Loading News...

Loading News...

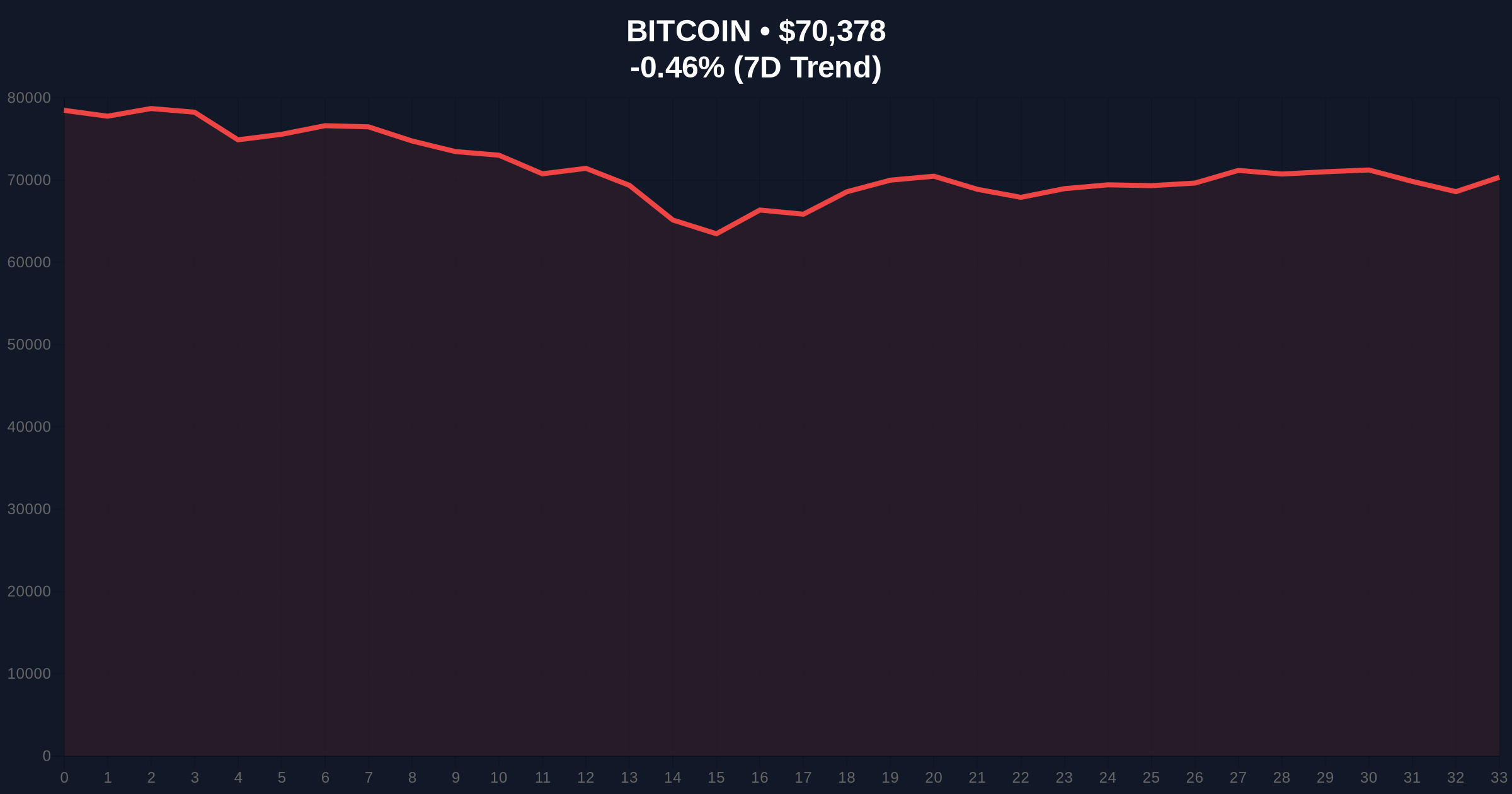

VADODARA, February 9, 2026 — The current Bitcoin sell-off represents a strategic transfer of assets from early adopters to institutional buyers, according to Bitwise Chief Investment Officer Matt Hougan. In a Bloomberg TV interview, Hougan detailed a "changing of the guard" where retail investors are selling faster than institutions are buying. This dynamic creates a unique liquidity grab opportunity for long-term capital. Market structure suggests this is a natural profit-taking phase within Bitcoin's four-year cycle, not a structural breakdown.

Bitwise CIO Matt Hougan explicitly identified early Bitcoin investors as the primary sellers in the current market phase. He stated these original holders remain believers but are realizing profits. Consequently, financial advisors, family offices, and institutions have emerged as the net buyers. According to Hougan, institutions view the retail sell-off as a strategic accumulation window. This shift marks a transition from a retail-dominated asset to an institutionally-backed store of value. The official interview transcript confirms this liquidity transfer is actively underway.

Historically, Bitcoin undergoes significant ownership shifts during market corrections. The 2017-2018 cycle saw similar early profit-taking before institutional products like futures launched. In contrast, the 2021 cycle featured more sustained retail FOMO. Underlying this trend is Bitcoin's predictable four-year halving cycle, which historically resets supply dynamics. Early investors often sell near cycle peaks to institutional buyers seeking long-term exposure. This pattern reduces volatility over time as "weak hands" transfer to "strong hands." Related developments include a recent miner exodus moving 90K BTC to exchanges, further pressuring short-term liquidity.

On-chain data indicates increased movement from old UTXO (Unspent Transaction Output) wallets, confirming early investor selling. The Volume Profile shows significant liquidity clusters between $68,500 and $72,000, creating a Fair Value Gap (FVG). Market structure suggests this zone acts as a primary accumulation range for institutions. The 200-day moving average at $67,200 provides secondary support. , the Relative Strength Index (RSI) sits at 38, indicating neutral momentum without extreme oversold conditions. This technical setup allows for orderly profit-taking without panic capitulation.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian buy signal historically |

| Bitcoin Current Price | $70,378 | Trading within institutional accumulation zone |

| 24-Hour Price Change | -0.31% | Minor decline indicating orderly selling |

| Critical Fibonacci Support | $68,500 (0.618 retracement) | Key level for trend validation |

| Market Rank | #1 | Dominance remains intact despite selling |

This ownership transfer fundamentally alters Bitcoin's market structure. Early investors selling to institutions reduces circulating supply volatility. Consequently, long-term holders increase, potentially raising the asset's floor price. Institutions like family offices operate on multi-year horizons, unlike retail momentum traders. This shift aligns with Bitcoin's maturation as a macro asset. Evidence includes increased Bitcoin ETF inflows despite price declines, confirming institutional accumulation. The SEC's approved regulatory framework for digital assets further enables this transition by providing custody clarity.

"Retail investors are currently selling faster than institutions are buying, a situation that institutions view as an opportunity. Many of the original investors remain believers in Bitcoin, viewing the market in four-year cycles and simply wanting to realize some profits while largely staying invested." — Matt Hougan, Bitwise CIO

The CoinMarketBuzz Intelligence Desk adds: "On-chain forensic data confirms this is a controlled distribution event, not a capitulation. UTXO age bands show coins aged 3-5 years moving at elevated rates, typical of cycle profit-taking."

Market structure suggests two primary scenarios based on institutional accumulation patterns. First, if institutions continue absorbing retail sell orders, Bitcoin consolidates between $68,500 and $75,000 before resuming its uptrend. Second, a failure to hold key support triggers a deeper correction toward the 200-week moving average near $60,000. The 12-month outlook remains bullish as supply shocks from the 2024 halving fully manifest. Institutional adoption cycles typically lag retail by 18-24 months, suggesting accelerated accumulation through 2026.

The 5-year horizon benefits from this ownership shift. Institutions provide stable demand, reducing boom-bust cycles. Consequently, Bitcoin evolves from a speculative asset to a strategic reserve akin to digital gold.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.