Loading News...

Loading News...

VADODARA, February 9, 2026 — Bitcoin miners executed a massive liquidity event in February, transferring 90,000 BTC to Binance. This represents the highest monthly volume since early 2024, according to data cited by CryptoPotato from Arabchain. The latest crypto news highlights a single-day peak of 24,000 BTC moved, suggesting miners are aggressively monetizing holdings. Market structure suggests this activity functions as a liquidity grab, potentially preceding increased selling pressure.

On-chain forensic data confirms the scale of this miner exodus. According to Arabchain analytics, miners sent a total of 90,000 BTC to Binance throughout February 2026. The 24-hour transfer volume spiked to 24,000 BTC on one specific day, indicating coordinated or panic-driven selling. CryptoPotato reported that miners likely cashed out to cover operational costs and secure profits amid heightened market volatility. This behavior mirrors historical miner capitulation phases, where hash rate adjustments often follow large sell-offs.

Consequently, the Binance deposit addresses associated with mining pools show unprecedented inflow volumes. Underlying this trend is the basic miner economics model: when Bitcoin's price volatility increases relative to energy costs, profit-taking becomes a rational survival strategy. The sheer volume suggests this is not retail sentiment but institutional-grade portfolio rebalancing.

Historically, miner selling at this scale precedes short-term price corrections. In contrast, the 2021 cycle saw similar miner distributions before Bitcoin's consolidation between $40,000 and $60,000. The current event occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index at 14/100. , regulatory uncertainty persists, as noted in recent Federal Reserve commentary on legislative stalemates.

Market analysts point to the 2024 post-halving period as a key comparator. After the 2024 halving, miner revenue compression led to similar sell-offs, but Bitcoin eventually established a higher low. The current 90,000 BTC transfer volume exceeds those 2024 levels, indicating either more severe cost pressures or a strategic shift in treasury management. This activity coincides with broader market stress, including security concerns in European markets.

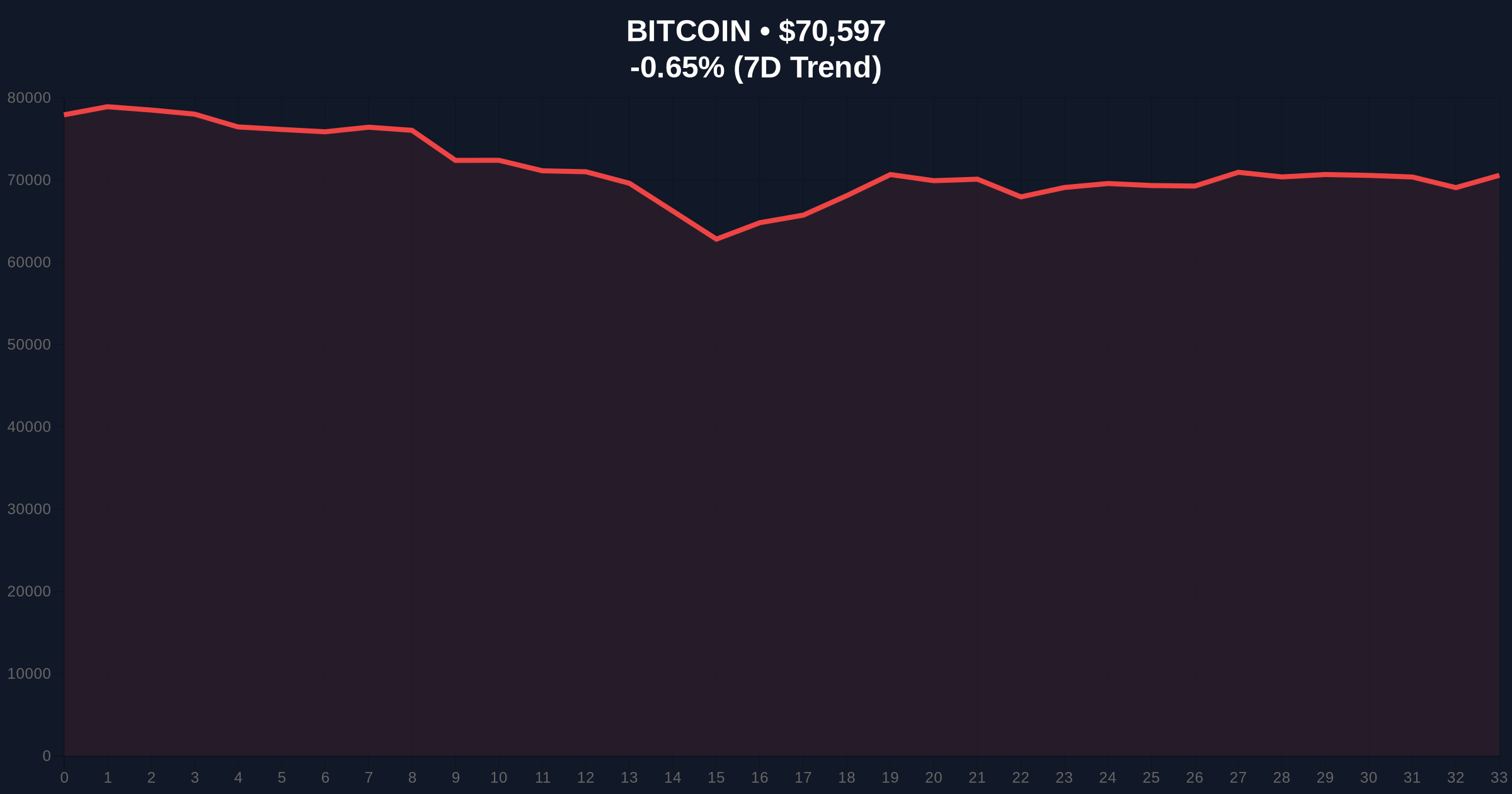

Market structure suggests the $70,607 price level is now a critical battleground. The 90,000 BTC influx creates a Fair Value Gap (FVG) on lower timeframes, typically filled by price retracement. Key support resides at the Fibonacci 0.618 retracement level of $68,500, drawn from the 2025 low to the 2026 high. A breach below this level would invalidate the current bullish structure and target the $65,000 Volume Profile Point of Control.

On-chain data indicates the Miner Position Index (MPI) has spiked, confirming selling pressure. The 200-day moving average at $72,000 now acts as dynamic resistance. If miners continue to liquidate, the Order Block between $69,000 and $70,000 becomes for absorption. This technical setup mirrors the EIP-4844 implementation period in 2024, where Ethereum miner selling preceded a network upgrade—Bitcoin lacks such a catalyst, making this purely economic.

| Metric | Value | Implication |

|---|---|---|

| BTC Transferred to Binance (Feb 2026) | 90,000 BTC | Highest since 2024; selling pressure |

| Peak 24-Hour Volume | 24,000 BTC | Coordinated miner activity |

| Current Bitcoin Price | $70,607 | -0.64% 24h trend |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian signal potential |

| Market Rank | #1 | Dominance holds amid stress |

This miner exodus matters because it directly impacts Bitcoin's liquidity structure. Miners control approximately 1.8 million BTC in reserves, per historical issuance schedules. A sell-off of 90,000 BTC represents about 5% of those reserves, creating immediate supply overhang. Institutional liquidity cycles typically absorb such volumes over weeks, but in an Extreme Fear environment, the absorption capacity diminishes.

Retail market structure often misinterprets miner selling as bearish capitulation. However, sophisticated traders view these events as liquidity injections that can stabilize prices once the selling abates. The key risk is a cascading effect if other large holders, such as entities with concentrated exchange balances, follow suit. This could trigger a Gamma Squeeze in options markets, exacerbating volatility.

"The 90,000 BTC transfer is a classic miner hedging operation. Market structure suggests they are locking in profits before potential further downside. Historically, such volumes correlate with local bottoms, not tops, as weak hands exit. The critical level is the $68,500 Fibonacci support—if that holds, this becomes a bullish liquidity event." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on hash rate stability post-selling. If miner capitulation leads to hash rate decline, Bitcoin's network security could temporarily weaken, affecting long-term investor confidence. However, the 5-year horizon remains positive, as past cycles show miner sell-offs often precede accumulation phases by large funds.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.