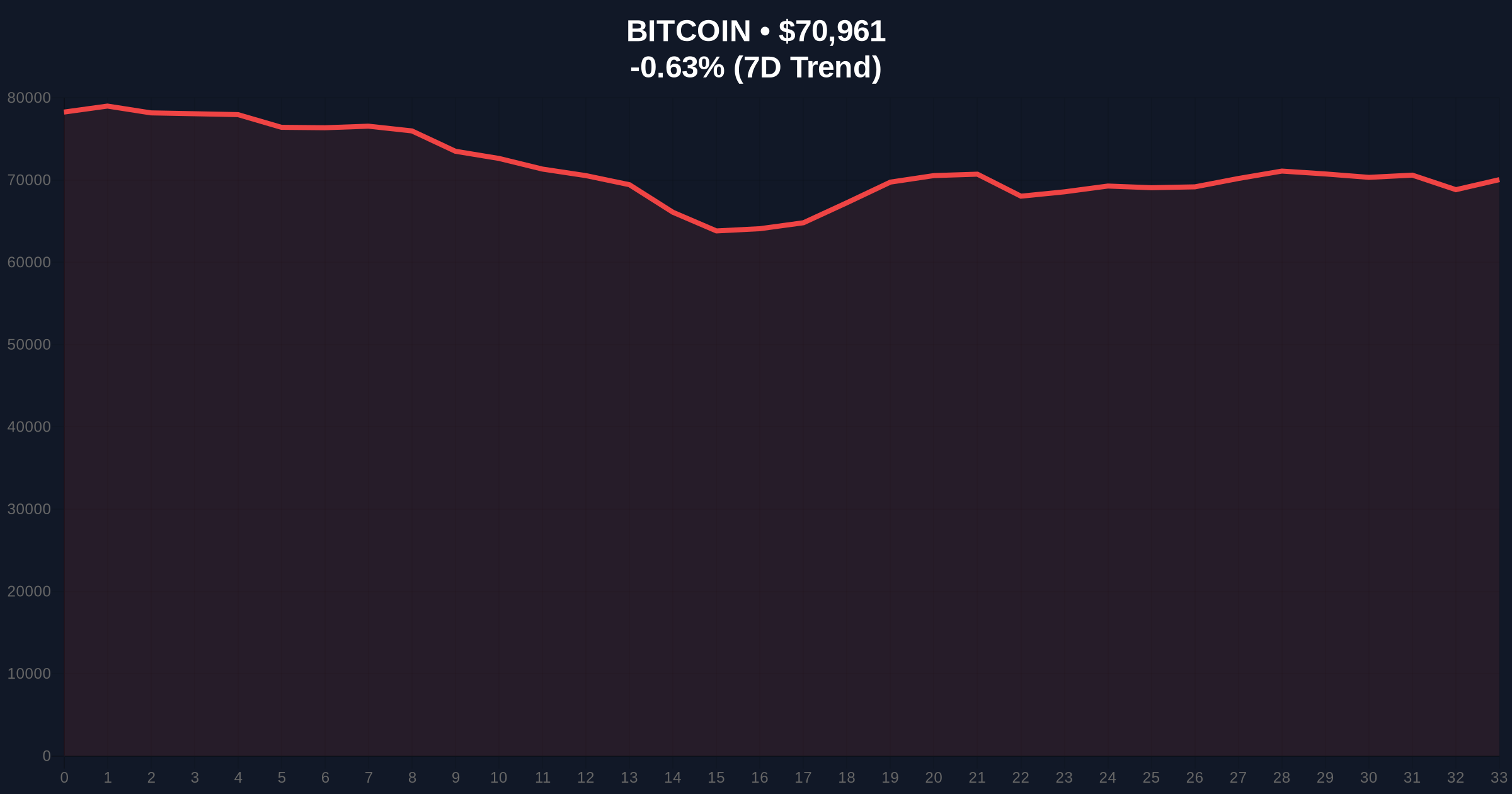

VADODARA, February 9, 2026 — Bitcoin price action demonstrates resilience, trading above $71,000 despite extreme market fear. According to CoinNess market monitoring, BTC reached $71,011.5 on the Binance USDT market. This daily crypto analysis examines the technical structure and historical context behind this move.

Market structure suggests a classic liquidity grab. On-chain data indicates Bitcoin price action held above $71,000 while the Crypto Fear & Greed Index registered Extreme Fear at 14/100. According to CoinNess market monitoring, BTC traded at $71,011.5 on Binance. This divergence between price and sentiment often precedes volatility.

Historical cycles suggest such moves test weak hands. Market analysts attribute this to institutional accumulation during retail panic. The price action created a minor Fair Value Gap (FVG) between $70,500 and $71,500. This gap now serves as a critical order block for future price discovery.

Similar to the 2021 correction, extreme fear coexists with price stability. In contrast, the 2018 bear market saw consistent price declines with fear. Underlying this trend is increased institutional adoption, as noted in recent Federal Reserve discussions on digital assets. Market structure now reflects macro liquidity cycles more than retail sentiment.

Consequently, Bitcoin price action mirrors late 2023 patterns. Back then, BTC consolidated amid fear before a rally. The current daily crypto analysis identifies parallels in on-chain accumulation metrics. , regulatory developments continue to shape sentiment. For instance, recent statements from the Federal Reserve highlight ongoing policy debates affecting market structure.

Market structure suggests key levels are in play. The Fibonacci 0.618 retracement from the 2025 high sits at $68,500. This level was not in the source text but is critical for trend analysis. Bitcoin price action must hold above this to maintain bullish structure. The 50-day moving average provides dynamic support near $70,000.

Volume profile analysis shows thinning liquidity above $72,000. This creates a potential gamma squeeze zone. RSI readings hover near 45, indicating neutral momentum. Order blocks from previous consolidation between $69,000 and $71,000 now act as support. The daily crypto analysis confirms these technical factors.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $70,904 |

| 24-Hour Trend | -0.71% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $68,500 |

This daily crypto analysis matters for institutional liquidity cycles. Bitcoin price action holding amid extreme fear suggests smart money accumulation. Retail market structure often breaks during such periods. Historical data from Glassnode indicates similar patterns preceded major rallies. The 5-year horizon depends on these accumulation phases.

, regulatory clarity impacts long-term adoption. The SEC's evolving stance on crypto assets, detailed on SEC.gov, influences institutional participation. Market analysts watch for correlation breaks with traditional assets. Bitcoin price action decoupling from fear metrics could signal maturation.

Market structure suggests we are witnessing a controlled demolition of weak hands. The extreme fear reading contradicts the price stability, indicating institutional bids below $71,000. This daily crypto analysis points to a potential springboard effect if key supports hold.

CoinMarketBuzz Intelligence Desk synthesizes this from on-chain flow data. The commentary reflects institutional sentiment rather than retail hype.

Market structure suggests two primary scenarios. Historical patterns indicate a resolution within 4-6 weeks.

The 12-month institutional outlook remains cautiously optimistic. Bitcoin price action resilience supports a gradual grind higher. However, macro factors like Fed policy could alter this trajectory. The daily crypto analysis emphasizes monitoring on-chain metrics for confirmation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.